Question

1. Consider an currency swap between Americana Auto Company (which wants to build an auto plant in the United Kingdom) and Britannia Bus Corporation (which

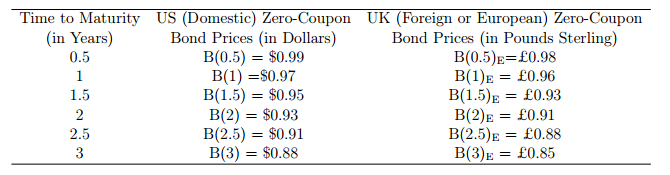

1. Consider an currency swap between Americana Auto Company (which wants to build an auto plant in the United Kingdom) and Britannia Bus Corporation (which wants to build an auto plant in the United States; both fictitious names). The automakers enter into a swap with a three-year term on a principal of $200 million.The spot exchange rate is $2 per pound. Americana raises 100 2 = $200 million and gives it to Britannia, who, in turn, raises 100 million and gives it to Americana. Americana pays Britannia at the coupon rate of 4 percent per year on 100 million and Britannia pays Americana at the coupon rate of 5 percent per year on $200 million for three years. Now, assume that the companies make payments every six months: the swap ends after six semi-annual payments, and the principals are handed back after three years. Compute the value of this currency swap.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started