Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Dining World Inc.'s business income is a result of retail sales operations and, therefore, does not partake in any manufacturing or processing activities

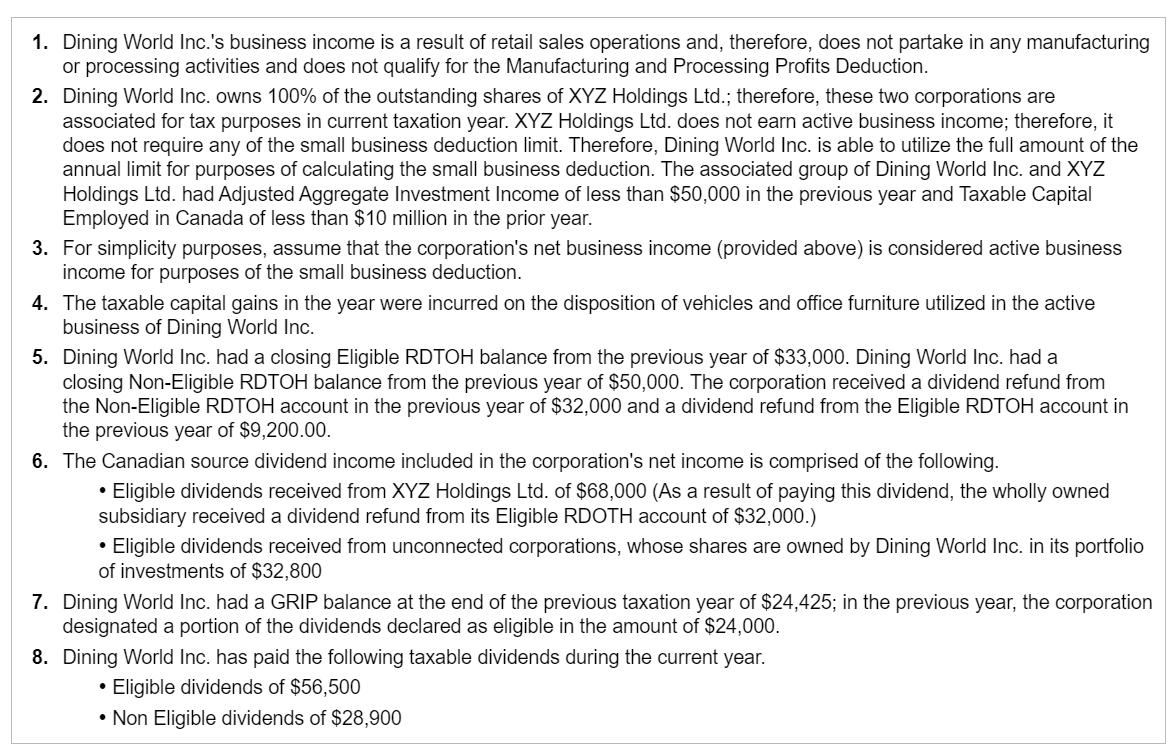

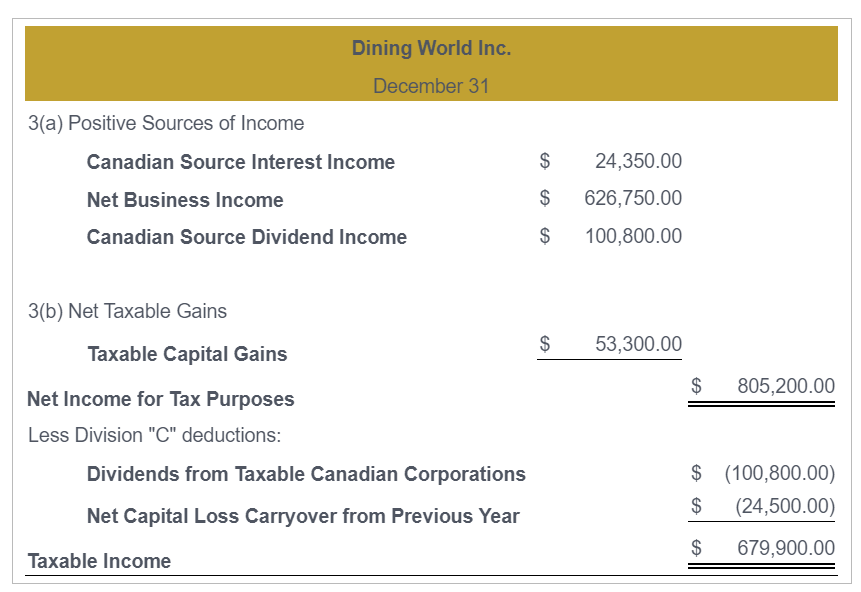

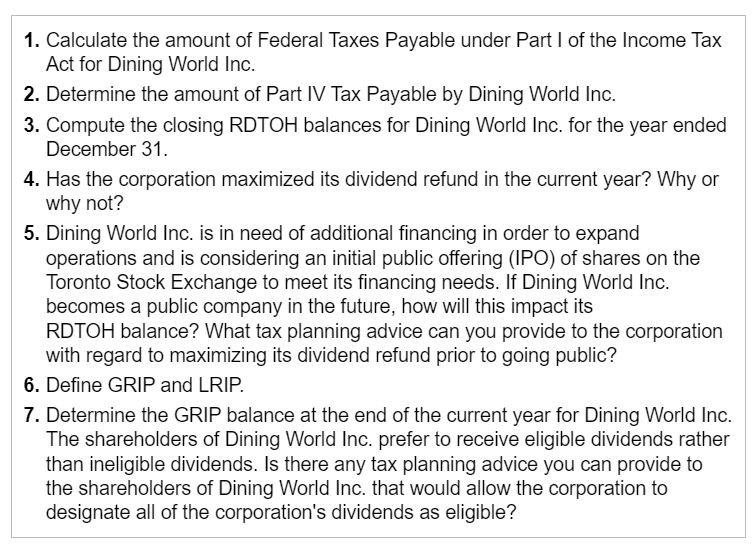

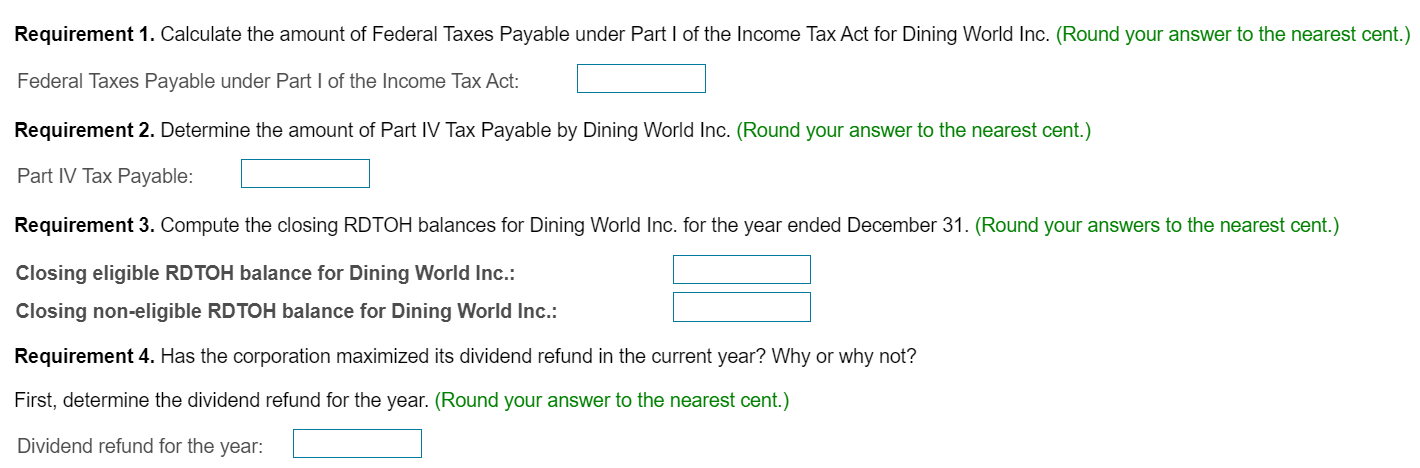

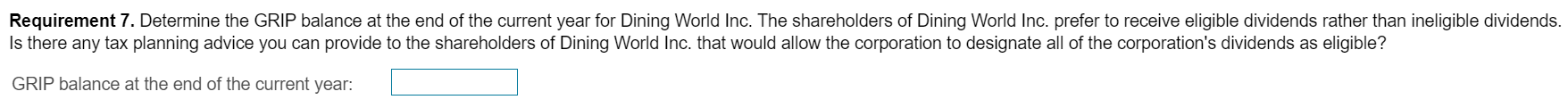

1. Dining World Inc.'s business income is a result of retail sales operations and, therefore, does not partake in any manufacturing or processing activities and does not qualify for the Manufacturing and Processing Profits Deduction. 2. Dining World Inc. owns 100% of the outstanding shares of XYZ Holdings Ltd.; therefore, these two corporations are associated for tax purposes in current taxation year. XYZ Holdings Ltd. does not earn active business income; therefore, it does not require any of the small business deduction limit. Therefore, Dining World Inc. is able to utilize the full amount of the annual limit for purposes of calculating the small business deduction. The associated group of Dining World Inc. and XYZ Holdings Ltd. had Adjusted Aggregate Investment Income of less than $50,000 in the previous year and Taxable Capital Employed in Canada of less than $10 million in the prior year. 3. For simplicity purposes, assume that the corporation's net business income (provided above) is considered active business income for purposes of the small business deduction. 4. The taxable capital gains in the year were incurred on the disposition of vehicles and office furniture utilized in the active business of Dining World Inc. 5. Dining World Inc. had a closing Eligible RDTOH balance from the previous year of $33,000. Dining World Inc. had a closing Non-Eligible RDTOH balance from the previous year of $50,000. The corporation received a dividend refund from the Non-Eligible RDTOH account in the previous year of $32,000 and a dividend refund from the Eligible RDTOH account in the previous year of $9,200.00. 