Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Define the term annuity. (2 marks) 2. Barrack buys a car costing 25600 $. He agrees to make payment at the end of each

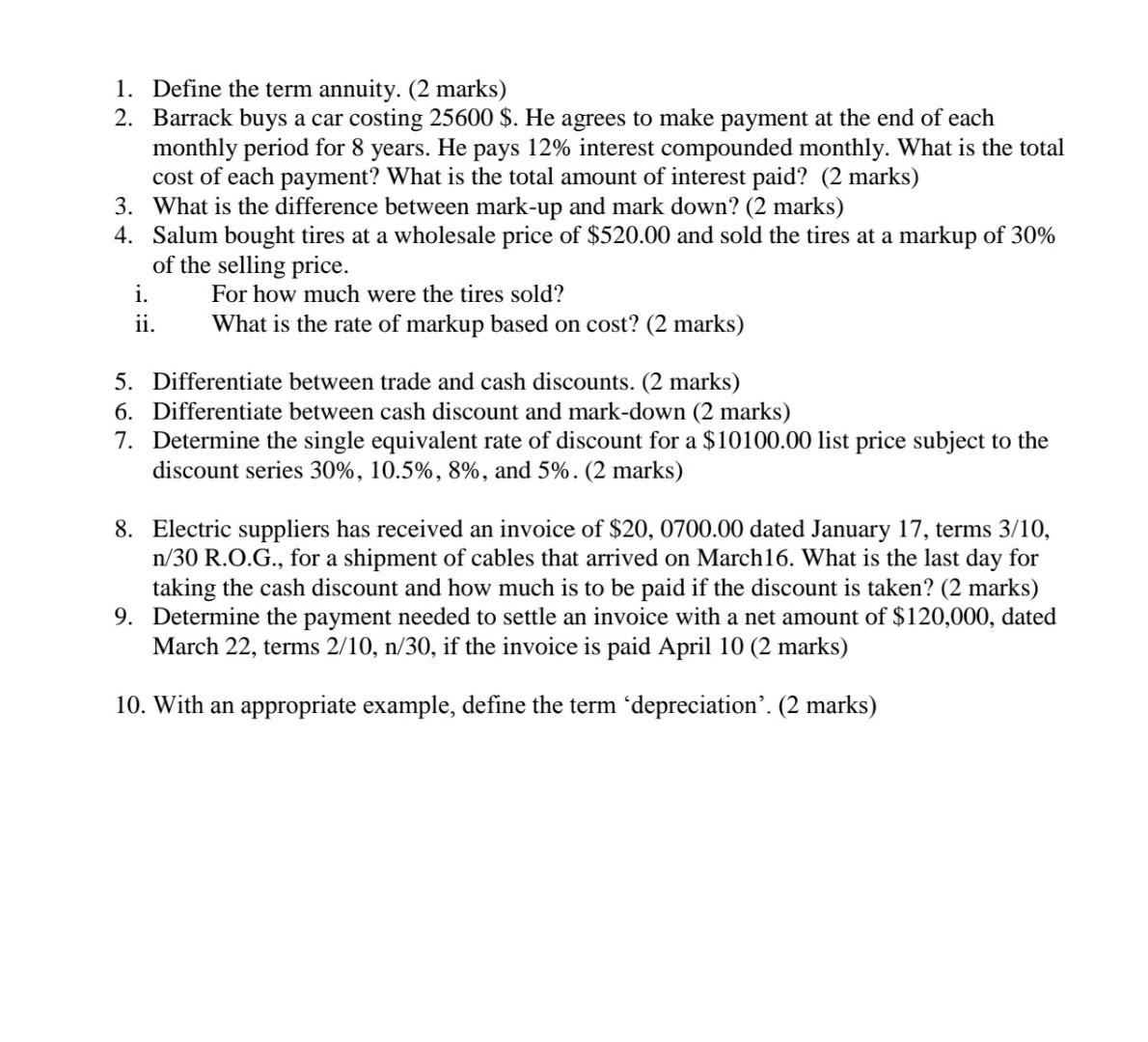

1. Define the term annuity. (2 marks) 2. Barrack buys a car costing 25600 $. He agrees to make payment at the end of each monthly period for 8 years. He pays 12% interest compounded monthly. What is the total cost of each payment? What is the total amount of interest paid? (2 marks) 3. What is the difference between mark-up and mark down? (2 marks) 4. Salum bought tires at a wholesale price of $520.00 and sold the tires at a markup of 30% of the selling price. i. For how much were the tires sold? ii. What is the rate of markup based on cost? (2 marks) 5. Differentiate between trade and cash discounts. (2 marks) 6. Differentiate between cash discount and mark-down (2 marks) 7. Determine the single equivalent rate of discount for a $10100.00 list price subject to the discount series 30%, 10.5%, 8%, and 5%.(2 marks) 8. Electric suppliers has received an invoice of $20, 0700.00 dated January 17, terms 3/10, n/30 R.O.G., for a shipment of cables that arrived on March16. What is the last day for taking the cash discount and how much is to be paid if the discount is taken? (2 marks) 9. Determine the payment needed to settle an invoice with a net amount of $120,000, dated March 22, terms 2/10, n/30, if the invoice is paid April 10 (2 marks) 10. With an appropriate example, define the term depreciation'. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started