Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Describe clearly each the accounting changes Harnischfeger made in 1984 as stated in Note 2 of its financial statements 2. What is the

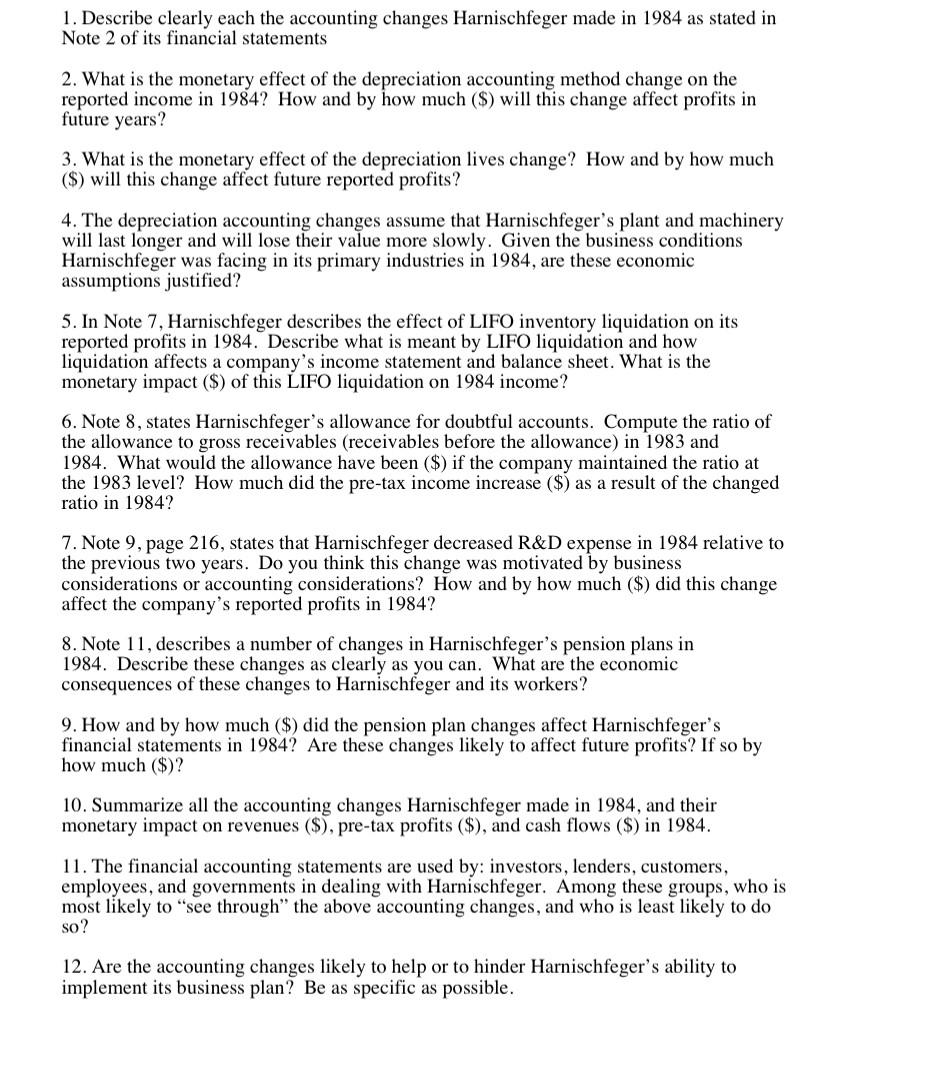

1. Describe clearly each the accounting changes Harnischfeger made in 1984 as stated in Note 2 of its financial statements 2. What is the monetary effect of the depreciation accounting method change on the reported income in 1984? How and by how much ($) will this change affect profits in future years? 3. What is the monetary effect of the depreciation lives change? How and by how much ($) will this change affect future reported profits? 4. The depreciation accounting changes assume that Harnischfeger's plant and machinery will last longer and will lose their value more slowly. Given the business conditions Harnischfeger was facing in its primary industries in 1984, are these economic assumptions justified? 5. In Note 7, Harnischfeger describes the effect of LIFO inventory liquidation on its reported profits in 1984. Describe what is meant by LIFO liquidation and how liquidation affects a company's income statement and balance sheet. What is the monetary impact ($) of this LIFO liquidation on 1984 income? 6. Note 8, states Harnischfeger's allowance for doubtful accounts. Compute the ratio of the allowance to gross receivables (receivables before the allowance) in 1983 and 1984. What would the allowance have been ($) if the company maintained the ratio at the 1983 level? How much did the pre-tax income increase ($) as a result of the changed ratio in 1984? 7. Note 9, page 216, states that Harnischfeger decreased R&D expense in 1984 relative to the previous two years. Do you think this change was motivated by business considerations or accounting considerations? How and by how much ($) did this change affect the company's reported profits in 1984? 8. Note 11, describes a number of changes in Harnischfeger's pension plans in 1984. Describe these changes as clearly as you can. What are the economic consequences of these changes to Harnischfeger and its workers? 9. How and by how much ($) did the pension plan changes affect Harnischfeger's financial statements in 1984? Are these changes likely to affect future profits? If so by how much ($)? 10. Summarize all the accounting changes Harnischfeger made in 1984, and their monetary impact on revenues ($), pre-tax profits ($), and cash flows ($) in 1984. 11. The financial accounting statements are used by: investors, lenders, customers, employees, and governments in dealing with Harnischfeger. Among these groups, who is most likely to "see through" the above accounting changes, and who is least likely to do so? 12. Are the accounting changes likely to help or to hinder Harnischfeger's ability to implement its business plan? Be as specific as possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 In 1984 Harnischfeger made several accounting changes as stated in Note 2 of its financial statements These changes included switching from accelerated to straightline depreciation for certai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started