Answered step by step

Verified Expert Solution

Question

1 Approved Answer

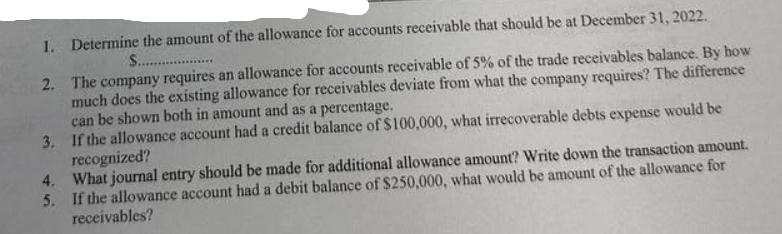

1. Determine the amount of the allowance for accounts receivable that should be at December 31, 2022. S................... 2. The company requires an allowance

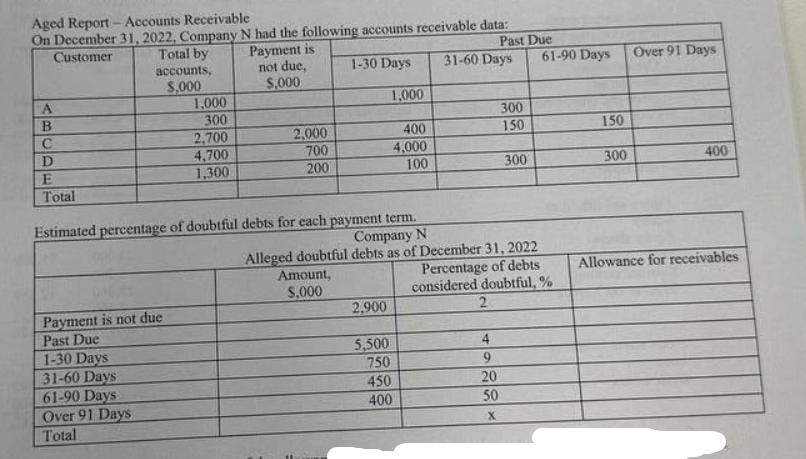

1. Determine the amount of the allowance for accounts receivable that should be at December 31, 2022. S................... 2. The company requires an allowance for accounts receivable of 5% of the trade receivables balance. By how much does the existing allowance for receivables deviate from what the company requires? The difference can be shown both in amount and as a percentage. 3. If the allowance account had a credit balance of $100,000, what irrecoverable debts expense would be recognized? 4. What journal entry should be made for additional allowance amount? Write down the transaction amount. 5. If the allowance account had a debit balance of $250,000, what would be amount of the allowance for receivables? Aged Report - Accounts Receivable On December 31, 2022, Company N had the following accounts receivable data: A Customer B C D E Total Total by Payment is Past Due accounts, not due, 1-30 Days 31-60 Days 61-90 Days Over 91 Days $,000 $,000 1,000 1,000 300 300 2,700 2,000 400 150 150 4,700 700 4,000 1,300 200 100 300 300 400 Estimated percentage of doubtful debts for each payment term. Company N Alleged doubtful debts as of December 31, 2022 Payment is not due Past Due 1-30 Days 31-60 Days 61-90 Days Over 91 Days Total Amount, Percentage of debts Allowance for receivables $,000 considered doubtful, % 2,900 2 5,500 4 750 9 450 20 400 50 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started