Question: 1. Decker has a $1,000 loss from an activity in which he materially participates. He has $500 of basis in the activity and his at

1. Decker has a $1,000 loss from an activity in which he materially participates. He has $500 of basis in the activity and his at risk basis is $300. How much of the $1,000 loss may Decker deduct against ordinary income?

2. Hope and Joy formed a partnership by each contributing $3,000. This year, the partnership borrowed $60,000 as a nonrecourse loan. The loan is considered qualified nonrecourse debt. Each partner took a $1,000 distribution this year. What is each partner's at-risk amount at the end of the year?

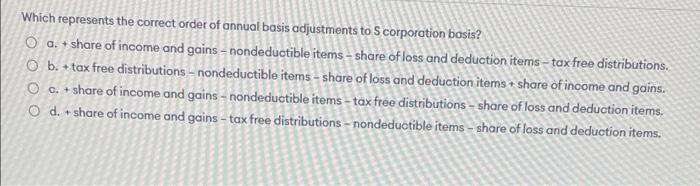

Which represents the correct order of annual basis adjustments to S corporation basis? O a. + share of income and gains nondeductible items - share of loss and deduction items - tax free distributions. O b. + tax free distributions nondeductible items - share of loss and deduction items + share of income and gains. O C. + share of income and gains nondeductible items - tax free distributions - share of loss and deduction items. O d. share of income and gains - tax free distributions - nondeductible items - share of loss and deduction items.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Explanation Option4 Correct In computation of the stock basis there is an orde... View full answer

Get step-by-step solutions from verified subject matter experts