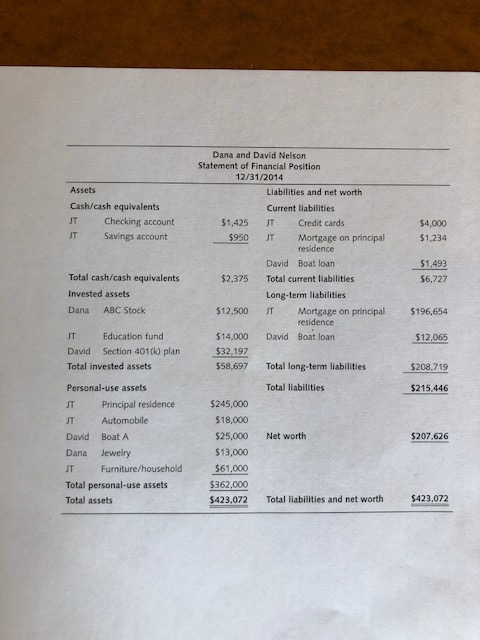

1. Calculate the Nelsons taxable income and tax liability for 2015 (ignoring any credits)

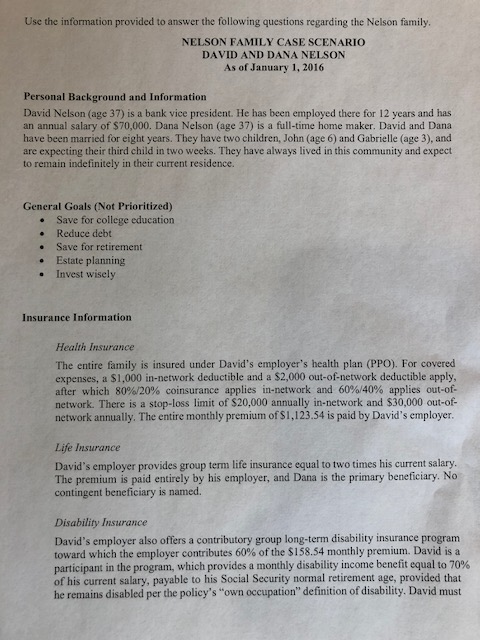

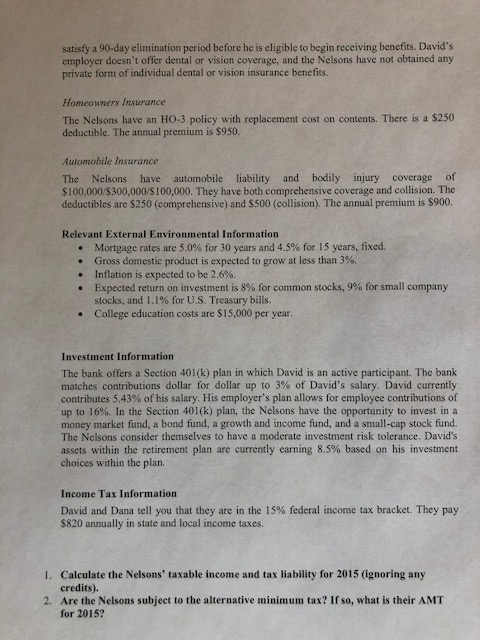

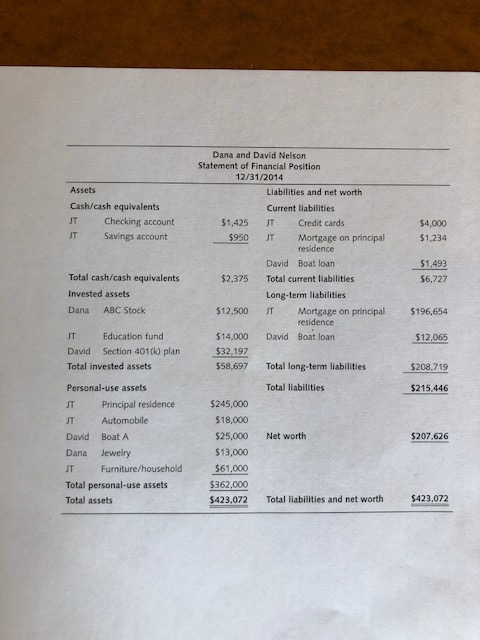

Use the information provided to answer the following questions regarding the Nelson family. NELSON FAMILY CASE SCENARIO DAVID AND DANA NELSON As of January 1, 2016 Personal Background and Information David Nelson (age 37) is a bank vice president. He has been employed there for 12 years and has an annual salary of $70,000. Dana Nelson (age 37) is a full-time home maker. David and Dana have been married for eight years. They have two children, John (age 6) and Gabrielle (age 3), and are expecting their third child in two weeks. They have always lived in this community and expect to remain indefinitely in their current residence. General Goals (Not Prioritized) e Save for college education . Reduce debt . Save for retirement Estate planning . Invest wisely Insurance Information Heaith Insurance The entire family is insured under David's employer's health plan (PPO). For covered expenses, a $1,000 in-network deductible and a $2,000 out-of-network deductible apply after which 80%/20% coinsurance applies in-network and 60%/40% applies out-of- network. There is a stop-loss limit of $20,000 annually in-network and $30,000 out-of- network annually. The entire monthly premium of $1,123.54 is paid by David's employer. Life Insurance David's employer provides group term life insurance equal to two times his current salary. The premium is paid entirely by his employer, and Dana is the primary beneficiary. No contingent beneficiary is named. Disability Insurance David's employer also offers a contributory group long-term disability insurance program toward which the employer contributes 60% of the $158.54 monthly premium. David is a participant in the program, which provides a monthly disability income benefit equal to 70% of his current salary, payable to his Social Security normal retirement age, provided that he remains disabled per the policy's "own occupation" definition of disability. David must Use the information provided to answer the following questions regarding the Nelson family. NELSON FAMILY CASE SCENARIO DAVID AND DANA NELSON As of January 1, 2016 Personal Background and Information David Nelson (age 37) is a bank vice president. He has been employed there for 12 years and has an annual salary of $70,000. Dana Nelson (age 37) is a full-time home maker. David and Dana have been married for eight years. They have two children, John (age 6) and Gabrielle (age 3), and are expecting their third child in two weeks. They have always lived in this community and expect to remain indefinitely in their current residence. General Goals (Not Prioritized) e Save for college education . Reduce debt . Save for retirement Estate planning . Invest wisely Insurance Information Heaith Insurance The entire family is insured under David's employer's health plan (PPO). For covered expenses, a $1,000 in-network deductible and a $2,000 out-of-network deductible apply after which 80%/20% coinsurance applies in-network and 60%/40% applies out-of- network. There is a stop-loss limit of $20,000 annually in-network and $30,000 out-of- network annually. The entire monthly premium of $1,123.54 is paid by David's employer. Life Insurance David's employer provides group term life insurance equal to two times his current salary. The premium is paid entirely by his employer, and Dana is the primary beneficiary. No contingent beneficiary is named. Disability Insurance David's employer also offers a contributory group long-term disability insurance program toward which the employer contributes 60% of the $158.54 monthly premium. David is a participant in the program, which provides a monthly disability income benefit equal to 70% of his current salary, payable to his Social Security normal retirement age, provided that he remains disabled per the policy's "own occupation" definition of disability. David must