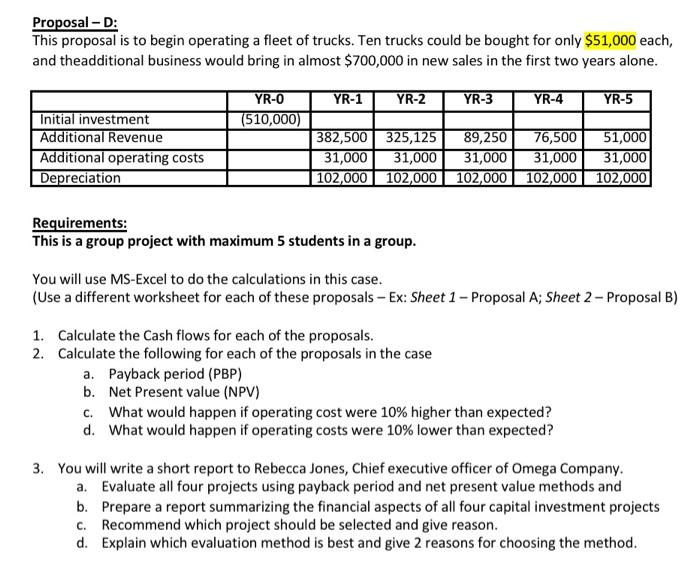

1. Calculate the Cash flows for each of the proposals.

2. Calculate the following for each of the proposals in the case

a. Payback period (PBP)

b. Net Present value (NPV)

c. What would happen if operating cost were 10% higher than expected?

d. What would happen if operating costs were 10% lower than expected?

3. You will write a short report to Rebecca Jones, Chief executive officer of Omega Company.

a. Evaluate all four projects using payback period and net present value methods and

b. Prepare a report summarizing the financial aspects of all four capital investment projects

c. Recommend which project should be selected and give reason.

d. Explain which evaluation method is best and give 2 reasons for choosing the method.

