Answered step by step

Verified Expert Solution

Question

1 Approved Answer

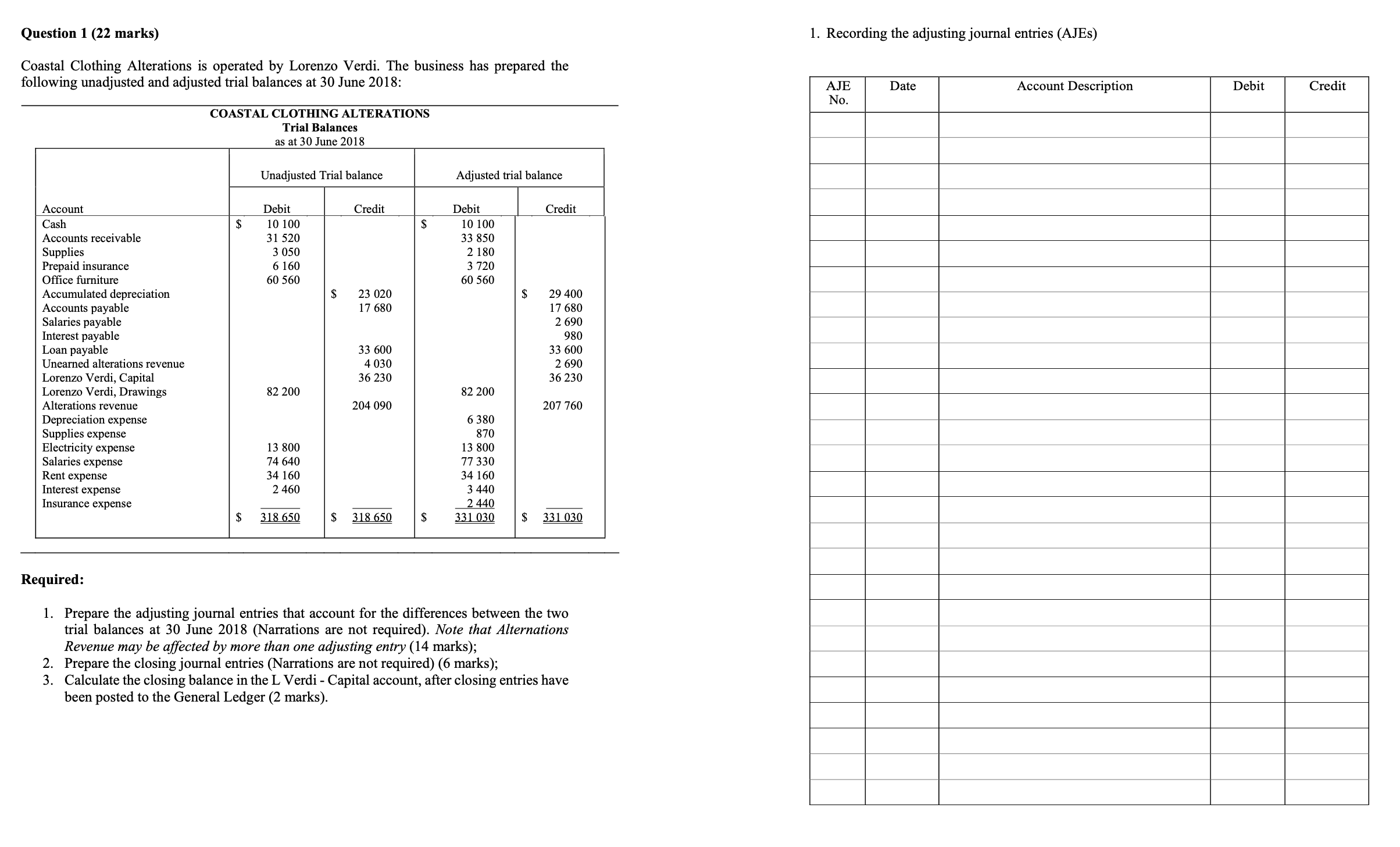

Question 1 (22 marks) Coastal Clothing