Answered step by step

Verified Expert Solution

Question

1 Approved Answer

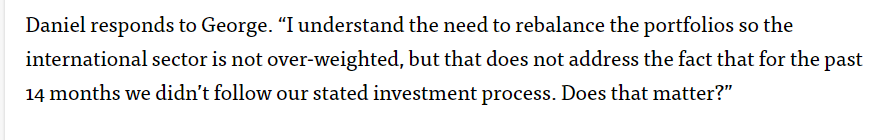

Daniel responds to George. I understand the need to rebalance the portfolios so the international sector is not over-weighted, but that does not address the

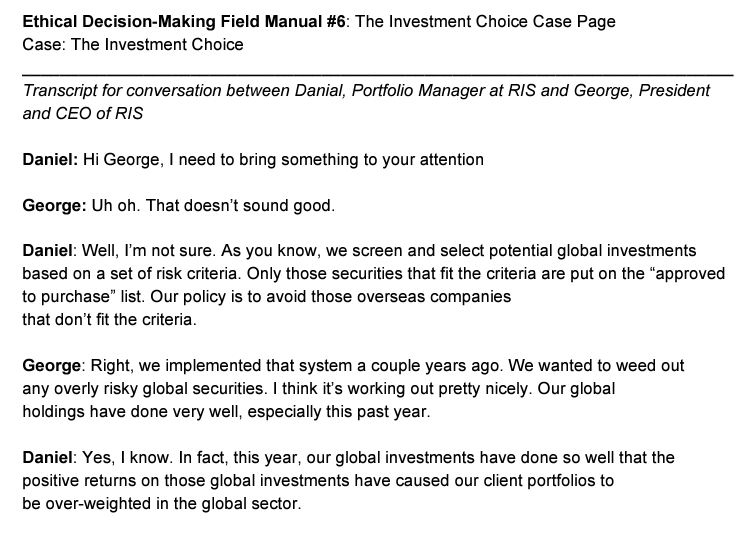

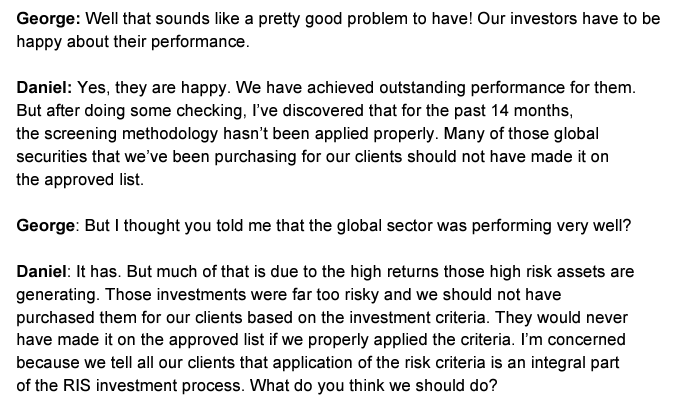

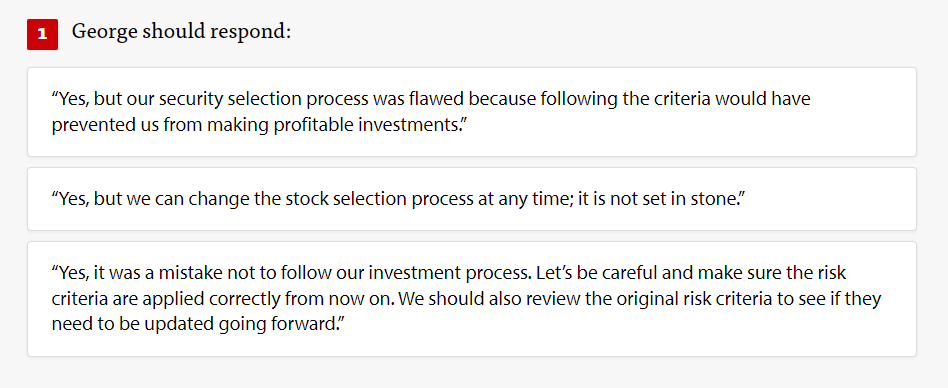

Daniel responds to George. "I understand the need to rebalance the portfolios so the international sector is not over-weighted, but that does not address the fact that for the past 14 months we didn't follow our stated investment process. Does that matter?" George should respond: "Yes, but our security selection process was flawed because following the criteria would have prevented us from making profitable investments." "Yes, but we can change the stock selection process at any time; it is not set in stone." "Yes, it was a mistake not to follow our investment process. Let's be careful and make sure the risk criteria are applied correctly from now on. We should also review the original risk criteria to see if they need to be updated going forward." George: Well that sounds like a pretty good problem to have! Our investors have to be happy about their performance. Daniel: Yes, they are happy. We have achieved outstanding performance for them. But after doing some checking, I've discovered that for the past 14 months, the screening methodology hasn't been applied properly. Many of those global securities that we've been purchasing for our clients should not have made it on the approved list. George: But I thought you told me that the global sector was performing very well? Daniel: It has. But much of that is due to the high returns those high risk assets are generating. Those investments were far too risky and we should not have purchased them for our clients based on the investment criteria. They would never have made it on the approved list if we properly applied the criteria. I'm concerned because we tell all our clients that application of the risk criteria is an integral part of the RIS investment process. What do you think we should do? Ethical Decision-Making Field Manual \#6: The Investment Choice Case Page Case: The Investment Choice Transcript for conversation between Danial, Portfolio Manager at RIS and George, President and CEO of RIS Daniel: Hi George, I need to bring something to your attention George: Uh oh. That doesn't sound good. Daniel: Well, I'm not sure. As you know, we screen and select potential global investments based on a set of risk criteria. Only those securities that fit the criteria are put on the "approved to purchase "list. Our policy is to avoid those overseas companies that don't fit the criteria. George: Right, we implemented that system a couple years ago. We wanted to weed out any overly risky global securities. I think it's working out pretty nicely. Our global holdings have done very well, especially this past year. Daniel: Yes, I know. In fact, this year, our global investments have done so well that the positive returns on those global investments have caused our client portfolios to be over-weighted in the global sector

