Answered step by step

Verified Expert Solution

Question

1 Approved Answer

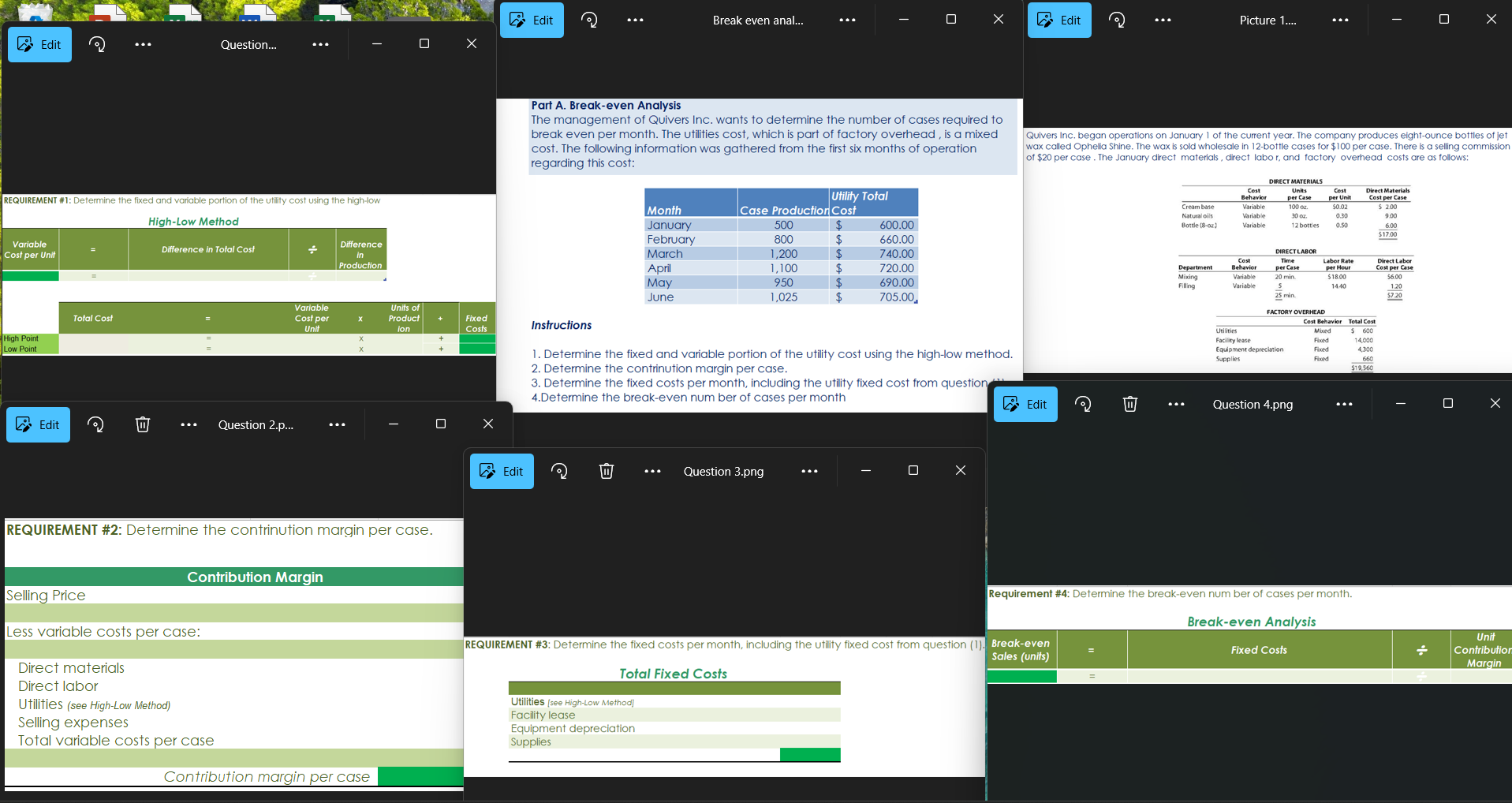

# 1 : Determine the fixed and variable portion of the utility cost using the high - low method. # 2 : Determine the contribution

#: Determine the fixed and variable portion of the utility cost using the highlow method. #: Determine the contribution margin per case. #: Determine the fixed costs per month, including the utility fixed cost from question #: Determine the breakeven number of cases per month.

Quivers Inc. began operations on January of the current year. The company produces eightounce bottles of jet

wax called Ophelia Shine. The wax is sold wholesale in bottle cases for $ per case. There is a selling commission

of $ per case The January direct materials, direct labor and factory overhead costs are as follows:

DIRECT MATERIALS

DIRECT LABOR

FACTORY OVERHEAD

Part A Breakeven Analysis

The management of Quivers Inc. wants to determine the number of cases required to

break even per month. The utilities cost, which is part of factory overhead, is a mixed

cost The following information was gathered from the first six months of operation

regarding this cost:

Instructions

Determine the fixed and variable portion of the utility cost using the highlow method.

Determine the contrinution margin per case.

Determine the fixed costs per month, including the utility fixed cost from question

Determine the breakeven num ber of cases per month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started