(1) Common stock, par value 1. It refers to the Book Value of Common Equity.

For 2021 BV of Common Shares, we can assume that it is as the same as 2020 value.

According to the buyout plan, Diamond equity would purchase Sports Worlds remaining 5,197,000 shares in 2020. We can assume the Book Value for such amount shares would be 1 x 5,197,000 = 5,197,000. Therefore, the 2022 BV of common shares = 2021 BV + BV of the buyout.

We can assume that the BV of common shares won't be changed in 2022-26 as the number of common shares will be constant.

(2) Additional paid-in capital. It refers to the differences between the Market Value and Book Value of Common Shares. Similar to BV of Common Equities,

For 2021 Additional paid-in capital of Common Shares, we can assume that it is as the same as 2020 figure.

According to the case, the Market Value for the buyout shares is 249,456,000, while the Book Value for the buyout shares would be 5,197,000. So the Additional paid-in capital for the buyout plan would be MV - BV (249,456,000 - 5,197,000 = 244,259,000). Therefore, the 2022 Additional paid-in capital = 2021 Figure + Additional paid-in capital for the buyout plan

To simplify the calculation, we can assume that the Additional paid-in capital of common shares won't be changed in 2022-26 as there won't be new shares issued.

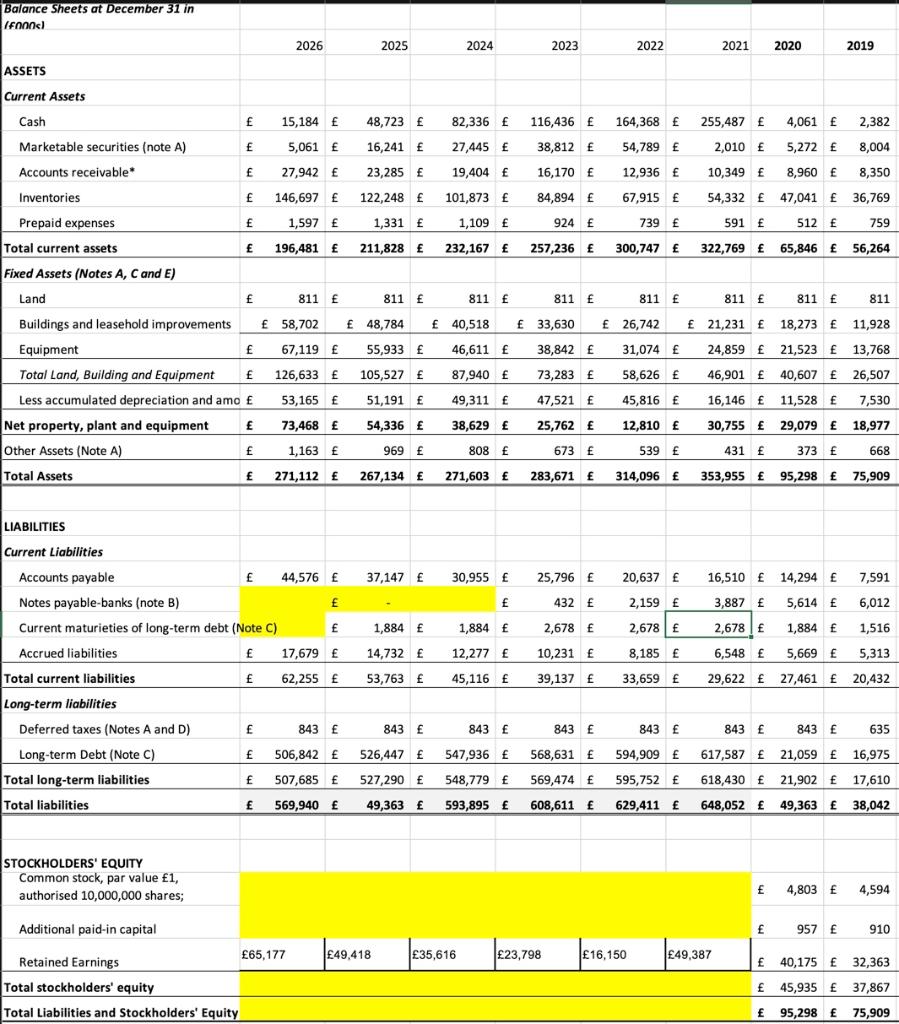

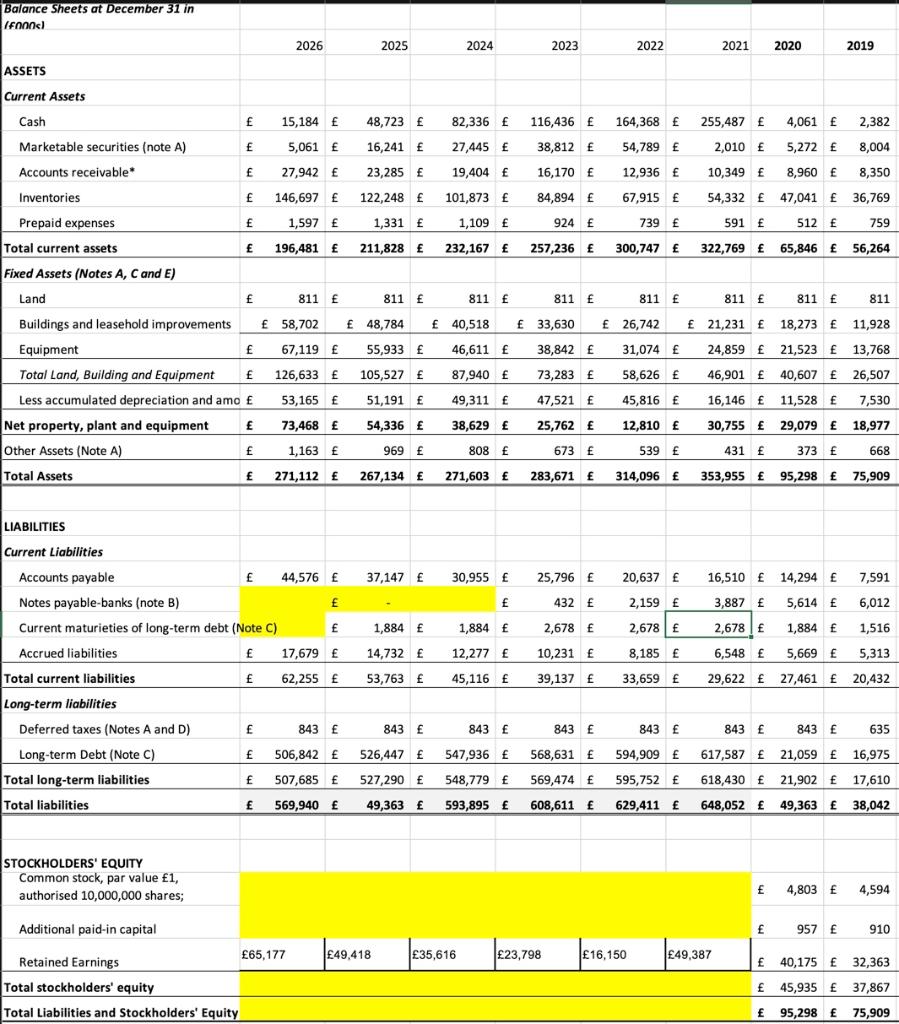

Balance Sheets at December 31 in IFOonal 2026 2025 2024 2023 2022 2021 2020 2019 ASSETS Current Assets E 15,184 48,723 82,336 116,436 164,368 255,487 4,061 E 2,382 Cash Marketable securities (note A) Accounts receivable E 2,010 5,272 E 8,004 54,789 12,936 67,915 5,061 16,241 27,445 38,812 27,942 23,285 19,404 16,170 146,697 122,248 101,873 84,894 1,597 1,331 1,109 924 E 196,481 211,828 232,167 257,236 10,349 8,960 8,350 54,332 47,041 36,769 Inventories E Prepaid expenses 739 591 E 512 E 759 Total current assets 300,747 322,769 65,846 56,264 Fixed