Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Crystal Investments is currently engaged in the planting of wheat with irrigation facilities in place. It is expected that they will harvest 3

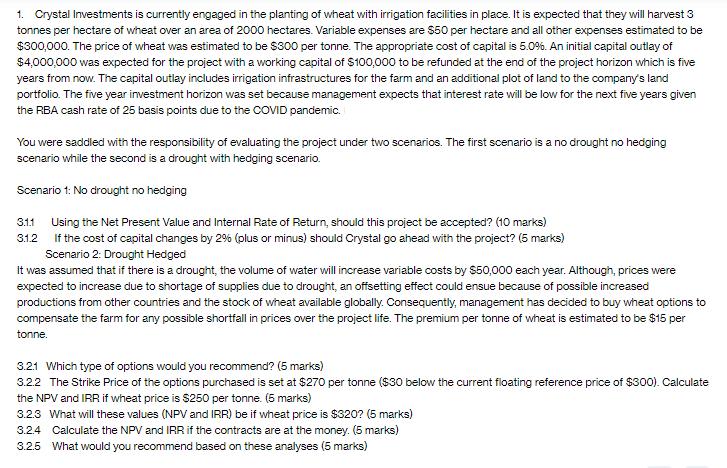

1. Crystal Investments is currently engaged in the planting of wheat with irrigation facilities in place. It is expected that they will harvest 3 tonnes per hectare of wheat over an area of 2000 hectares. Variable expenses are $50 per hectare and all other expenses estimated to be $300,000. The price of wheat was estimated to be $300 per tonne. The appropriate cost of capital is 5.0%. An initial capital outlay of $4,000,000 was expected for the project with a working capital of $100,000 to be refunded at the end of the project horizon which is five years from now. The capital outlay includes irrigation infrastructures for the farm and an additional plot of land to the company's land portfolio. The five year investment horizon was set because management expects that interest rate will be low for the next five years given the RBA cash rate of 25 basis points due to the COVID pandemic. You were saddled with the responsibility of evaluating the project under two scenarios. The first scenario is a no drought no hedging scenario while the second is a drought with hedging scenario. Scenario 1: No drought no hedging 3.1.1 Using the Net Present Value and Internal Rate of Return, should this project be accepted? (10 marks) 3.1.2 If the cost of capital changes by 2% (plus or minus) should Crystal go ahead with the project? (5 marks) Scenario 2: Drought Hedged It was assumed that if there is a drought, the volume of water will increase variable costs by $50,000 each year. Although, prices were expected to increase due to shortage of supplies due to drought, an offsetting effect could ensue because of possible increased productions from other countries and the stock of wheat available globally. Consequently, management has decided to buy wheat options to compensate the farm for any possible shortfall in prices over the project life. The premium per tonne of wheat is estimated to be $15 per tonne. 3.2.1 Which type of options would you recommend? (5 marks) 3.2.2 The Strike Price of the options purchased is set at $270 per tonne ($30 below the current floating reference price of $300). Calculate the NPV and IRR if wheat price is $250 per tonne. (5 marks) 3.2.3 What will these values (NPV and IRR) be if wheat price is $320? (5 marks) 3.2.4 Calculate the NPV and IRR if the contracts are at the money. (5 marks) 3.2.5 What would you recommend based on these analyses (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

It seems youve provided a detailed financial analysis with various scenarios for Crystal Investments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started