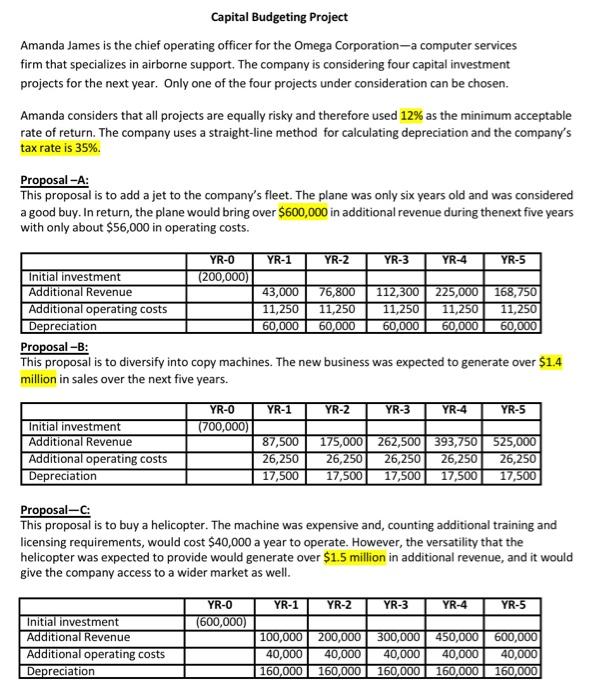

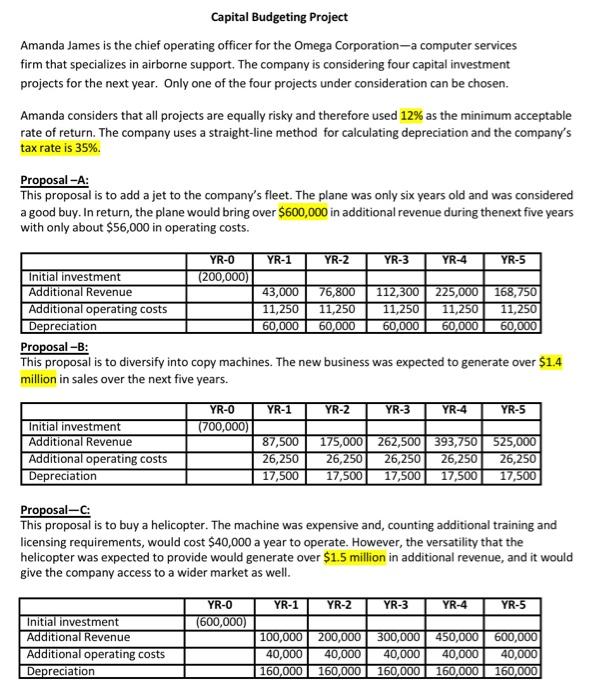

Capital Budgeting Project Amanda James is the chief operating officer for the Omega Corporation-a computer services firm that specializes in airborne support. The company is considering four capital investment projects for the next year. Only one of the four projects under consideration can be chosen. Amanda considers that all projects are equally risky and therefore used 12% as the minimum acceptable rate of return. The company uses a straight-line method for calculating depreciation and the company's tax rate is 35% Proposal -A: This proposal is to add a jet to the company's fleet. The plane was only six years old and was considered a good buy. In return, the plane would bring over $600,000 in additional revenue during thenext five years with only about $56,000 in operating costs. YR-O YR-1 YR-2 YR-3 YR-4 YR-5 Initial investment (200,000) Additional Revenue 43,000 76,800 112,300 225,000 168,750 Additional operating costs 11,250 11,250 11,250 11,250 11,250 Depreciation 60,000 60,000 60,000 60,000 60,000 Proposal-B: This proposal is to diversify into copy machines. The new business was expected to generate over $1.4 million in sales over the next five years. YR-2 YR-3 YR-4 YR-5 Initial investment Additional Revenue Additional operating costs Depreciation YR-0 YR-1 (700,000) 87,500 26,250 17,500 175,000 262,500 393,750 525,000 26,250 26,250 26,250 26,250 17,500 17,500 17,500 17,500 Proposal-c: This proposal is to buy a helicopter. The machine was expensive and, counting additional training and licensing requirements, would cost $40,000 a year to operate. However, the versatility that the helicopter was expected to provide would generate over $1.5 million in additional revenue, and it would give the company access to a wider market as well. YR-1 YR-2 YR-3 YR-4 YR-5 YR-O (600,000) Initial investment Additional Revenue Additional operating costs Depreciation 100,000 200,000 40,000 40,000 160,000 160,000 300,000 450,000 40,000 40,000 160,000 160,000 600,000 40,000 160,000 Proposal - D: This proposal is to begin operating a fleet of trucks. Ten trucks could be bought for only $51,000 each, and theadditional business would bring in almost $700,000 in new sales in the first two years alone. YR-1 YR-2 YR-3 YR-4 YR-5 YR-O (510,000) Initial investment Additional Revenue Additional operating costs Depreciation 382,500 325,125 89,250 76,500 51,000 31,000 31,000 31,000 31,000 31,000 102,000 102,000 102,000 102,000 102,000 Requirements: This is a group project with maximum 5 students in a group. You will use MS-Excel to do the calculations in this case. (Use a different worksheet for each of these proposals - Ex: Sheet 1 - Proposal A; Sheet 2 - Proposal B) 1. Calculate the Cash flows for each of the proposals. 2. Calculate the following for each of the proposals in the case a. Payback period (PBP) b. Net Present value (NPV) c. What would happen if operating cost were 10% higher than expected? d. What would happen if operating costs were 10% lower than expected? 3. You will write a short report to Rebecca Jones, Chief executive officer of Omega Company. a. Evaluate all four projects using payback period and net present value methods and b. Prepare a report summarizing the financial aspects of all four capital investment projects C. Recommend which project should be selected and give reason. d. Explain which evaluation method is best and give 2 reasons for choosing the method