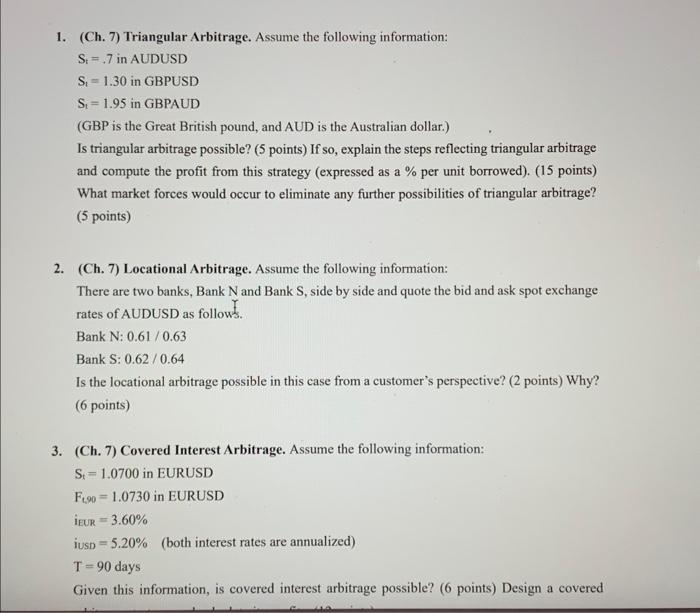

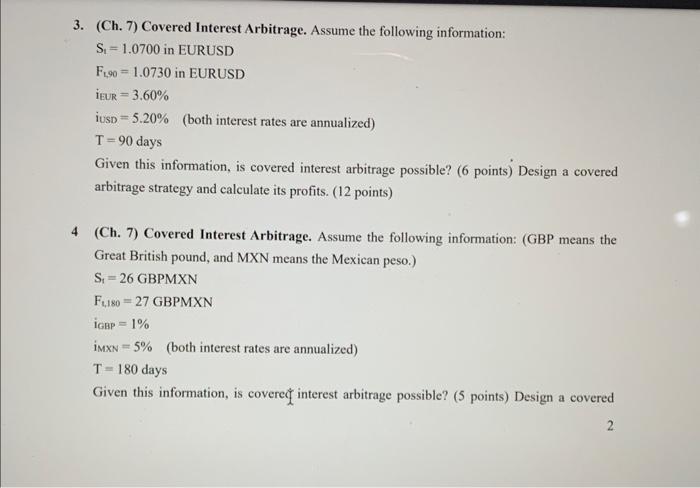

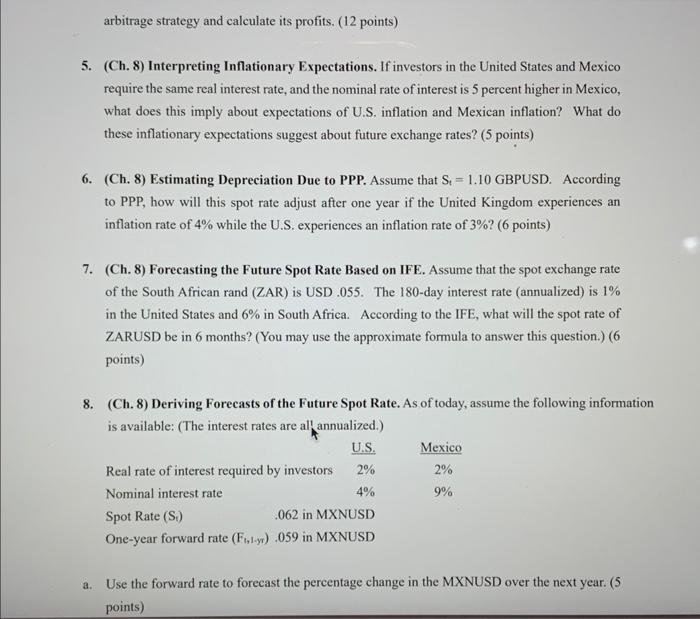

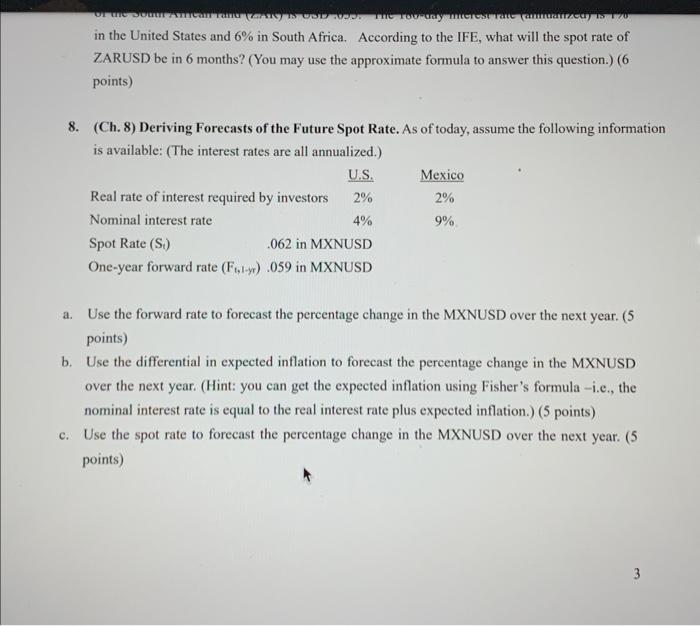

1. (Ch. 7) Triangular Arbitrage. Assume the following information: St=.7 in AUDUSD S1=1.30 in GBPUSD St=1.95 in GBPAUD (GBP is the Great British pound, and AUD is the Australian dollar.) Is triangular arbitrage possible? ( 5 points) If so, explain the steps reflecting triangular arbitrage and compute the profit from this strategy (expressed as a \% per unit borrowed). (15 points) What market forces would occur to eliminate any further possibilities of triangular arbitrage? (5 points) 2. (Ch. 7) Locational Arbitrage. Assume the following information: There are two banks, Bank N and Bank S, side by side and quote the bid and ask spot exchange rates of AUDUSD as follows. Bank N: 0.61/0.63 Bank S: 0.62/0.64 Is the locational arbitrage possible in this case from a customer's perspective? ( 2 points) Why? (6 points) 3. (Ch. 7) Covered Interest Arbitrage. Assume the following information: St=1.0700 in EURUSD FL,90=1.0730in EURUSD iEUR=3.60% iusD =5.20% (both interest rates are annualized) T=90 days Given this information, is covered interest arbitrage possible? (6 points) Design a covered 3. (Ch. 7) Covered Interest Arbitrage. Assume the following information: S1=1.0700 in EURUSD FL,90=1.0730 in EURUSD iEUR=3.60% iusD =5.20% (both interest rates are annualized) T=90 days Given this information, is covered interest arbitrage possible? (6 points) Design a covered arbitrage strategy and calculate its profits. (12 points) 4 (Ch. 7) Covered Interest Arbitrage. Assume the following information: (GBP means the Great British pound, and MXN means the Mexican peso.) S1=26 GBPMXN FL,180=27GBPMXN iGBP=1% iMXN=5% (both interest rates are annualized) T=180 days Given this information, is coverec interest arbitrage possible? (5 points) Design a covered 2 arbitrage strategy and calculate its profits. (12 points) 5. (Ch. 8) Interpreting Inflationary Expectations. If