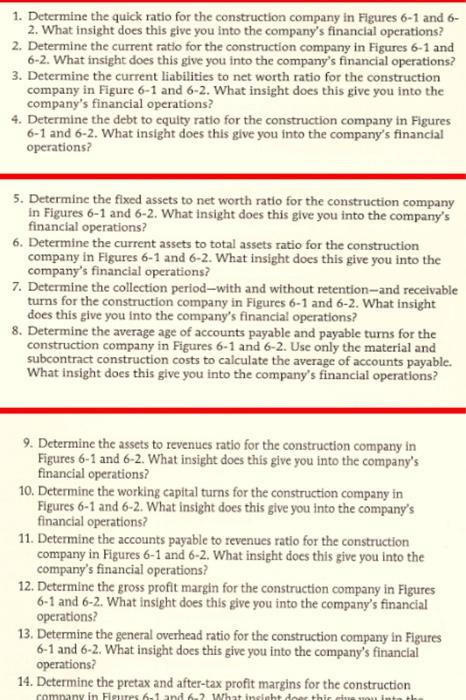

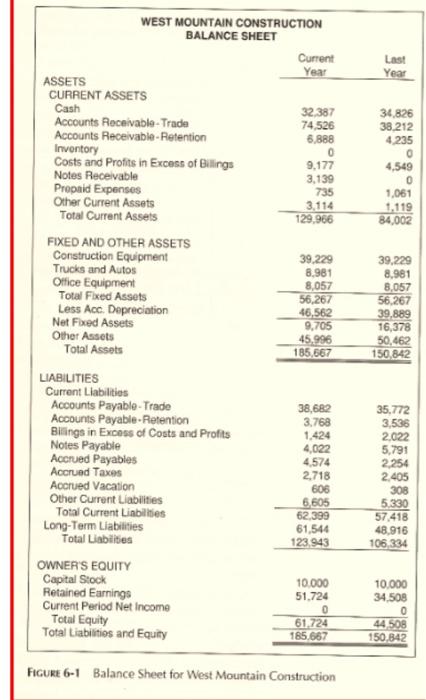

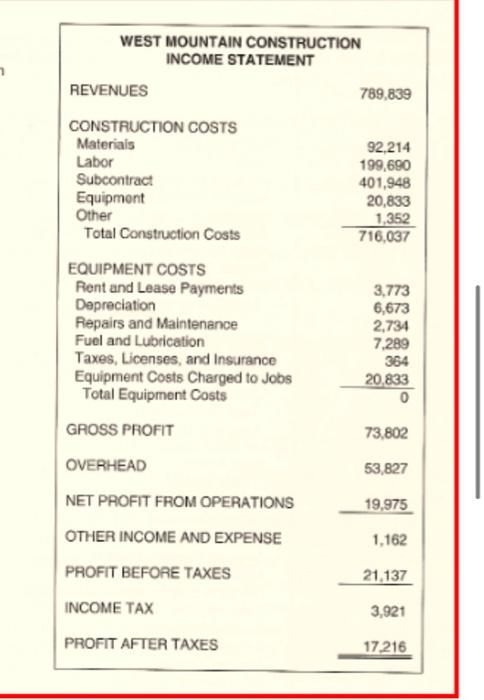

1. Determine the quick ratio for the construction company in Figures 6-1 and 6- 2. What insight does this give you into the company's financial operations? 2. Determine the current ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 3. Determine the current liabilities to net worth ratio for the construction company in Figure 6-1 and 6-2. What insight does this give you into the company's financial operations? 4. Determine the debt to equity ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 5. Determine the fixed assets to net worth ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 6. Determine the current assets to total assets ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 7. Determine the collection period with and without retention-and receivable turns for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 8. Determine the average age of accounts payable and payable turns for the construction company in Figures 6-1 and 6-2. Use only the material and subcontract construction costs to calculate the average of accounts payable. What insight does this give you into the company's financial operations? 9. Determine the assets to revenues ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 10. Determine the working capital turns for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 11. Determine the accounts payable to revenues ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 12. Determine the gross profit margin for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 13. Determine the general overhead ratio for the construction company in Figures 6-1 and 6-2. What insight does this give you into the company's financial operations? 14. Determine the pretax and after-tax profit margins for the construction company in Fium 1 and 6? What insight does this woul into the Last Year 34,826 38,212 4.235 4,549 0 1,061 1.119 84,002 WEST MOUNTAIN CONSTRUCTION BALANCE SHEET Current Year ASSETS CURRENT ASSETS Cash 32.387 Accounts Receivable-Trade 74,526 Accounts Receivable - Retention 6,888 Inventory 0 Costs and Profits in Excess of Billings 9.177 Notes Receivable 3,139 Prepaid Expenses 735 Other Current Assets 3114 Total Current Assets 129,966 FIXED AND OTHER ASSETS Construction Equipment 39.229 Trucks and Autos 8,981 Office Equipment 8,057 Total Fixed Assets 56,267 Less Acc. Depreciation 46,562 Net Fored Assets 9,705 Other Assets 45.996 Total Assets 185,667 LIABILITIES Current Liabilities Accounts Payable-Trade 38,682 Accounts Payable-Retention 3.768 Bilings in Excess of Costs and Profits 1.424 Notes Payable 4,022 Accrued Payables 4.574 Accrued Taxes 2,718 Accrued Vacation 606 Other Current Liabilities 6,605 Total Current Liabilities 62.399 Long-Term Liabilities 61,544 Total Liabilities 123.943 OWNER'S EQUITY Capital Stock 10.000 Retained Earnings 51.724 Current Period Net Income 0 Total Equity 61,724 Total Liabilitios and Equity 185.667 39,229 8,981 8,057 56,267 39,889 16,378 50,462 150,842 35.772 3,536 2.022 5,791 2.254 2.405 308 5.330 57 418 48,916 106,334 10.000 34,508 0 44 508 150 842 FIGURE 6-1 Balance Sheet for West Mountain Construction WEST MOUNTAIN CONSTRUCTION INCOME STATEMENT REVENUES 789,839 CONSTRUCTION COSTS Materials 92,214 Labor 199,690 Subcontract 401,948 Equipmont 20,833 Other 1,352 Total Construction Costs 716,037 EQUIPMENT COSTS Rent and Lease Payments 3,773 Depreciation 6,673 Repairs and Maintenance 2,734 Fuel and Lubrication 7.289 Taxes, Licenses, and Insurance 364 Equipment Costs Charged to Jobs 20.833 Total Equipment Costs 0 GROSS PROFIT 73,802 OVERHEAD 53,827 NET PROFIT FROM OPERATIONS 19,975 OTHER INCOME AND EXPENSE 1,162 PROFIT BEFORE TAXES 21,137 INCOME TAX 3,921 PROFIT AFTER TAXES 17216