Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. depreciation of office equipment for july based on SL depreciation over 5 years 2. bad debt expense is 1% of sales for the month

1. depreciation of office equipment for july based on SL depreciation over 5 years

2. bad debt expense is 1% of sales for the month of july

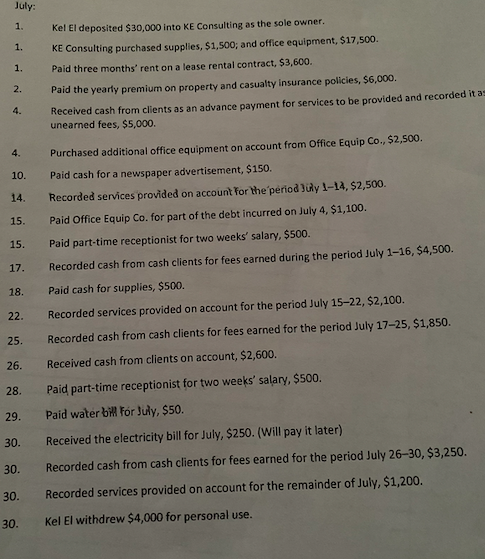

July Kel El deposited $30,000 into KE Consulting as the sole owner. KE Consulting purchased supplies, $1,500; and office equipment, $17,500. Pald three months' rent on a lease rental contract, $3,600. Paid the yearly premium on property and casualty Insurance policies, $6,000. keceived cash from clients as an advance payment for services to be provided and recorded it a unearned fees, $5,000. Purchased additional office equipment on account from Office Equip Co., $2,500. Paid cash for a newspaper advertisement, $150. Recorded services provided on account for the period ay 1-14, $2,500. Paid Office Equip Co. for part of the debt incurred on July 4, $1,100, Paid part-time receptionist for two weeks' salary, $500. Recorded cash from cash clients for fees earned during the period July 1-16, $4,500 Paid cash for supplies, $500. Recorded services provided on account for the period July 15-22, $2,100. Recorded cash from cash clients for fees earned for the period July 17-25, $1,850. Received cash from clients on account, $2,600. Paid part-time receptionist for two weeks' salary, $500. 30. Paid water bil For July, $50. Received the electricity bill for July, $250.(Will pay it later) Recorded cash from cash clients for fees earned for the period July 26-30, $3,250. Recorded services provided on account for the remainder of July, $1,200. 30. 30. Kel El withdrew $4,000 for personal use. July Kel El deposited $30,000 into KE Consulting as the sole owner. KE Consulting purchased supplies, $1,500; and office equipment, $17,500. Pald three months' rent on a lease rental contract, $3,600. Paid the yearly premium on property and casualty Insurance policies, $6,000. keceived cash from clients as an advance payment for services to be provided and recorded it a unearned fees, $5,000. Purchased additional office equipment on account from Office Equip Co., $2,500. Paid cash for a newspaper advertisement, $150. Recorded services provided on account for the period ay 1-14, $2,500. Paid Office Equip Co. for part of the debt incurred on July 4, $1,100, Paid part-time receptionist for two weeks' salary, $500. Recorded cash from cash clients for fees earned during the period July 1-16, $4,500 Paid cash for supplies, $500. Recorded services provided on account for the period July 15-22, $2,100. Recorded cash from cash clients for fees earned for the period July 17-25, $1,850. Received cash from clients on account, $2,600. Paid part-time receptionist for two weeks' salary, $500. 30. Paid water bil For July, $50. Received the electricity bill for July, $250.(Will pay it later) Recorded cash from cash clients for fees earned for the period July 26-30, $3,250. Recorded services provided on account for the remainder of July, $1,200. 30. 30. Kel El withdrew $4,000 for personal use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started