Question: 1. Describe the initial public offering (IPO) process and explain the role of the underwriter, the Securities and Exchange Commission (SEC), and the red herring.

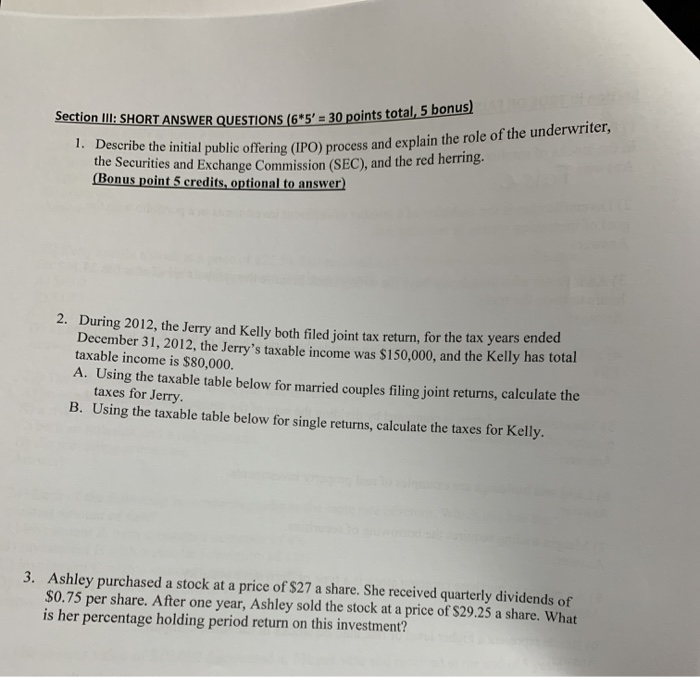

1. Describe the initial public offering (IPO) process and explain the role of the underwriter, the Securities and Exchange Commission (SEC), and the red herring. (Bonus point 5 credits, optional to answer) Section IlI: SHORT ANSWER QUESTIONS (6*5' = 30 points total, 5 bonus) 2. During 2012, the Jerry and Kelly both filed joint tax return, for the tax years ended December 31, 2012, the Jerry's taxable income was $150,000, and the Kelly has total taxable income is $80,000. A. Using the taxable table below for married couples filing joint returns, calculate the taxes for Jerry. B. Using the taxable table below for single returns, calculate the taxes for Kelly. 3. Ashley purchased a stock at a price of $27 a share. She received quarterly dividends of $0.75 per share. After one year, Ashley sold the stock at a price of $29.25 a share. What is her percentage holding period return on this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts