Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tax accounting question On the tab marked 'Schedule of Gains and Losses' complete the following steps. Use the depreciation schedule provided to calculate the basis

tax accounting question

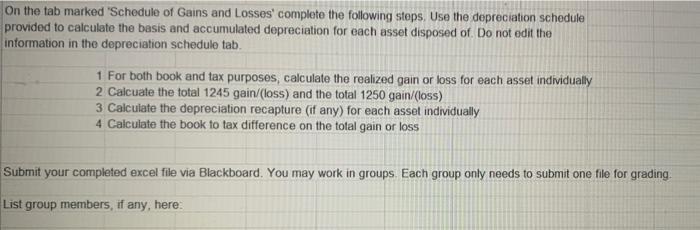

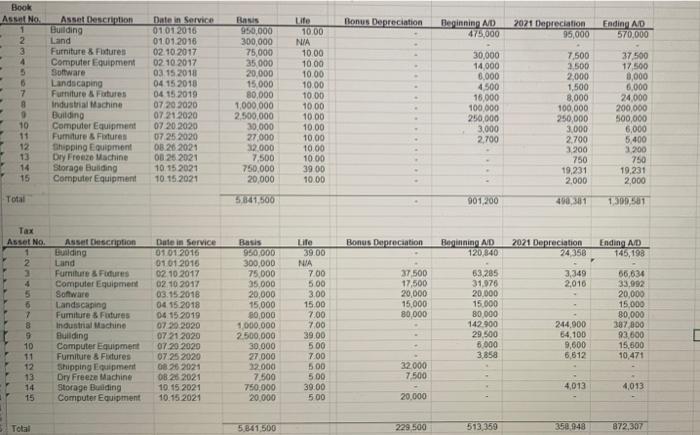

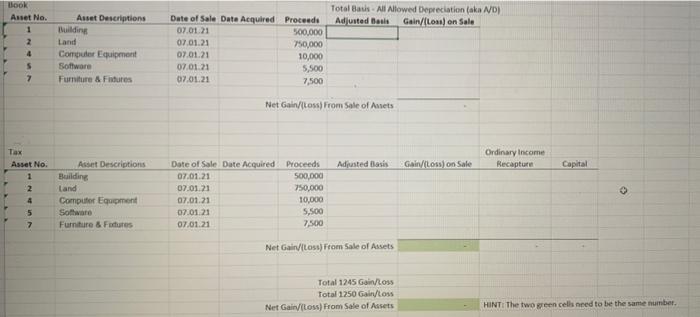

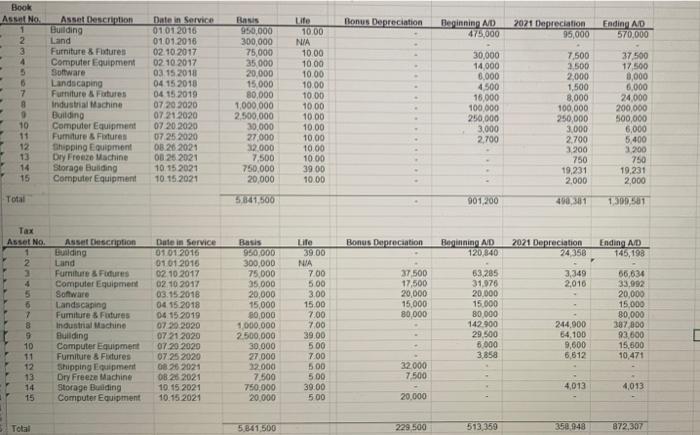

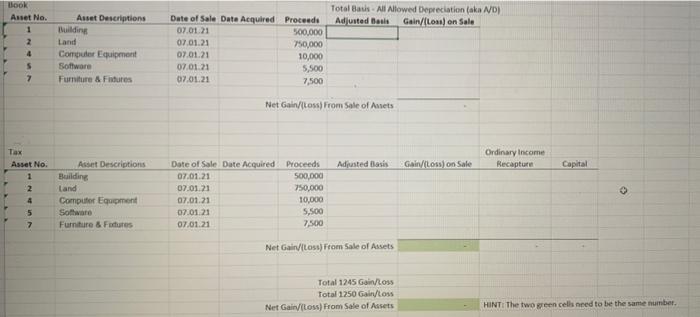

On the tab marked 'Schedule of Gains and Losses' complete the following steps. Use the depreciation schedule provided to calculate the basis and accumulated depreciation for each asset disposed of. Do not edit the information in the depreciation schedule tab. 1 For both book and tax purposes, calculate the realized gain or loss for each asset individually 2 Calcuate the total 1245 gain/(loss) and the total 1250 gain/(loss) 3 Calculate the depreciation recapture (if any) for each asset individually 4 Calculate the book to tax difference on the total gain or loss Submit your completed excel file via Blackboard. You may work in groups Each group only needs to submit one file for grading, List group members, if any, here: Bonus Depreciation Beginning MD 475,000 2021 Depreciation 95,000 Ending AD 570,000 Book Asset No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Asset. Description Building Land Furniture & Fixtures Computer Equipment Software Landscaping Furniture & Futures Industrial Machine Building Computer Equipment Parniture & Fixtures Shipping Equipment Dry Freeze Machine Storage Building Computer Equipment Date in Service 01 01 2016 01.01.2016 02.10.2017 02.10.2017 03 15 2018 04 15 2018 04 15 2019 0720 2020 0721 2020 07 20.2020 0725 2020 08.26 2021 0025 2021 10.15 2021 10 15 2021 Bass 950,000 300,000 75,000 35.000 20.000 15.000 80,000 1,000,000 2,500,000 30.000 27.000 32000 7.500 750,000 20.000 10.00 NIA 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 39.00 10 OD 30,000 14000 6,000 4500 16.000 100.000 250,000 3.000 2,700 7,500 3.500 2.000 1,500 8,000 100,000 250,000 3,000 2.700 3200 750 19,231 2.000 37.500 17.500 0,000 6,000 24,000 200,000 500,000 6,000 5,400 3.200 750 19,231 2.000 Total 5641,500 901200 490,381 1 500 501 Tax Asset No. 1 2 Bonus Depreciation Regioning AD 120.840 2021 Depreciation 24358 Ending AD 145,193 3,349 2,010 4 5 6 37.500 17,500 20,000 15,000 80,000 ! Asset escaption Building Land Furniture & Fidures Computer Equipment Software Landscaping Furniture & Futures Industrial Machine Building Computer Equipment Furniture & Fixtures Shipping Equipment Dry Freete Machine Storage Building Computer Equipment Date in Service 01 01 2016 01 01 2016 02.10.2017 02 10 2017 03.15 2018 04 15 2018 04 15 2019 0720 2020 0721 2020 07:20 2020 07. 