Question

1. Consider the two-period binomial model with a non-dividend paying stock S, where So = 4, u = 2, d = 0.5, r =

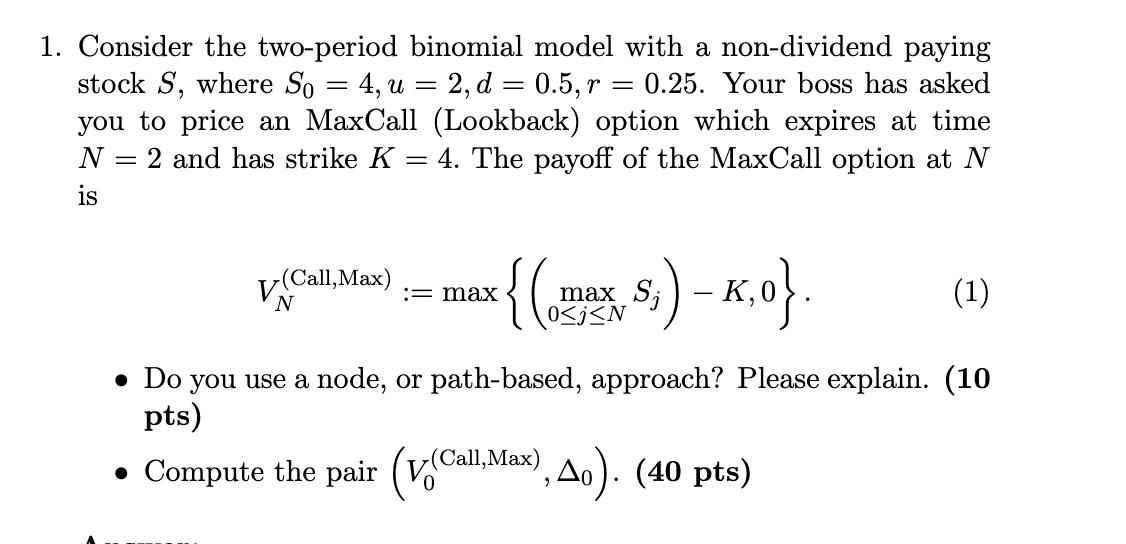

1. Consider the two-period binomial model with a non-dividend paying stock S, where So = 4, u = 2, d = 0.5, r = 0.25. Your boss has asked you to price an MaxCall (Lookback) option which expires at time N = 2 and has strike K = 4. The payoff of the MaxCall option at N is V(Call, Max) := max N {(max S,) - K,0}. (1) Do you use a node, or path-based, approach? Please explain. (10 pts) Compute the pair (v (Call,Max), Ao). (40 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer In this case to price the MaxCall Lookback option using the twoperiod binomial model we would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

2nd Canadian edition

176517308, 978-0176517304

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App