Assets (Notes A, C and E) Land E 811 811 40,518 33,630 46,611 38,842 87,940 73,283 Buildings and leasehold improvements Equipment E Total Land, Building and Equipment E Less accumulated depreciation and amo Net property, plant and equipment E Other Assets (Note A) E 811 E 811 58,702 48,784 67,119 55,933 126,633 105,527 53,165 51,191 73,468 54,336 1,163 969 271,112 267,134 811 811 811 811 26,742 21,231 18,273 11,928 31,074 24,859 21,523 13,768 58,626 46,901 40,607 26,507 45,816 16,146 11,528 7,530 12,810 30,755 29,079 18,977 539 431 373 668 314,096 353,955 95,298 75,909 49,311 47,521 38,629 25,762 808 E 673 283,671 Total Assets 271,603 LIABILITIES Current Liabilities Accounts payable 44,576 37,147 30,955 25,796 20,637 16,510 14,294 7,591 Notes payable-banks (note B) E 432 2,159 3,887 5,614 6,012 Current maturieties of long-term debt (Note C) E 1,884 1,884 2,678 2,678 2,678 1,884 1,516 Accrued liabilities 17,679 14,732 12,277 10,231 8,185 6,548 5,669 5,313 Total current liabilities E 62,255 53,763 45,116 39,137 E 33,659 29,622 27,461 20,432 Long-term liabilities Deferred taxes (Notes A and D) 843 843 843 E 843 843 843 843 635 Long-term Debt (Note C) E 506,842 526,447 547,936 568,631 594,909 617,587 21,059 16,975 Total long-term liabilities E 507,685 527,290 548,779 569,474 595,752 618,430 21,902 17,610 Total liabilities 569,940 49,363 593,895 608,611 629,411 648,052 49,363 38,042 STOCKHOLDERS' EQUITY Common stock, par value 1, authorised 10,000,000 shares; 4,803 E 4,594 Additional paid-in capital - 957 910 65, 177 49.418 Retained Earnings 35,616 23,798 16,150 49,387 Total stockholders' equity 40,175 32,363 45,935 37,867 95,298 75,909 Total Liabilities and Stockholders' Equity Balance Sheets at December 31 in IFOonal 2026 2025 2024 2023 2022 2021 2020 2019 ASSETS Current Assets E 15,184 48,723 82,336 116,436 164,368 255,487 4,061 E 2,382 Cash Marketable securities (note A) Accounts receivable E 2,010 5,272 E 8,004 54,789 12,936 67,915 5,061 16,241 