Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Construct an amortization schedule that shows premium/discount amortization over the life of the 2013 Notes 2) Show the journal entries for the 2013 Notes

1) Construct an amortization schedule that shows premium/discount amortization over the life

of the 2013 Notes

2) Show the journal entries for the 2013 Notes on November 8, 2010.

3) Assume the fiscal year ends on December 31, 2010. Show the appropriate adjusting entries

related to the 2013 Notes (round interest for the period to the nearest month for simplicity).

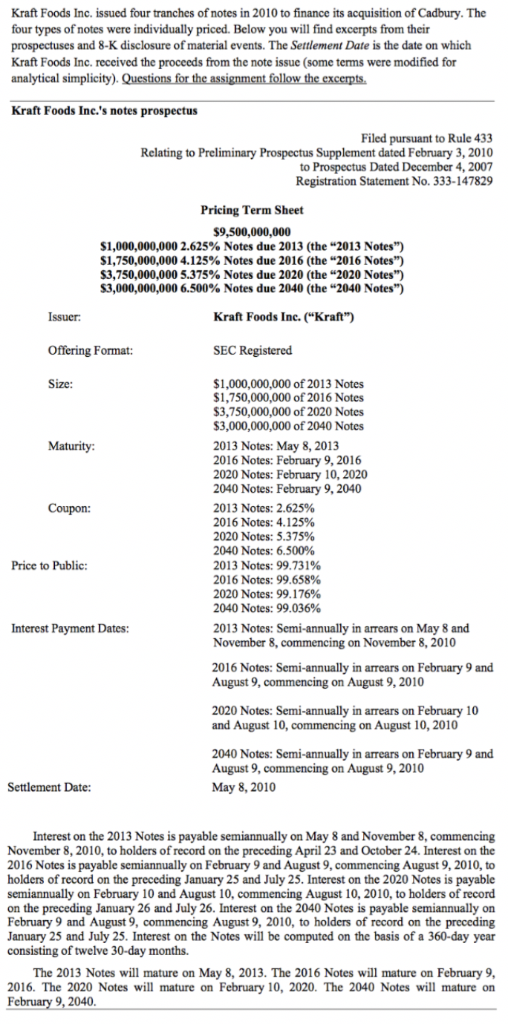

Kraft Foods Inc. issued four tranches of notes in 2010 to finance its acquisition of Cadbury. The four types of notes were individually priced. Below you will find excerpts from their prospectuses and 8-K disclosure of material events. The Settlement Date is the date on which Kraft Foods Inc. received the proceeds from the note issue (some terms were modified for Kraft Foods Inc.'s notes prospectus Filed pursuant to Rule 433 Relating to Preliminary Prospectus Supplement dated February 3, 2010 to Prospectus Dated December 4, 2007 Registration Statement No. 333-147829 Pricing Term Sheet $9,500,000,000 $1,000,000,000 2.625% Notes due 2013 (the "2013 Notes") $1,750,000,000 4.125% Notes due 2016 (the "2016 Notes") $3,750,000,000 5.375% Notes due 2020 (the "2020 Notes") $3,000,000,000 6.500% Notes due 2040 (the "2040 Notes") Kraft Foods Inc. ("Kraft") Offering Format: SEC Registered Size: $1,000,000,000 of 2013 Notes $1,750,000,000 of 2016 Notes $3,750,000,000 of 2020 Notes $3,000,000,000 of 2040 Notes Maturity: 2013 Notes: May 8, 2013 2016 Notes: February 9, 2016 2020 Notes: February 10, 2020 2040 Notes: February 9,2040 2013 Notes: 2.625% 2016 Notes: 4-125% 2020 Notes: 5.375% 2040 Notes: 6.500% 2013 Notes: 99.731% 2016 Notes: 99.658% 2020 Notes: 99.176% 2040 Notes: 99.036% Coupon: Price to Public: 2013 Notes: Semi-annually in arrears on May 8 and November 8, commencing on November 8,2010 Interest Payment Dates: 2016 Notes: Semi-annually in arrears on February 9 and August 9, commencing on August 9,2010 2020 Notes: Semi-annually in arrears on February 10 and August 10, commencing on August 10, 2010 2040 Notes: Semi-annually in arrears on February 9 and August 9, commencing on August 9,2010 Settlement Date: May 8, 2010 Interest on the 2013 Notes is payable semiannually on May 8 and November 8, commencing November 8, 2010, to holders of record on the preceding April 23 and October 24. Interest on the 2016 Notes is payable semiannually on February 9 and August 9, commencing August 9, 2010, to holders of record on the preceding January 25 and July 25. Interest on the 2020 Notes is payable semiannually on February 10 and August 10, commencing August 10, 2010, to holders of record on the preceding January 26 and July 26. Interest on the 2040 Notes is payable semiannually on February 9 and August 9, commencing August 9, 2010, to holders of record on the preceding January 25 and