Daniel responds to George. "I understand the need to rebalance the portfolios so the international sector is not over-weighted, but that does not address the fact that for the past 14 months we didn't follow our stated investment process. Does that matter?" George should respond: "Yes, but our security selection process was flawed because following the criteria would have prevented us from making profitable investments." "Yes, but we can change the stock selection process at any time; it is not set in stone." "Yes, it was a mistake not to follow our investment process. Let's be careful and make sure the risk criteria are applied correctly from now on. We should also review the original risk criteria to see if they need to be updated going forward." George: Well that sounds like a pretty good problem to have! Our investors have to be happy about their performance. Daniel: Yes, they are happy. We have achieved outstanding performance for them. But after doing some checking, I've discovered that for the past 14 months, the screening methodology hasn't been applied properly. Many of those global securities that we've been purchasing for our clients should not have made it on the approved list. George: But I thought you told me that the global sector was performing very well? Daniel: It has. But much of that is due to the high returns those high risk assets are generating. Those investments were far too risky and we should not have purchased them for our clients based on the investment criteria. They would never have made it on the approved list if we properly applied the criteria. I'm concerned because we tell all our clients that application of the risk criteria is an integral part of the RIS investment process. What do you think we should do? Ethical Decision-Making Field Manual \#6: The Investment Choice Case Page Case: The Investment Choice Transcript for conversation between Danial, Portfolio Manager at RIS and George, President and CEO of RIS Daniel: Hi George, I need to bring something to your attention George: Uh oh. That doesn't sound good. Daniel: Well, I'm not sure. As you know, we screen and select potential global investments based on a set of risk criteria. Only those securities that fit the criteria are put on the "approved to purchase "list. Our policy is to avoid those overseas companies that don't fit the criteria. George: Right, we implemented that system a couple years ago. We wanted to weed out any overly risky global securities. I think it's working out pretty nicely. Our global holdings have done very well, especially this past year. Daniel: Yes, I know. In fact, this year, our global investments have done so well that the positive returns on those global investments have caused our client portfolios to be over-weighted in the global sector Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started