investors in the United States and Mexico require the same real interest rate, and the nominal rate of interest is 5 percent higher in Mexico, what does this imply about expectations of U.S. inflation and Mexican inflation? What do these inflationary expectations suggest about future exchange rates? ( 5 points) 6. (Ch. 8) Estimating Depreciation Due to PPP. Assume that St=1.10 GBPUSD. According to PPP, how will this spot rate adjust after one year if the United Kingdom experiences an inflation rate of 4% while the U.S. experiences an inflation rate of 3% ? (6 points) 7. (Ch. 8) Forecasting the Future Spot Rate Based on IFE. Assume that the spot exchange rate of the South African rand (ZAR) is USD .055. The 180-day interest rate (annualized) is 1% in the United States and 6% in South Africa. According to the IFE, what will the spot rate of ZARUSD be in 6 months? (You may use the approximate formula to answer this question.) ( 6 points) 8. (Ch. 8) Deriving Forecasts of the Future Spot Rate. As of today, assume the following information is available: (The interest rates are al! annualized.) a. Use the forward rate to forecast the percentage change in the MXNUSD over the next year. (5 points) in the United States and 6% in South Africa. According to the IFE, what will the spot rate of ZARUSD be in 6 months? (You may use the approximate formula to answer this question.) ( 6 points) 8. (Ch. 8) Deriving Forecasts of the Future Spot Rate. As of today, assume the following information is available: (The interest rates are all annualized.) a. Use the forward rate to forecast the percentage change in the MXNUSD over the next year. (5 points) b. Use the differential in expected inflation to forecast the percentage change in the MXNUSD over the next year. (Hint: you can get the expected inflation using Fisher's formula -i.e., the nominal interest rate is equal to the real interest rate plus expected inflation.) ( 5 points) c. Use the spot rate to forecast the percentage change in the MXNUSD over the next year. ( 5 points)