Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 . Depreciation Method: The company uses the straight - line depreciation method for its equipment. 2 . Inventory Method: The company follows the FIFO

Depreciation Method:The company uses the straightline depreciation method for its equipment.

Inventory Method:The company follows the FIFO FirstIn FirstOut method for valuing inventory.

Revenue Recognition:Revenue is recognized when earned, in accordance with accrual accounting principles.

Tax Considerations:Income tax expense at a rate and liabilities are not reflected in the trial balance and should be considered in the preparation of financial statements.

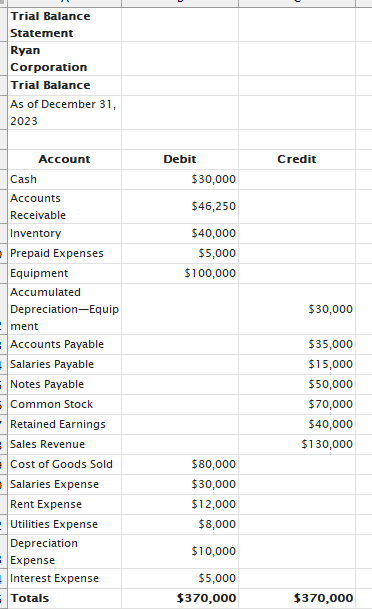

Using the provided trial balance, prepare an income statement for XYZ Corporation for the year ending December

tabletableTrial BalanceStatementtableRyanCorporationTrial Balance,,tabletableAs of December AccountDebit,CreditCash$tableAccountsReceivable$Inventory$Prepaid Expenses,$Equipment$tableAccumulatedDepreciationEquipment$Accounts Payable,,$Salaries Payable,,$Notes Payable,,$Common Stock,,$Retained Earnings,,$Sales Revenue,,$Cost of Goods Sold,$Salaries Expense,$Rent Expense,$Utilities Expense,$tableDepreciationExpense$Interest Expense,$Totals$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started