6. The Canadian source dividend income included in the corporation's net income is comprised of the following. Eligible dividends received from XYZ Holdings Ltd. of $68,000 (As a result of paying this dividend, the wholly owned subsidiary received a dividend refund from its Eligible RDOTH account of $32,000.) Eligible dividends received from unconnected corporations, whose shares are owned by Dining World Inc. in its portfolio of investments of $32,800 7. Dining World Inc. had a GRIP balance at the end of the previous taxation year of $24,425; in the previous year, the corporation designated a portion of the dividends declared as eligible in the amount of $24,000. 8. Dining World Inc. has paid the following taxable dividends during the current year. . Eligible dividends of $56,500 Non Eligible dividends of $28,900 Dining World Inc. December 31 3(a) Positive Sources of Income Canadian Source Interest Income Net Business Income $ 24,350.00 $ 626,750.00 Canadian Source Dividend Income $ 100,800.00 3(b) Net Taxable Gains Taxable Capital Gains Net Income for Tax Purposes $ 53,300.00 $ 805,200.00 Less Division "C" deductions: Dividends from Taxable Canadian Corporations $ (100,800.00) $ (24,500.00) Net Capital Loss Carryover from Previous Year Taxable Income $ 679,900.00 1. Calculate the amount of Federal Taxes Payable under Part I of the Income Tax Act for Dining World Inc. 2. Determine the amount of Part IV Tax Payable by Dining World Inc. 3. Compute the closing RDTOH balances for Dining World Inc. for the year ended December 31. 4. Has the corporation maximized its dividend refund in the current year? Why or why not? 5. Dining World Inc. is in need of additional financing in order to expand operations and is considering an initial public offering (IPO) of shares on the Toronto Stock Exchange to meet its financing needs. If Dining World Inc. becomes a public company in the future, how will this impact its RDTOH balance? What tax planning advice can you provide to the corporation with regard to maximizing its dividend refund prior to going public? 