Question

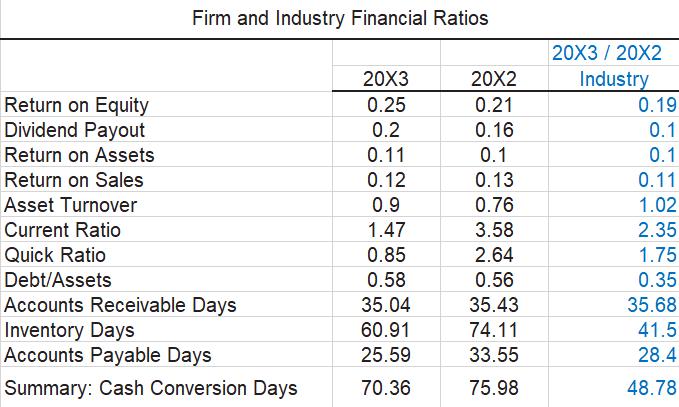

1) Calculate the weighted average cost of capital for Corporation B as of yearend 20X3. Corporation B purchased equipment in order to facilitate the processing

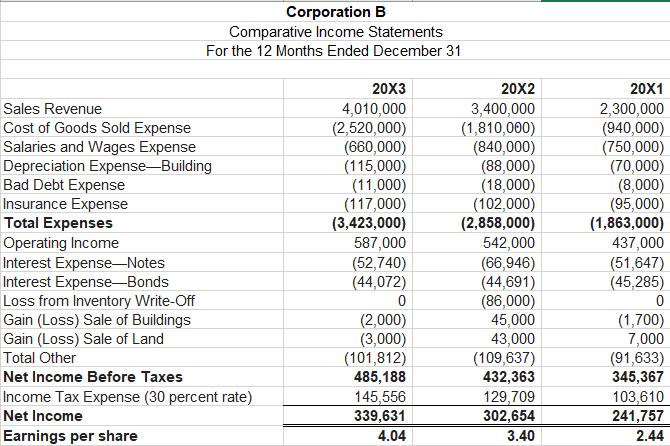

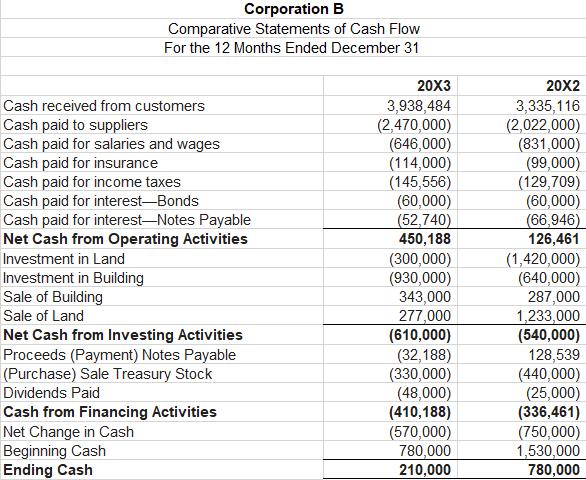

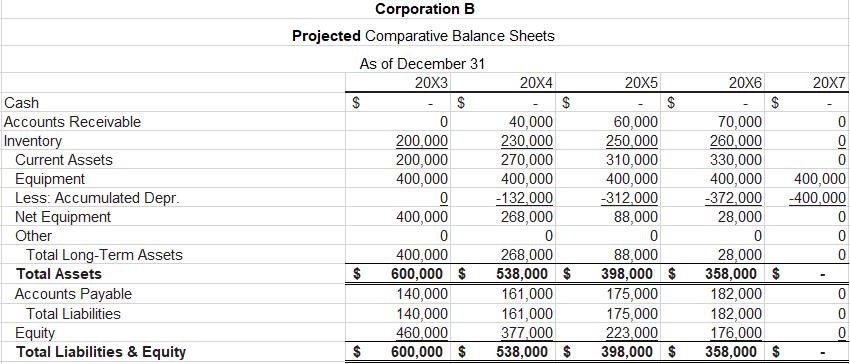

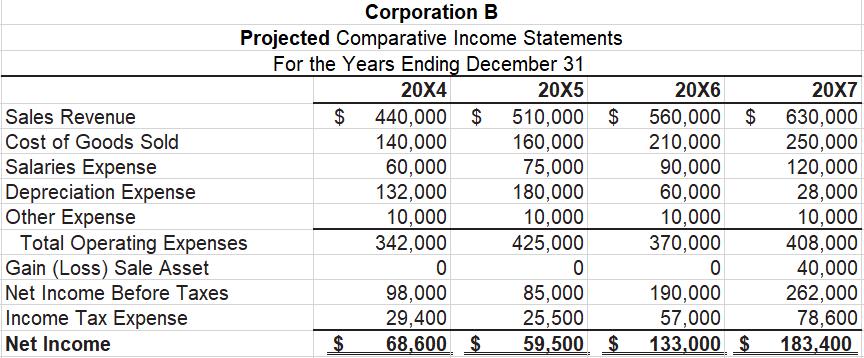

1) Calculate the weighted average cost of capital for Corporation B as of yearend 20X3. Corporation B purchased equipment in order to facilitate the processing of its product (with the intent of expanding its revenue) over the next few years. At the end of this project (end of 20X7), a supplier will begin to take over the processing of this product. A few facts about the purchase are listed below: a. The cost of the equipment, including shipping and installation, is $400,000. The entire amount will be paid in cash. The equipment will be purchased in early 20X4. b. The life of the equipment is four years (end of 20X7), at which time it is expected to sell for $40,000. c. Corporation B will initially purchase $200,000 of inventory; 70% of inventory purchases over the life of this project will be financed via accounts payable. d. Recurring cash flows occur at year-end of each year, and termination cash flows occur at year-end 20X7. e. All cash flows generated each year are paid to Corporation B (i.e., owner of the project). Based on this information, Corporation B prepared the Projected Balance Sheet and Projected Income Statement for this project, which can be found in Appendix A. 2) Calculate the cash flows associated with this project. Calculate these cashflows by year, andfor 20X4, separately calculate the cash flows that occur at the beginning and end of the year. You will have five cash flow calculations: i. Beginning of 20X4 ii. End of 20X4 iii. End of 20X5 iv. End of 20X6 v. End of 20X7 (includes recurring cash flows and termination cash flows). 3) Compare the aggregate undiscounted cash flows to the aggregate net income flows. Explain the difference (if any). 4) Calculate the present value of the future cash flows.