27,445 38,812 27,942 23,285 19,404 16,170 146,697 122,248 101,873 84,894 1,597 1,331 1,109 924 E 196,481 211,828 232,167 257,236 10,349 8,960 8,350 54,332 47,041 36,769 Inventories E Prepaid expenses 739 591 E 512 E 759 Total current assets 300,747 322,769 65,846 56,264 Fixed Assets (Notes A, C and E) Land E 811 811 40,518 33,630 46,611 38,842 87,940 73,283 Buildings and leasehold improvements Equipment E Total Land, Building and Equipment E Less accumulated depreciation and amo Net property, plant and equipment E Other Assets (Note A) E 811 E 811 58,702 48,784 67,119 55,933 126,633 105,527 53,165 51,191 73,468 54,336 1,163 969 271,112 267,134 811 811 811 811 26,742 21,231 18,273 11,928 31,074 24,859 21,523 13,768 58,626 46,901 40,607 26,507 45,816 16,146 11,528 7,530 12,810 30,755 29,079 18,977 539 431 373 668 314,096 353,955 95,298 75,909 49,311 47,521 38,629 25,762 808 E 673 283,671 Total Assets 271,603 LIABILITIES Current Liabilities Accounts payable 44,576 37,147 30,955 25,796 20,637 16,510 14,294 7,591 Notes payable-banks (note B) E 432 2,159 3,887 5,614 6,012 Current maturieties of long-term debt (Note C) E 1,884 1,884 2,678 2,678 2,678 1,884 1,516 Accrued liabilities 17,679 14,732 12,277 10,231 8,185 6,548 5,669 5,313 Total current liabilities E 62,255 53,763 45,116 39,137 E 33,659 29,622 27,461 20,432 Long-term liabilities Deferred taxes (Notes A and D) 843 843 843 E 843 843 843 843 635 Long-term Debt (Note C) E 506,842 526,447 547,936 568,631 594,909 617,587 21,059 16,975 Total long-term liabilities E 507,685 527,290 548,779 569,474 595,752 618,430 21,902 17,610 Total liabilities 569,940 49,363 593,895 608,611 629,411 648,052 49,363 38,042 STOCKHOLDERS' EQUITY Common stock, par value 1, authorised 10,000,000 shares; 4,803 E 4,594 Additional paid-in capital - 957 910 65, 177 49.418 Retained Earnings 35,616 23,798 16,150 49,387 Total stockholders' equity 40,175 32,363 45,935 37,867 95,298 75,909 Total Liabilities and Stockholders' Equity