Alterations is operated by Lorenzo Verdi. The business has prepared the following unadjusted and adjusted trial balances at

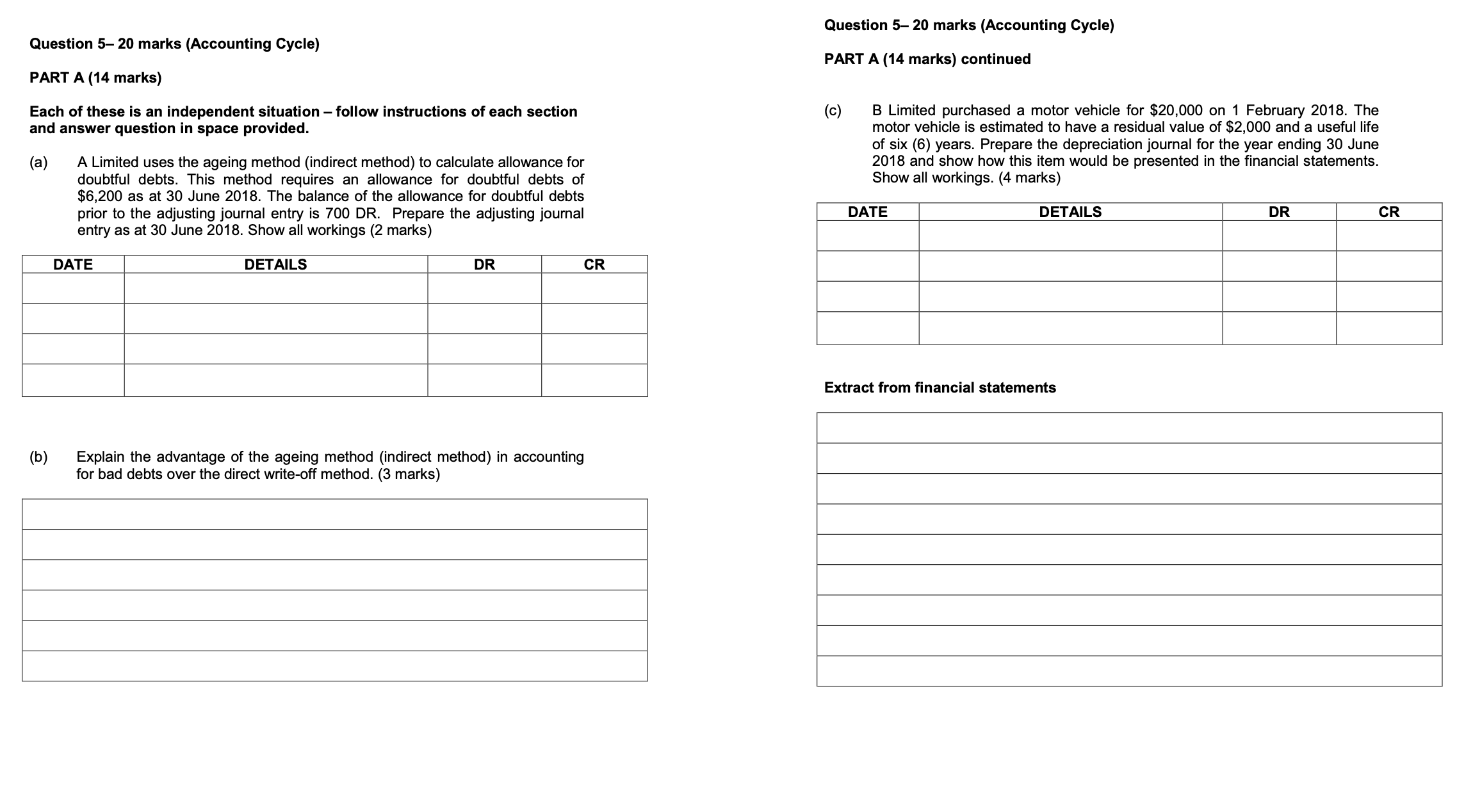

