1) Determine the fair market value of CRLs common shares as of December 31, 2021, based on the status quo.

Based on your external research and experience, you have determined the following:

- The appropriate real weighted average cost of capital that you should use to value CRLs existing operations is 12%. Given the additional risk associated with the proposed expansion, you have decided to assess the expansion plan using a real weighted average cost of capital in a range of 14% to 16%.

- The Companys applicable tax rate for the foreseeable future is expected to be 25%.

- $1.2 million of the Companys cash, as well as the short-term investments and due from related party at the valuation date should be considered redundant. Assume that CRLs interest income would cease following the disposal of the short-term investments. Ignore any tax implications arising from the sale of the short-term investments.

- You should assume that the carrying value of the Companys interest-bearing debt on December 31, 2021, approximates its fair market value.

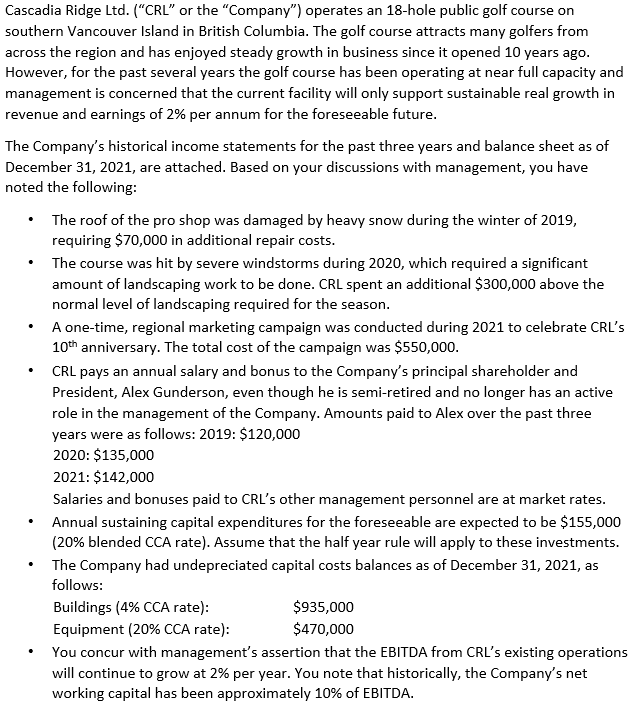

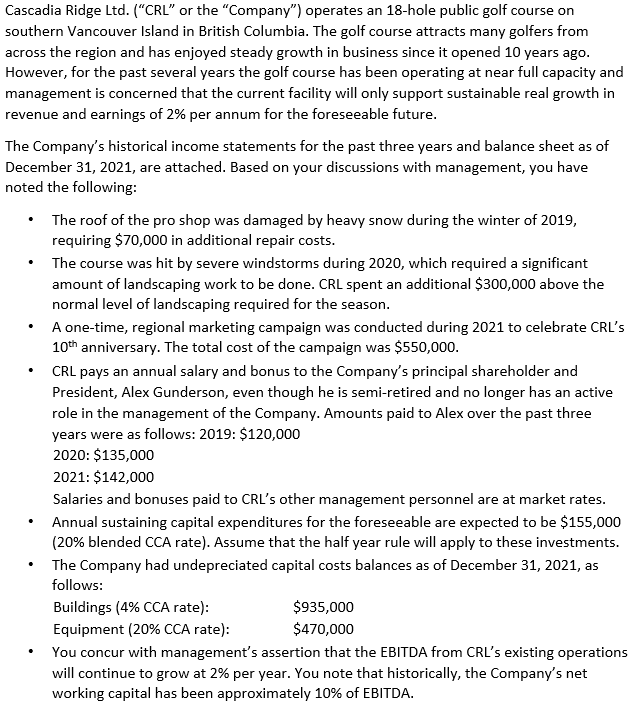

Cascadia Ridge Ltd. ("CRL" or the "Company") operates an 18-hole public golf course on southern Vancouver Island in British Columbia. The golf course attracts many golfers from across the region and has enjoyed steady growth in business since it opened 10 years ago. However, for the past several years the golf course has been operating at near full capacity and management is concerned that the current facility will only support sustainable real growth in revenue and earnings of 2% per annum for the foreseeable future. The Company's historical income statements for the past three years and balance sheet as of December 31, 2021, are attached. Based on your discussions with management, you have noted the following: The roof of the pro shop was damaged by heavy snow during the winter of 2019, requiring $70,000 in additional repair costs. The course was hit by severe windstorms during 2020, which required a significant amount of landscaping work to be done. CRL spent an additional $300,000 above the normal level of landscaping required for the season. A one-time, regional marketing campaign was conducted during 2021 to celebrate CRL's 10th anniversary. The total cost of the campaign was $550,000. CRL pays an annual salary and bonus to the Company's principal shareholder and President, Alex Gunderson, even though he is semi-retired and no longer has an active role in the management of the Company. Amounts paid to Alex over the past three years were as follows: 2019: $120,000 2020: $135,000 2021: $142,000 Salaries and bonuses paid to CRL's other management personnel are at market rates. Annual sustaining capital expenditures for the foreseeable are expected to be $155,000 (20% blended CCA rate). Assume that the half year rule will apply to these investments. The Company had undepreciated capital costs balances as of December 31, 2021, as follows: Buildings (4% CCA rate): $935,000 Equipment (20% CCA rate): $470,000 You concur with management's assertion that the EBITDA from CRL's existing operations will continue to grow at 2% per year. You note that historically, the Company's net working capital has been approximately 10% of EBITDA. Cascadia Ridge Ltd. ("CRL" or the "Company") operates an 18-hole public golf course on southern Vancouver Island in British Columbia. The golf course attracts many golfers from across the region and has enjoyed steady growth in business since it opened 10 years ago. However, for the past several years the golf course has been operating at near full capacity and management is concerned that the current facility will only support sustainable real growth in revenue and earnings of 2% per annum for the foreseeable future. The Company's historical income statements for the past three years and balance sheet as of December 31, 2021, are attached. Based on your discussions with management, you have noted the following: The roof of the pro shop was damaged by heavy snow during the winter of 2019, requiring $70,000 in additional repair costs. The course was hit by severe windstorms during 2020, which required a significant amount of landscaping work to be done. CRL spent an additional $300,000 above the normal level of landscaping required for the season. A one-time, regional marketing campaign was conducted during 2021 to celebrate CRL's 10th anniversary. The total cost of the campaign was $550,000. CRL pays an annual salary and bonus to the Company's principal shareholder and President, Alex Gunderson, even though he is semi-retired and no longer has an active role in the management of the Company. Amounts paid to Alex over the past three years were as follows: 2019: $120,000 2020: $135,000 2021: $142,000 Salaries and bonuses paid to CRL's other management personnel are at market rates. Annual sustaining capital expenditures for the foreseeable are expected to be $155,000 (20% blended CCA rate). Assume that the half year rule will apply to these investments. The Company had undepreciated capital costs balances as of December 31, 2021, as follows: Buildings (4% CCA rate): $935,000 Equipment (20% CCA rate): $470,000 You concur with management's assertion that the EBITDA from CRL's existing operations will continue to grow at 2% per year. You note that historically, the Company's net working capital has been approximately 10% of EBITDA