Question

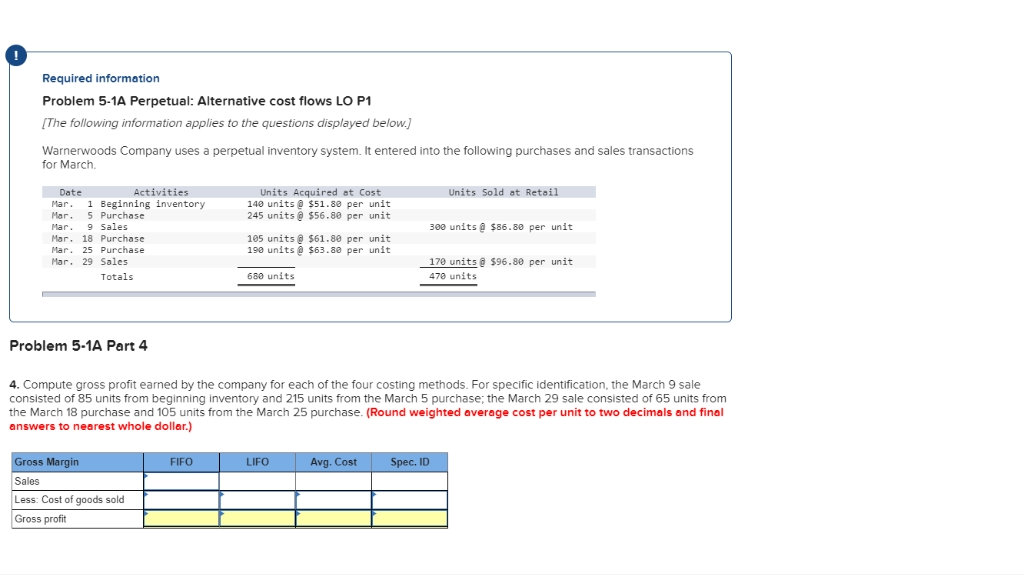

1. Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 85

1.Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 85 units from beginning inventory and 215 units from the March 5 purchase; the March 29 sale consisted of 65 units from the March 18 purchase and 105 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.) Need help filling out this chart.

1.Compute gross profit earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 85 units from beginning inventory and 215 units from the March 5 purchase; the March 29 sale consisted of 65 units from the March 18 purchase and 105 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.) Need help filling out this chart.

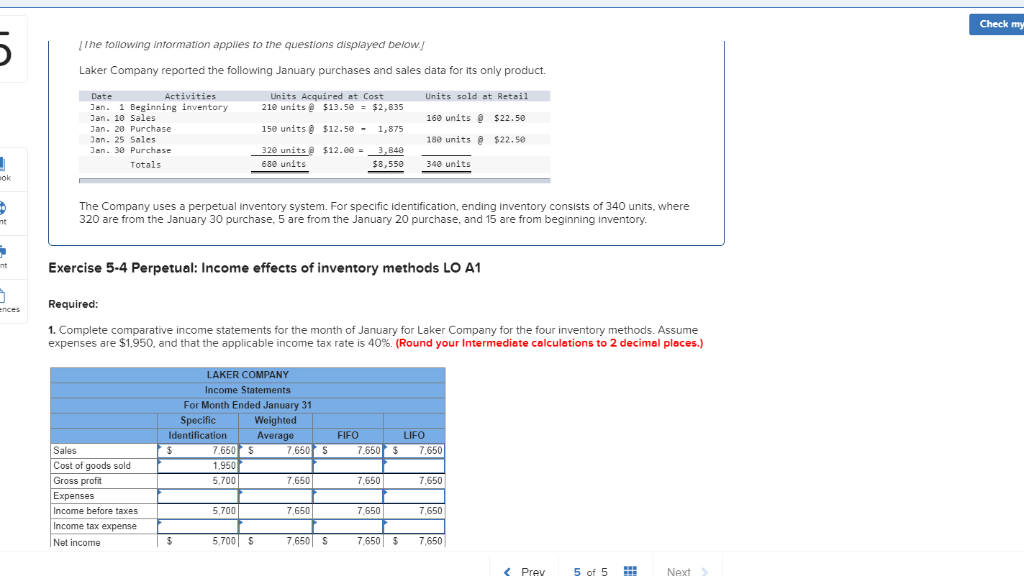

2.Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,950, and that the applicable income tax rate is 40%. (Round your Intermediate calculations to 2 decimal places.) Need help filling out the rest of the income statement chart.

2.Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,950, and that the applicable income tax rate is 40%. (Round your Intermediate calculations to 2 decimal places.) Need help filling out the rest of the income statement chart.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started