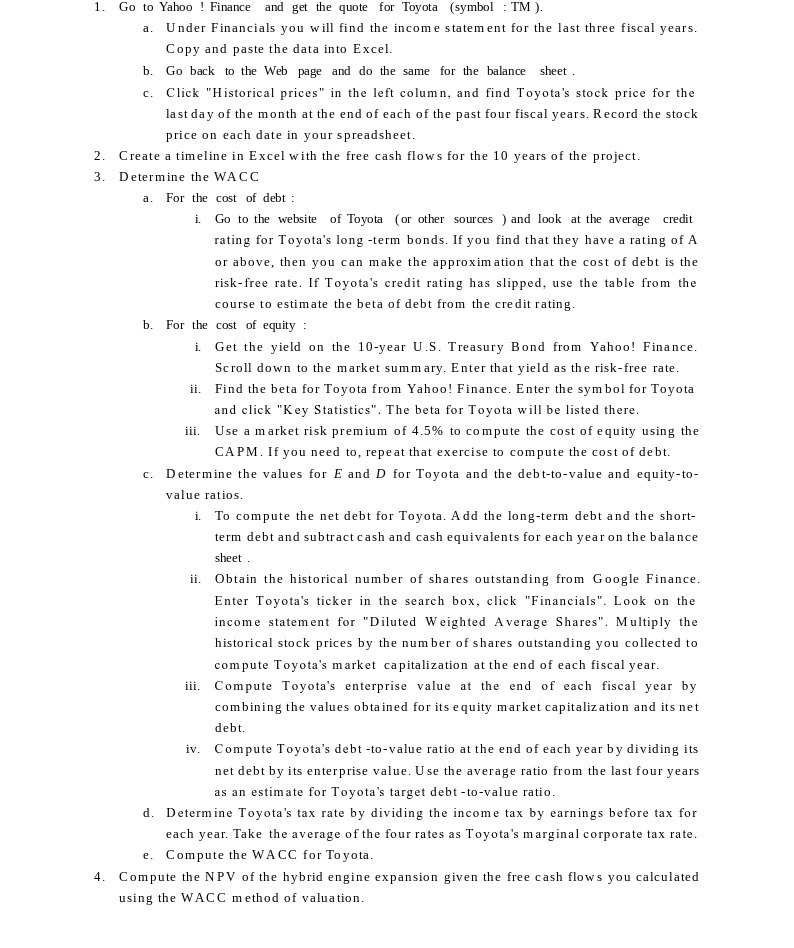

1. Co to Yahoo ! Finance and get the quote for Toyota (symbol :TM ]. a . Under Financials you will find the income statement for Ll'IE last three fiscal years. Copy and paste the data into Excel. Go back to the 1|Web page and do the same for the balance sheet. Click "Historical prices" in the left column, and find Toyota's stock price for the lastday of the month at the end of each of the past [our fiscal years. Record the stock price on each date in your spreadsheet. 2. Create a timeline in Excel with the free cash ows for the 11] years of U112 project. 3. Determine the WACC a . For the For the ill. cost of debt : Co to the website of Toyota (or other sources )and look at the average credit rating for Toyota's long term bonds. [f you find that they have a rating of or above, then you can make the approximation that the cost of debt is the riskfree rate. If Toyota's credit rating has slipped+ use the table from the course to estimate the beta of debt from the credit rating. cost of equity : l[Set the yield on the lD-year U.S. Treasury Bond from Yahoo! Finance. Scroll down to the market summary. Enter that yield as the risk-free rate. Find the beta for Toyota from Yahoo! Finance. Enter the symbol for Toyota and click "Key Statistics". The beta for Toyota will be listed there. Use a market risk premium of 4.5% to compute the cost ofequity using the CAPM. [f you need to, repeat that exercise to compute the costof debt. Determine the values for E and D for Toyota and the debtto-value and equity-to value ratios. iii. iv. To compute the net debt for Toyota. Add the long-term debt and the short- term debt and subtractcash and cash equivalents for each year on the balance sheet . lDbtain the historical number of shares outstanding from lCoogle Finance. Enter Toyota's ticker in the search box, click "Financials". Look on the income statement for "Diluted Weighted Average Shares". Multiply the historical stock prices by the number ofshares outstanding you collected to compute Toyota's market capitalization at the end of each fiscal year. Compute Toyota's enterprise value at the end of each fiscal year by combining the values obtained for its equity market capitalization and its net debt. Compute Toyota's debt tovalue ratio at the end of each year by dividing its net debt by its enterprise value. Use the average ratio from the last four years as an estimate for Toyota's target debtto-value ratio. d. Determine Toyota's tax rate by dividing the income tax by earnings before tax for E . each year. Take the average ofthe fourrates as Toyota's marginal corporate tax rate. Compute the WACC for Toyota. 4-. Compute the N111; ofthe hybrid engine expansion given the free cash ows you calculated using the WACC method of valuation