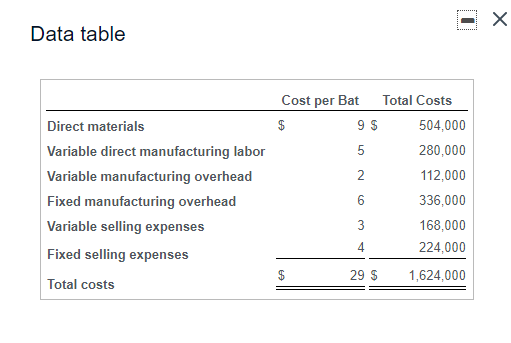

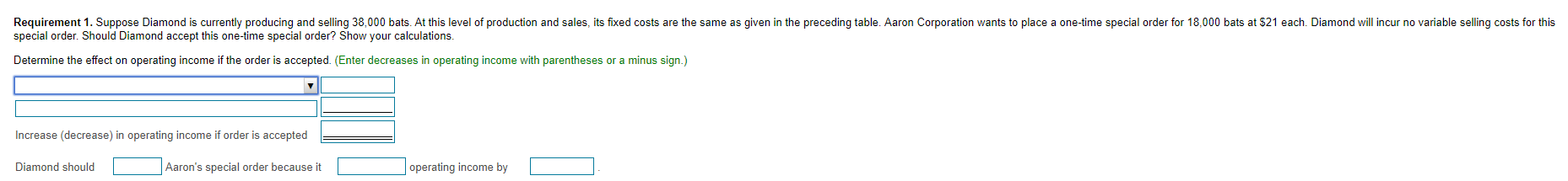

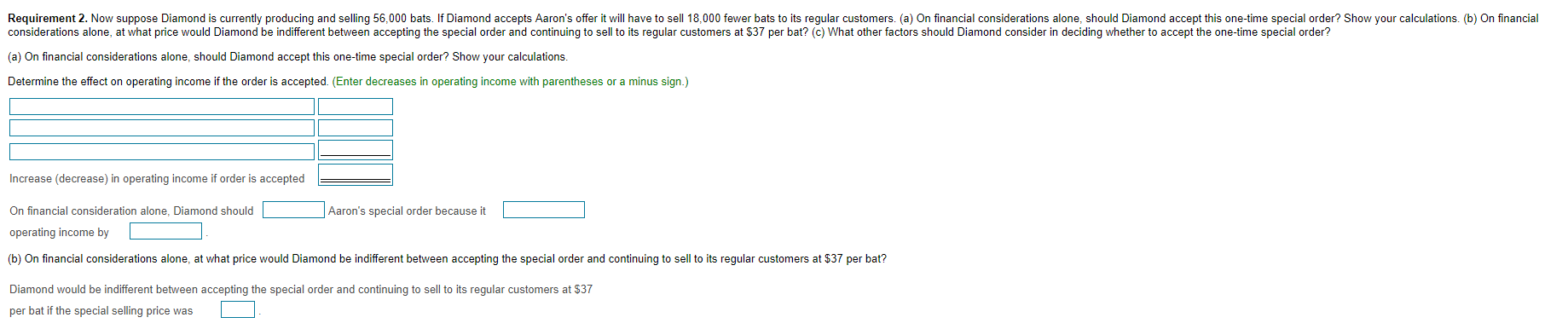

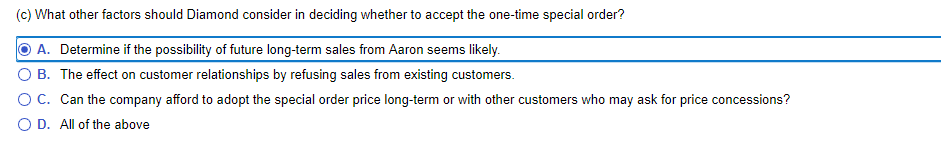

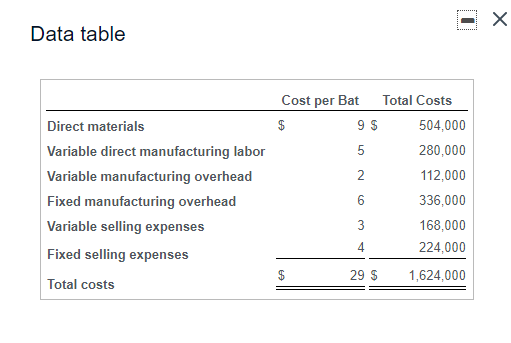

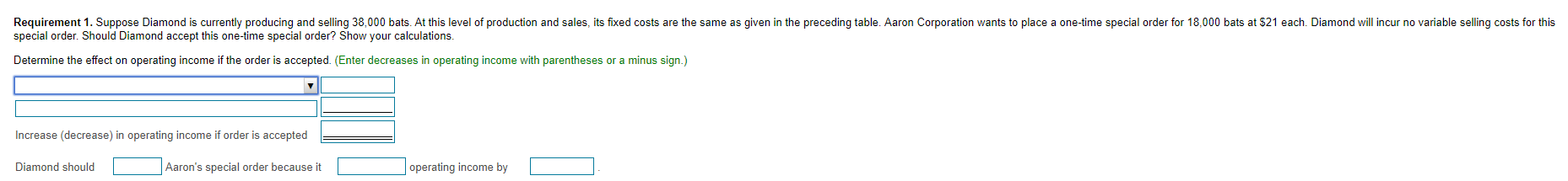

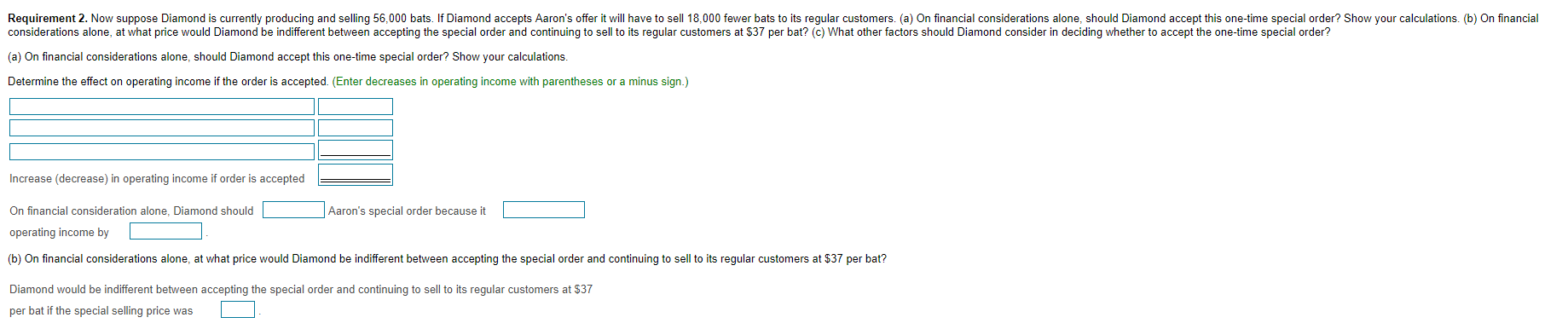

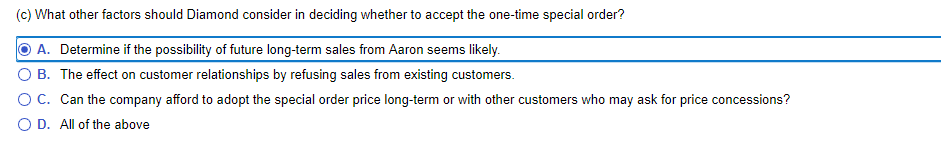

1 Data table Direct materials Variable direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total costs Cost per Bat Total Costs 9 $ 504,000 5 280,000 2 112,000 6 336,000 3 168,000 4 224,000 $ 29 $ 1,624,000 Requirement 1. Suppose Diamond is currently producing and selling 38,000 bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Aaron Corporation wants to place a one-time special order for 18,000 bats at $21 each. Diamond will incur no variable selling costs for this special order. Should Diamond accept this one-time special order? Show your calculations. Determine the effect on operating income if the order is accepted. (Enter decreases in operating income with parentheses or a minus sign.) Increase (decrease) in operating income if order is accepted Diamond should Aaron's special order because it operating income by Requirement 2. Now suppose Diamond is currently producing and selling 56,000 bats. If Diamond accepts Aaron's offer it will have to sell 18,000 fewer bats to its regular customers. (a) On financial considerations alone, should Diamond accept this one-time special order? Show your calculations. (b) On financial considerations alone, at what price would Diamond be indifferent between accepting the special order and continuing to sell to its regular customers at $37 per bat? (c) What other factors should Diamond consider in deciding whether to accept the one-time special order? (a) On financial considerations alone, should Diamond accept this one-time special order? Show your calculations Determine the effect on operating income if the order is accepted. (Enter decreases in operating income with parentheses or a minus sign.) Increase (decrease) in operating income if order is accepted Aaron's special order because it On financial consideration alone, Diamond should operating income by (b) On financial considerations alone, at what price would Diamond be indifferent between accepting the special order and continuing to sell to its regular customers at $37 per bat? Diamond would be indifferent between accepting the special order and continuing to sell to its regular customers at $37 per bat if the special selling price was (c) What other factors should Diamond consider in deciding whether to accept the one-time special order? A. Determine if the possibility of future long-term sales from Aaron seems likely O B. The effect on customer relationships by refusing sales from existing customers. OC. Can the company afford to adopt the special order price long-term or with other customers who may ask for price concessions? OD. All of the above