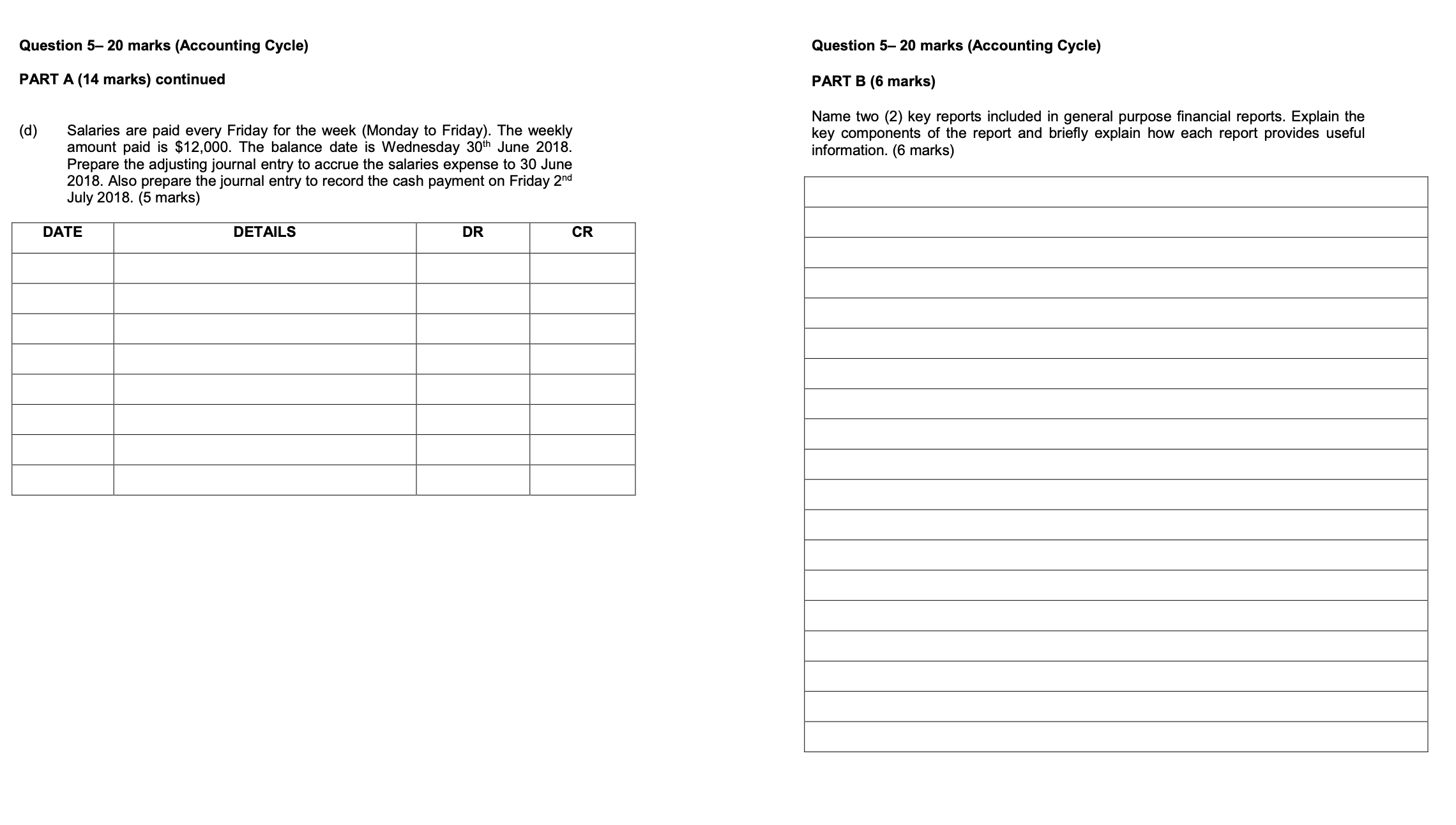

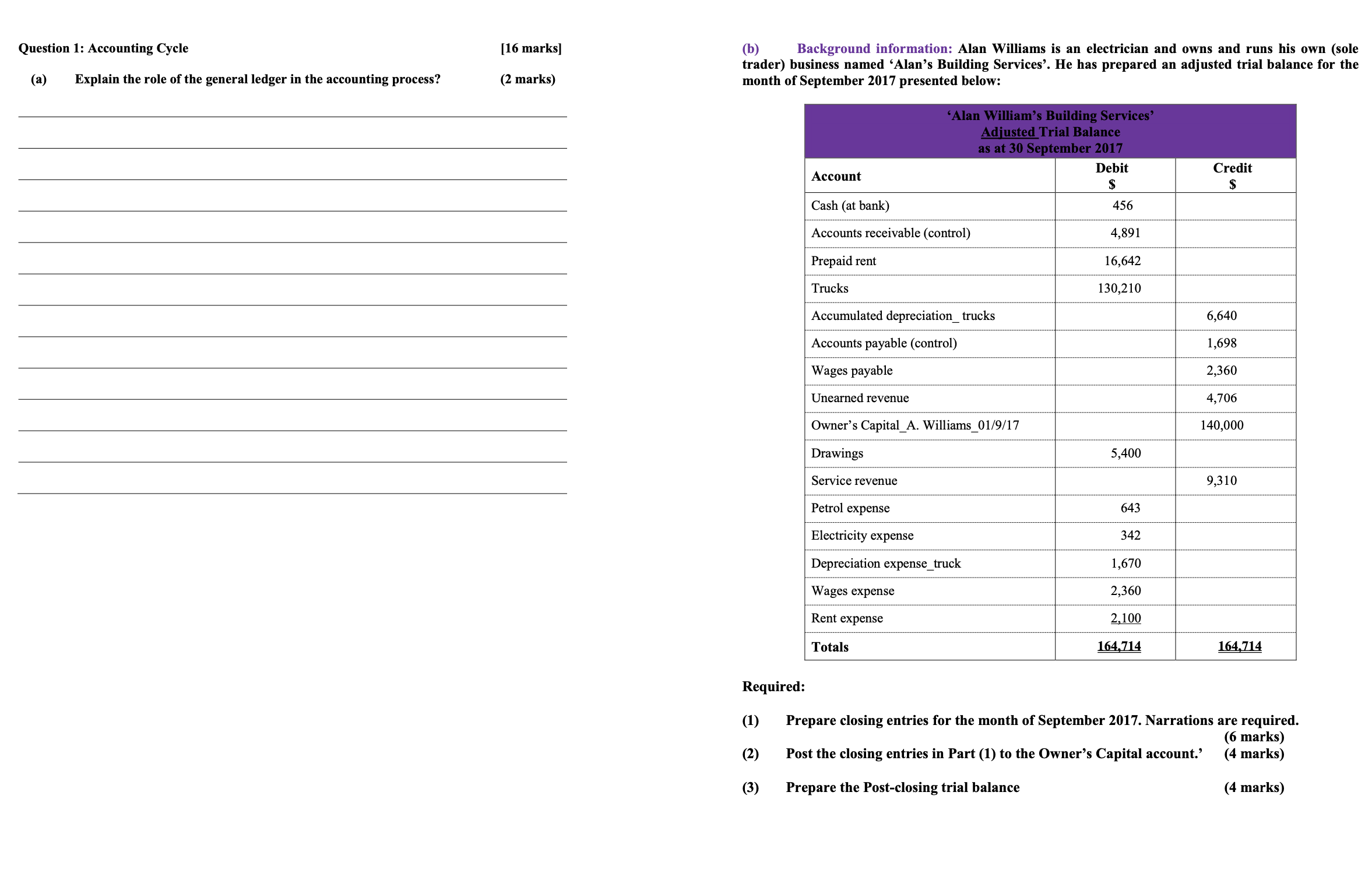

