Question

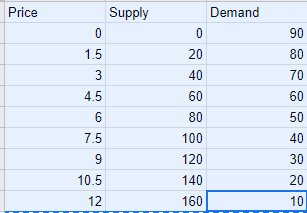

1) Consider the following supply and demand schedule. a) Calculate producer surplus, consumer surplus, and total surplus. (6 points) b) Suppose the government decides the

1) Consider the following supply and demand schedule.

a) Calculate producer surplus, consumer surplus, and total surplus. (6 points)

b) Suppose the government decides the price is too high for customers, thus they impose a price restriction of $1.50. Draw a graph showing this situation. What is the type of price restriction? What is the impact on the market? Are customers helped as desired? (4 points)

c) Suppose the government decides the price is too low for sellers, thus they impose a price restriction of $9.00. Draw a graph showing this situation. What is the type of price restriction? What is the impact on the market? Are suppliers helped as desired? (4 points)

2) Draw a typical supply and demand diagram. Show what happens when the preference for the product declines, causing the demand to decline. What is the effect on consumer surplus? What is the effect on producer surplus? What happens to total surplus? Is total surplus maximized? Explain. (6 points)

3) For each of the following situations, draw a graph showing the shifts of the curve, explain the reason for the shift(s), and the effect on the equilibrium price and quantity in the market for bicycles.

a) The price of automobiles increases. (6 points)

b) Consumers' incomes decrease at the same time the price of steel used to make bicycle frames increases. (6 points)

c) An environmental movement shifts tastes toward bicycling. (6 points)

d) A technological advance in the manufacture of bicycles occurs at the same time the price of bicycle helmets and shoes falls. (6 points)

4) The payroll tax for unemployment insurance in a certain nation taxes all wages up to a maximum per worker of $30,000 at a 5 percent flat rate. What are the marginal and average tax rates on the wages for each of the following three workers?

a) A restaurant worker with annual wages of $18,000. (2 points)

b) An assistant bank manager with wages of $35,000 per year. (2 points)

c) A corporate CEO with an annual salary of $500,000 per year. (2 points)

5) A tax on shoe sales that requires the dealer to pay a $2 tax on every pair of shoes sold should not concern consumers because the dealer has to pay the tax. Evaluate this statement. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started