July 25. Interest on the Notes will be computed on the basis of a 360-day year g of twelve 30-day months. The 2013 Notes will mature on May 8, 2013. The 2016 Notes will mature on February 9, 2016. The 2020 Notes will mature on February 10, 2020. The 2040 Notes will mature on 9, 2040 Kraft Foods Inc. issued four tranches of notes in 2010 to finance its acquisition of Cadbury. The four types of notes were individually priced. Below you will find excerpts from their prospectuses and 8-K disclosure of material events. The Settlement Date is the date on which Kraft Foods Inc. received the proceeds from the note issue (some terms were modified for Kraft Foods Inc.'s notes prospectus Filed pursuant to Rule 433 Relating to Preliminary Prospectus Supplement dated February 3, 2010 to Prospectus Dated December 4, 2007 Registration Statement No. 333-147829 Pricing Term Sheet $9,500,000,000 $1,000,000,000 2.625% Notes due 2013 (the "2013 Notes") $1,750,000,000 4.125% Notes due 2016 (the "2016 Notes") $3,750,000,000 5.375% Notes due 2020 (the "2020 Notes") $3,000,000,000 6.500% Notes due 2040 (the "2040 Notes") Kraft Foods Inc. ("Kraft") Offering Format: SEC Registered Size: $1,000,000,000 of 2013 Notes $1,750,000,000 of 2016 Notes $3,750,000,000 of 2020 Notes $3,000,000,000 of 2040 Notes Maturity: 2013 Notes: May 8, 2013 2016 Notes: February 9, 2016 2020 Notes: February 10, 2020 2040 Notes: February 9,2040 2013 Notes: 2.625% 2016 Notes: 4-125% 2020 Notes: 5.375% 2040 Notes: 6.500% 2013 Notes: 99.731% 2016 Notes: 99.658% 2020 Notes: 99.176% 2040 Notes: 99.036% Coupon: Price to Public: 2013 Notes: Semi-annually in arrears on May 8 and November 8, commencing on November 8,2010 Interest Payment Dates: 2016 Notes: Semi-annually in arrears on February 9 and August 9, commencing on August 9,2010 2020 Notes: Semi-annually in arrears on February 10 and August 10, commencing on August 10, 2010 2040 Notes: Semi-annually in arrears on February 9 and August 9, commencing on August 9,2010 Settlement Date: May 8, 2010 Interest on the 2013 Notes is payable semiannually on May 8 and November 8, commencing November 8, 2010, to holders of record on the preceding April 23 and October 24. Interest on the 2016 Notes is payable semiannually on February 9 and August 9, commencing August 9, 2010, to holders of record on the preceding January 25 and July 25. Interest on the 2020 Notes is payable semiannually on February 10 and August 10, commencing August 10, 2010, to holders of record on the preceding January 26 and July 26. Interest on the 2040 Notes is payable semiannually on February 9 and August 9, commencing August 9, 2010, to holders of record on the preceding January 25 and July 25. Interest on the Notes will be computed on the basis of a 360-day year g of twelve 30-day months. The 2013 Notes will mature on May 8, 2013. The 2016 Notes will mature on February 9, 2016. The 2020 Notes will mature on February 10, 2020. The 2040 Notes will mature on 9, 2040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started