Answered step by step

Verified Expert Solution

Question

1 Approved Answer

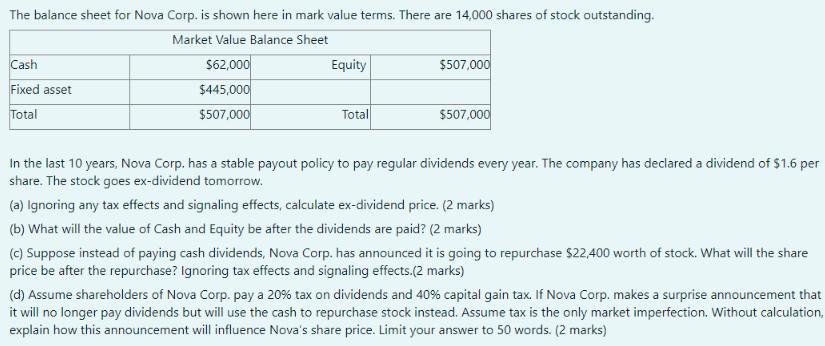

The balance sheet for Nova Corp. is shown here in mark value terms. There are 14,000 shares of stock outstanding. Market Value Balance Sheet

The balance sheet for Nova Corp. is shown here in mark value terms. There are 14,000 shares of stock outstanding. Market Value Balance Sheet $62,000 Cash Fixed asset Total $445,000 $507,000 Equity Total $507,000 $507,000 In the last 10 years, Nova Corp. has a stable payout policy to pay regular dividends every year. The company has declared a dividend of $1.6 per share. The stock goes ex-dividend tomorrow. (a) Ignoring any tax effects and signaling effects, calculate ex-dividend price. (2 marks) (b) What will the value of Cash and Equity be after the dividends are paid? (2 marks) (c) Suppose instead of paying cash dividends, Nova Corp. has announced it is going to repurchase $22,400 worth of stock. What will the share price be after the repurchase? Ignoring tax effects and signaling effects.(2 marks) (d) Assume shareholders of Nova Corp. pay a 20% tax on dividends and 40% capital gain tax. If Nova Corp. makes a surprise announcement that it will no longer pay dividends but will use the cash to repurchase stock instead. Assume tax is the only market imperfection. Without calculation, explain how this announcement will influence Nova's share price. Limit your answer to 50 words. (2 marks)

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Cumdividend price Market value of equity Number of shares 507000 14000 3621 H...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started