25 2020 0826 2021 0826 2021 10.15.2021 10.15 2021 Basis 950.000 300.000 75.000 35.000 20,000 15,000 20,000 1 000.000 2.500,000 30.000 27 000 32 000 7,500 750 000 20.000 Life 39.00 NIA 7.00 500 3.00 15.00 7.00 7.00 39.00 500 7.00 500 500 39.00 500 63,285 31.076 20.000 15 000 80.000 142.900 29.500 8.000 3858 66,634 33,092 20,000 15.000 80,000 387 800 93.600 15,600 10,471 244,000 54.100 9,600 6,612 5 10 11 12 13 14 15 32.000 7,500 4,013 4,013 20.000 Total 5.841.500 229 500 513 359 352 948 872,307 book Asset No. Total Bus - All Allowed Depreciation (aka ND) Adjusted Basis Gain/(loan) on Sale 2 4 Anset Descriptions Building Land Computer Equipment Software Furniture & Fitues Date of Sale Data Acquired Proceeds 07.01.21 500,000 07.01.21 750,000 07.01.21 10,000 07.01.21 5,500 07.01.21 7,500 5 7 Net Gain/itoss) From Sale of Amets Ordinary Income Recapture Adjusted Basis Gain/Loss) on Sale Capital Tax Asset No. 1 2 4 5 7 Asset Descriptions Building Land Computer Equipment Software Furniture & Fodtures Date of Sale Date Acquired Proceeds 07.01.21 500,000 07.01.21 750,000 07.01.21 10,000 07.01.21 5,500 07.01.21 7500 Net Gardiloss) From Sale of Assets Total 1245 Gain/Loss Total 1250 Gain/Loss Net Gain/(Loss) From Sale of Assets HINT: The two green cells need to be the same number. On the tab marked 'Schedule of Gains and Losses' complete the following steps. Use the depreciation schedule provided to calculate the basis and accumulated depreciation for each asset disposed of. Do not edit the information in the depreciation schedule tab. 1 For both book and tax purposes, calculate the realized gain or loss for each asset individually 2 Calcuate the total 1245 gain/(loss) and the total 1250 gain/(loss) 3 Calculate the depreciation recapture (if any) for each asset individually 4 Calculate the book to tax difference on the total gain or loss Submit your completed excel file via Blackboard. You may work in groups Each group only needs to submit one file for grading, List group members, if any, here: Bonus Depreciation Beginning MD 475,000 2021 Depreciation 95,000 Ending AD 570,000 Book Asset No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Asset. Description Building Land Furniture & Fixtures Computer Equipment Software Landscaping Furniture & Futures Industrial Machine Building Computer Equipment Parniture & Fixtures Shipping Equipment Dry