Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) Calculate the amount of direct labor cost charged to Job A-75 during 2022. (2) Calculate the amount of direct materials cost charged to Job

(1) Calculate the amount of direct labor cost charged to Job A-75 during 2022.

(2) Calculate the amount of direct materials cost charged to Job A-75 during 2022.

(3) Calculate the total amount of inventory reported in Thomas Company's December 31, 2022 balance sheet.

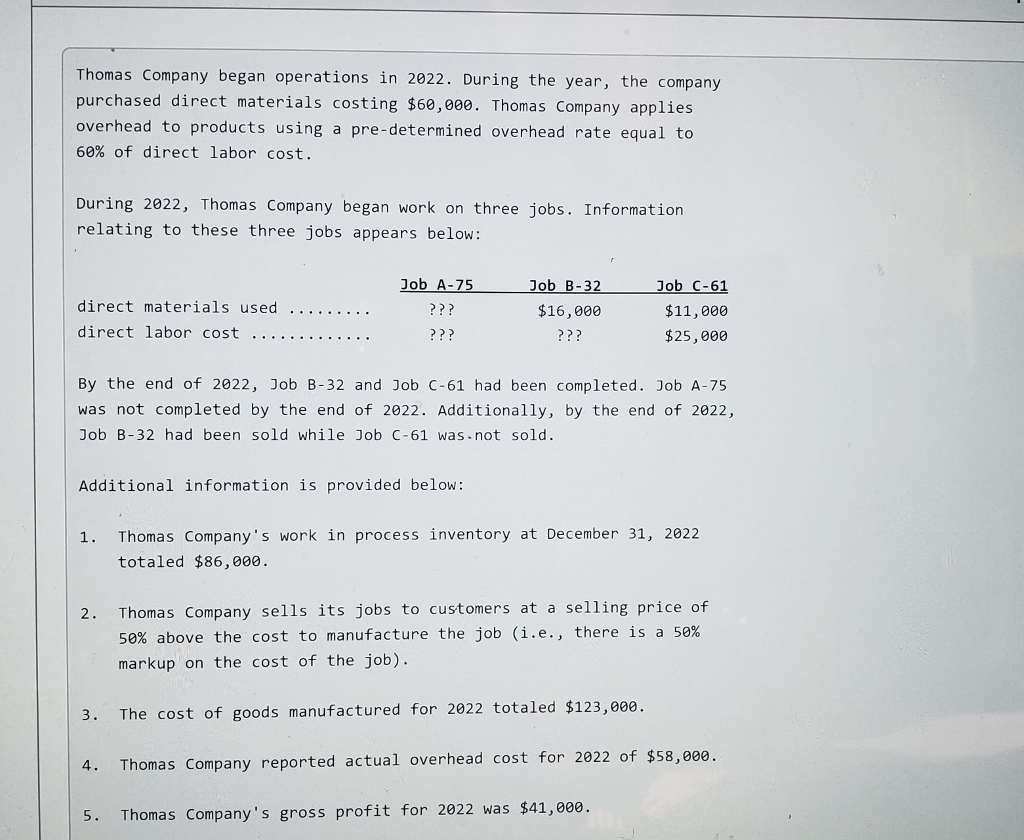

Thomas Company began operations in 2022. During the year, the company purchased direct materials costing $60,008. Thomas Company applies overhead to products using a pre-determined overhead rate equal to 60% of direct labor cost. During 2022, Thomas Company began work on three jobs. Information relating to these three jobs appears below: ob A-75 Job B-32 Job C-61 $11,000 $25,000 $16,000 By the end of 2022, Job B-32 and Job C-61 had been completed. Job A-75 was not completed by the end of 2022. Additionally, by the end of 2022, Job B-32 had been sold while Job C-61 was.not sold. Additional information is provided below: 1. Thomas Company's work in process inventory at December 31, 2022 totaled $86,000. 2. Thomas Company sells its jobs to customers at a selling price of 50% above the cost to manufacture the job (i.e., there is a 50% markup on the cost of the job). 3. The cost of goods manufactured for 2022 totaled $123,000 Thomas Company reported actual overhead cost for 2022 of $58,e08. 5. Thomas Company's gross profit for 2022 was $41,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started