6. Define GRIP and LRIP. 7. Determine the GRIP balance at the end of the current year for Dining World Inc. The shareholders of Dining World Inc. prefer to receive eligible dividends rather than ineligible dividends. Is there any tax planning advice you can provide to the shareholders of Dining World Inc. that would allow the corporation to designate all of the corporation's dividends as eligible? Dining World Inc. is a Canadian controlled private corporation (CCPC) that operates a retail business selling cooking utensils, knives, and small appliances for both professional chefs and home cooks. Dining World Inc. is operated out of Ottawa, Ontario, and all of the corporation's revenue and expenses are incurred in Ontario. Requirement 1. Calculate the amount of Federal Taxes Payable under Part I of the Income Tax Act for Dining World Inc. (Round your answer to the nearest cent.) Federal Taxes Payable under Part I of the Income Tax Act: Requirement 2. Determine the amount of Part IV Tax Payable by Dining World Inc. (Round your answer to the nearest cent.) Part IV Tax Payable: Requirement 3. Compute the closing RDTOH balances for Dining World Inc. for the year ended December 31. (Round your answers to the nearest cent.) Closing eligible RDTOH balance for Dining World Inc.: Closing non-eligible RDTOH balance for Dining World Inc.: Requirement 4. Has the corporation maximized its dividend refund in the current year? Why or why not? First, determine the dividend refund for the year. (Round your answer to the nearest cent.) Dividend refund for the year: Requirement 7. Determine the GRIP balance at the end of the current year for Dining World Inc. The shareholders of Dining World Inc. prefer to receive eligible dividends rather than ineligible dividends. Is there any tax planning advice you can provide to the shareholders of Dining World Inc. that would allow the corporation to designate all of the corporation's dividends as eligible? GRIP balance at the end of the current year:

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the amount of Federal Taxes Payable under Part I of the Income Tax Act for Dining World Inc Round your answer to the nearest cent Part I tax calculation First 500000 of active business inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started