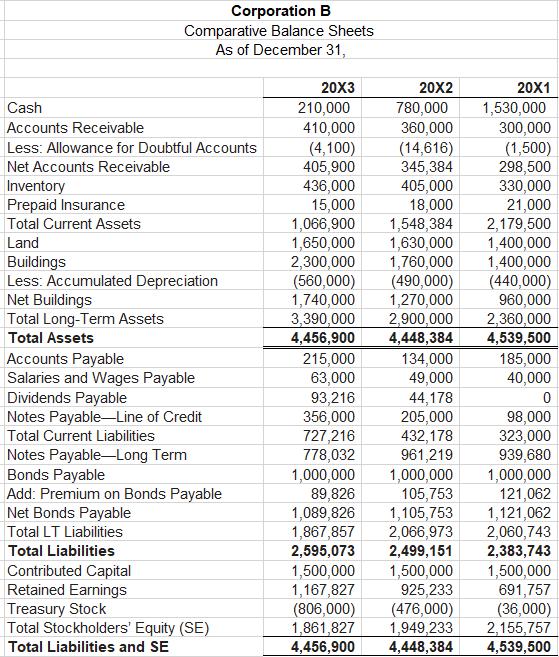

Cash Accounts Receivable Less: Allowance for Doubtful Accounts Net Accounts Receivable Inventory Prepaid Insurance Corporation B Comparative Balance Sheets As of December 31, Total Current Assets Land Buildings Less: Accumulated Depreciation Net Buildings Total Long-Term Assets Total Assets Accounts Payable Salaries and Wages Payable Dividends Payable Notes Payable-Line of Credit Total Current Liabilities Notes Payable-Long Term Bonds Payable Add: Premium on Bonds Payable Net Bonds Payable Total LT Liabilities Total Liabilities Contributed Capital Retained Earnings Treasury Stock Total Stockholders' Equity (SE) Total Liabilities and SE 20X3 210,000 410,000 (4,100) 405,900 436,000 15,000 20X2 780,000 360,000 (14,616) 345,384 405,000 18,000 215,000 63,000 93,216 356,000 727,216 778,032 1,000,000 89,826 1,066,900 1,548,384 1,650,000 1,630,000 2,300,000 1,760,000 (560,000) 1,740,000 3,390,000 2,900,000 2,360,000 4,456,900 4,448,384 4,539,500 (490,000) 1,270,000 134,000 49,000 44,178 205,000 432,178 961,219 1,000,000 105,753 1,089,826 1,105,753 1,867,857 2,066,973 2,595,073 2,499,151 20X1 1,530,000 300,000 (1,500) 298,500 330,000 21,000 1,500,000 1,500,000 1,167,827 925,233 (806,000) (476,000) 1,861,827 1,949,233 4,456,900 4,448,384 2,179,500 1,400,000 1,400,000 (440,000) 960,000 185,000 40,000 0 98,000 323,000 939,680 1,000,000 121,062 1,121,062 2,060,743 2,383,743 1,500,000 691,757 (36,000) 2,155,757 4,539,500

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the cash flows associated with this project Beginning of 20X4 Equipment purchase of 400000 paid in cash End of 20X4 Revenues of 200000 giv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started