Freeze Machine Storage Building Computer Equipment Date in Service 01 01 2016 01.01.2016 02.10.2017 02.10.2017 03 15 2018 04 15 2018 04 15 2019 0720 2020 0721 2020 07 20.2020 0725 2020 08.26 2021 0025 2021 10.15 2021 10 15 2021 Bass 950,000 300,000 75,000 35.000 20.000 15.000 80,000 1,000,000 2,500,000 30.000 27.000 32000 7.500 750,000 20.000 10.00 NIA 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 39.00 10 OD 30,000 14000 6,000 4500 16.000 100.000 250,000 3.000 2,700 7,500 3.500 2.000 1,500 8,000 100,000 250,000 3,000 2.700 3200 750 19,231 2.000 37.500 17.500 0,000 6,000 24,000 200,000 500,000 6,000 5,400 3.200 750 19,231 2.000 Total 5641,500 901200 490,381 1 500 501 Tax Asset No. 1 2 Bonus Depreciation Regioning AD 120.840 2021 Depreciation 24358 Ending AD 145,193 3,349 2,010 4 5 6 37.500 17,500 20,000 15,000 80,000 ! Asset escaption Building Land Furniture & Fidures Computer Equipment Software Landscaping Furniture & Futures Industrial Machine Building Computer Equipment Furniture & Fixtures Shipping Equipment Dry Freete Machine Storage Building Computer Equipment Date in Service 01 01 2016 01 01 2016 02.10.2017 02 10 2017 03.15 2018 04 15 2018 04 15 2019 0720 2020 0721 2020 07:20 2020 07. 25 2020 0826 2021 0826 2021 10.15.2021 10.15 2021 Basis 950.000 300.000 75.000 35.000 20,000 15,000 20,000 1 000.000 2.500,000 30.000 27 000 32 000 7,500 750 000 20.000 Life 39.00 NIA 7.00 500 3.00 15.00 7.00 7.00 39.00 500 7.00 500 500 39.00 500 63,285 31.076 20.000 15 000 80.000 142.900 29.500 8.000 3858 66,634 33,092 20,000 15.000 80,000 387 800 93.600 15,600 10,471 244,000 54.100 9,600 6,612 5 10 11 12 13 14 15 32.000 7,500 4,013 4,013 20.000 Total 5.841.500 229 500 513 359 352 948 872,307 book Asset No. Total Bus - All Allowed Depreciation (aka ND) Adjusted Basis Gain/(loan) on Sale 2 4 Anset Descriptions Building Land Computer Equipment Software Furniture & Fitues Date of Sale Data Acquired Proceeds 07.01.21 500,000 07.01.21 750,000 07.01.21 10,000 07.01.21 5,500 07.01.21 7,500 5 7 Net Gain/itoss) From Sale of Amets Ordinary Income Recapture Adjusted Basis Gain/Loss) on Sale Capital Tax Asset No. 1 2 4 5 7 Asset Descriptions Building Land Computer Equipment Software Furniture & Fodtures Date of Sale Date Acquired Proceeds 07.01.21 500,000 07.01.21 750,000 07.01.21 10,000 07.01.21 5,500 07.01.21 7500 Net Gardiloss) From Sale of Assets Total 1245 Gain/Loss Total 1250 Gain/Loss Net Gain/(Loss) From Sale of Assets HINT: The two green cells need to be the same number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started