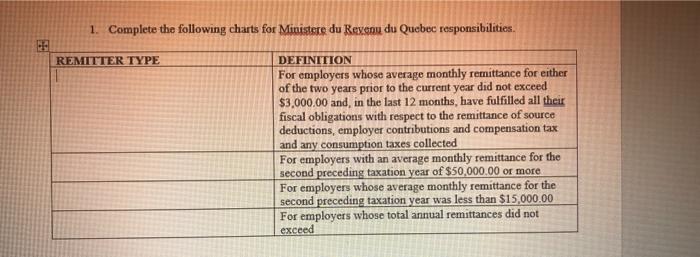

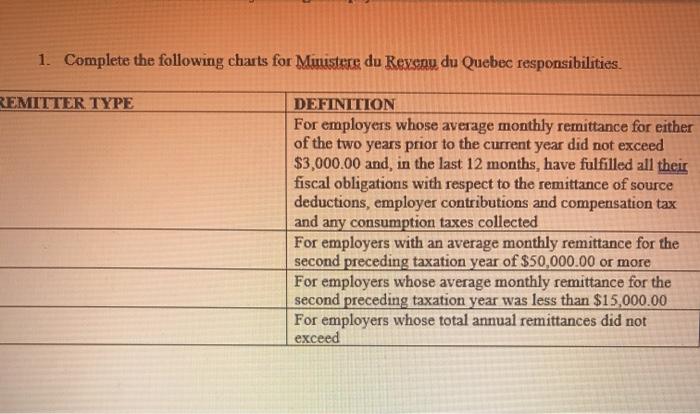

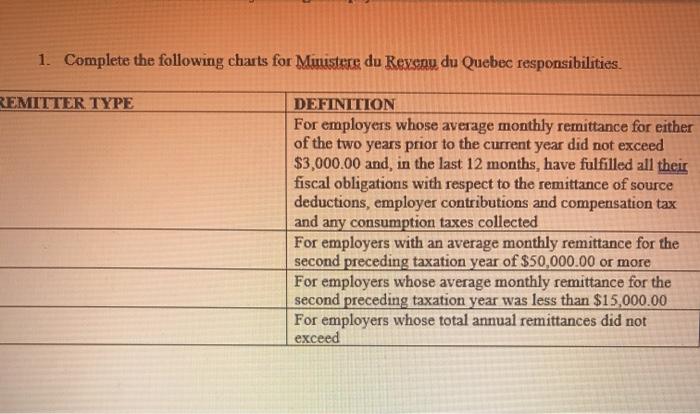

1. Complete the following charts for Ministere du Revsou du Quebec responsibilities. REMITTER TYPE DEFINITION For employers whose average monthly remittance for either of the two years prior to the current year did not exceed $3,000.00 and, in the last 12 months, have fulfilled all their fiscal obligations with respect to the remittance of source deductions, employer contributions and compensation tax and any consumption taxes collected For employers with an average monthly remittance for the second preceding taxation year of $50,000.00 or more For employers whose average monthly remittance for the second preceding taxation year was less than $15,000.00 For employers whose total annual remittances did not exceed 1. Complete the following charts for Musters du Rexsnu du Quebec responsibilities. REMITTER TYPE DEFINITION For employers whose average monthly remittance for either of the two years prior to the current year did not exceed $3,000.00 and, in the last 12 months, have fulfilled all their fiscal obligations with respect to the remittance of source deductions, employer contributions and compensation tax and any consumption taxes collected For employers with an average monthly remittance for the second preceding taxation year of $50,000.00 or more For employers whose average monthly remittance for the second preceding taxation year was less than $15,000.00 For employers whose total annual remittances did not exceed 1. Complete the following charts for Ministere du Revsou du Quebec responsibilities. REMITTER TYPE DEFINITION For employers whose average monthly remittance for either of the two years prior to the current year did not exceed $3,000.00 and, in the last 12 months, have fulfilled all their fiscal obligations with respect to the remittance of source deductions, employer contributions and compensation tax and any consumption taxes collected For employers with an average monthly remittance for the second preceding taxation year of $50,000.00 or more For employers whose average monthly remittance for the second preceding taxation year was less than $15,000.00 For employers whose total annual remittances did not exceed 1. Complete the following charts for Musters du Rexsnu du Quebec responsibilities. REMITTER TYPE DEFINITION For employers whose average monthly remittance for either of the two years prior to the current year did not exceed $3,000.00 and, in the last 12 months, have fulfilled all their fiscal obligations with respect to the remittance of source deductions, employer contributions and compensation tax and any consumption taxes collected For employers with an average monthly remittance for the second preceding taxation year of $50,000.00 or more For employers whose average monthly remittance for the second preceding taxation year was less than $15,000.00 For employers whose total annual remittances did not exceed