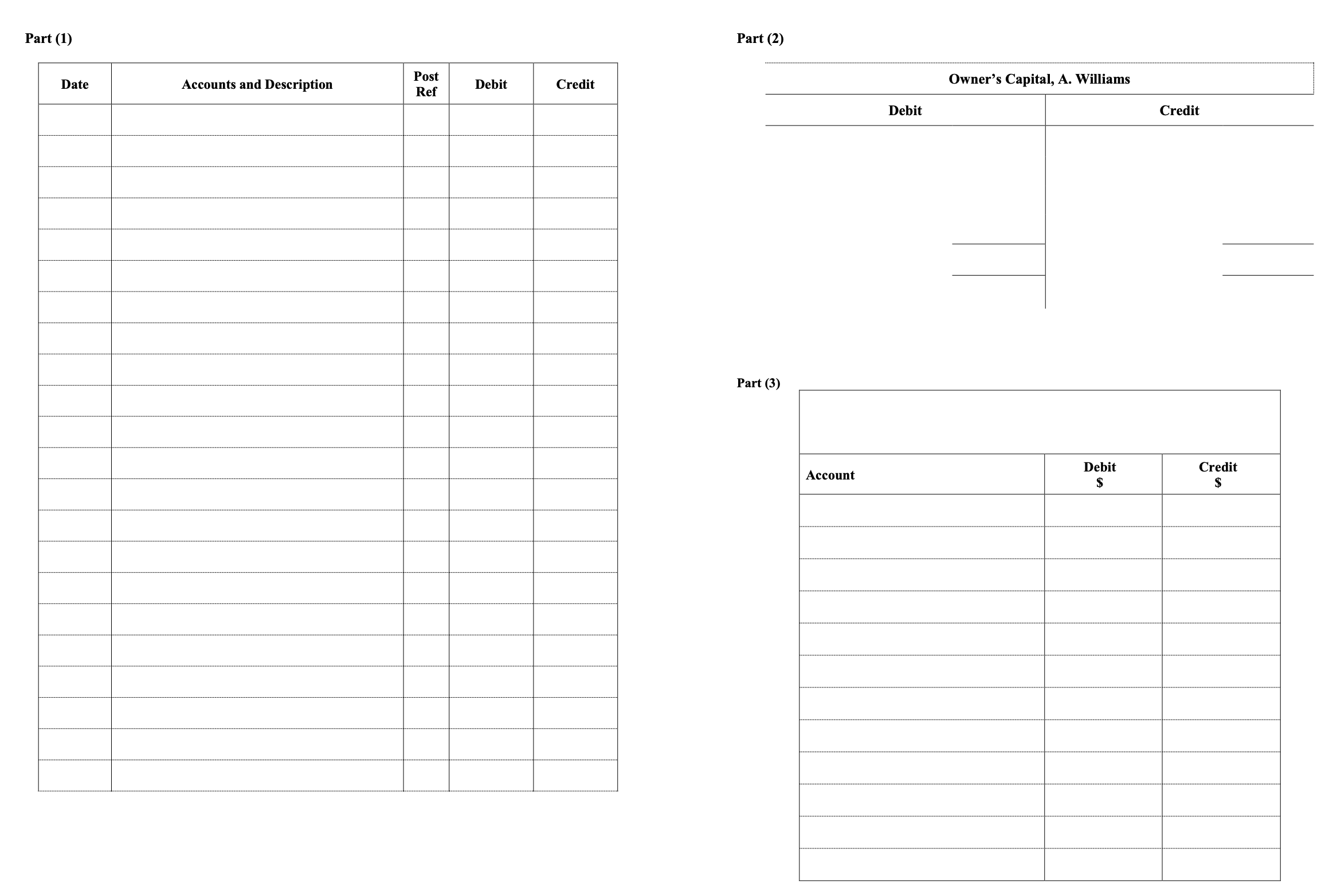

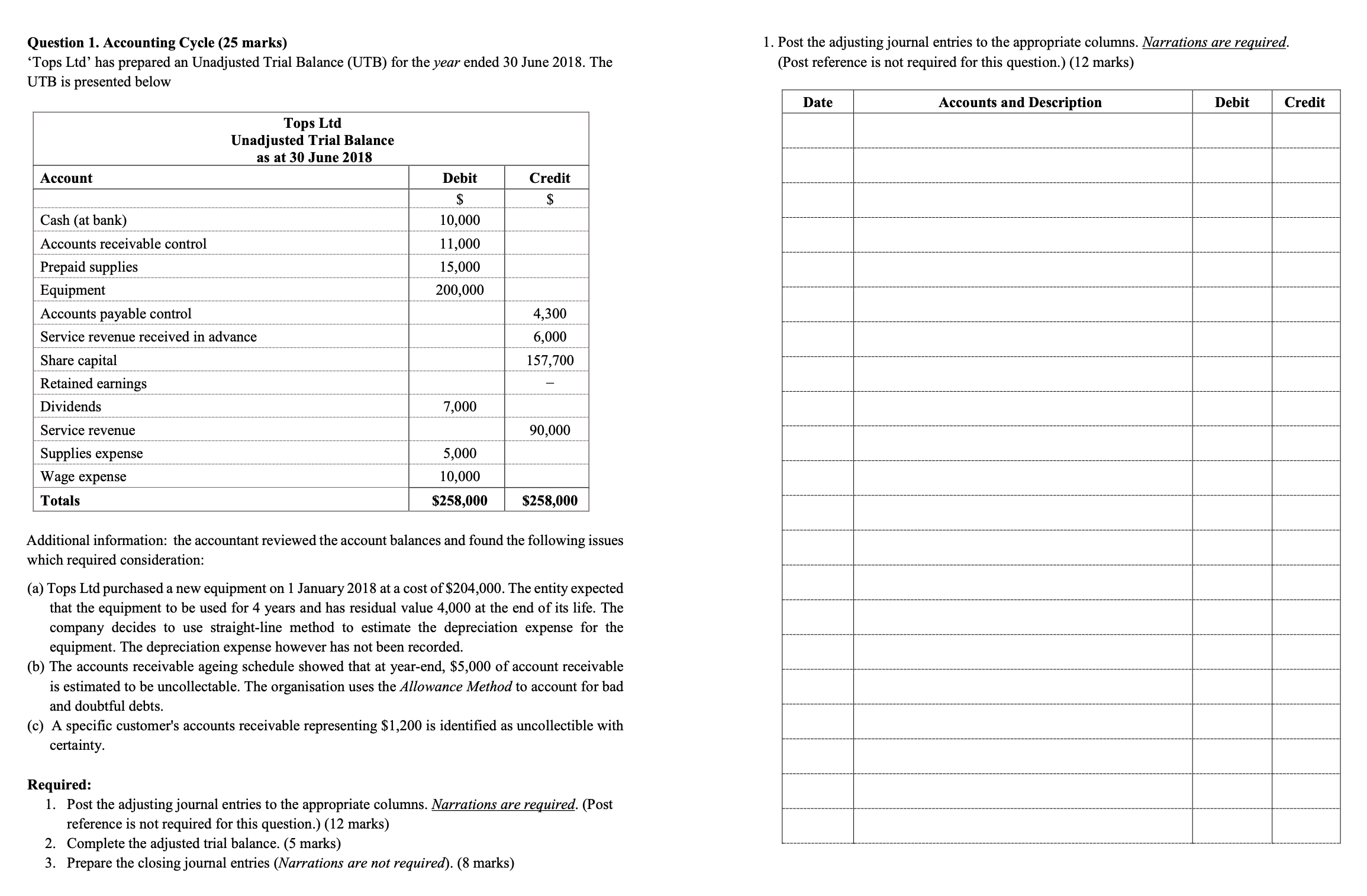

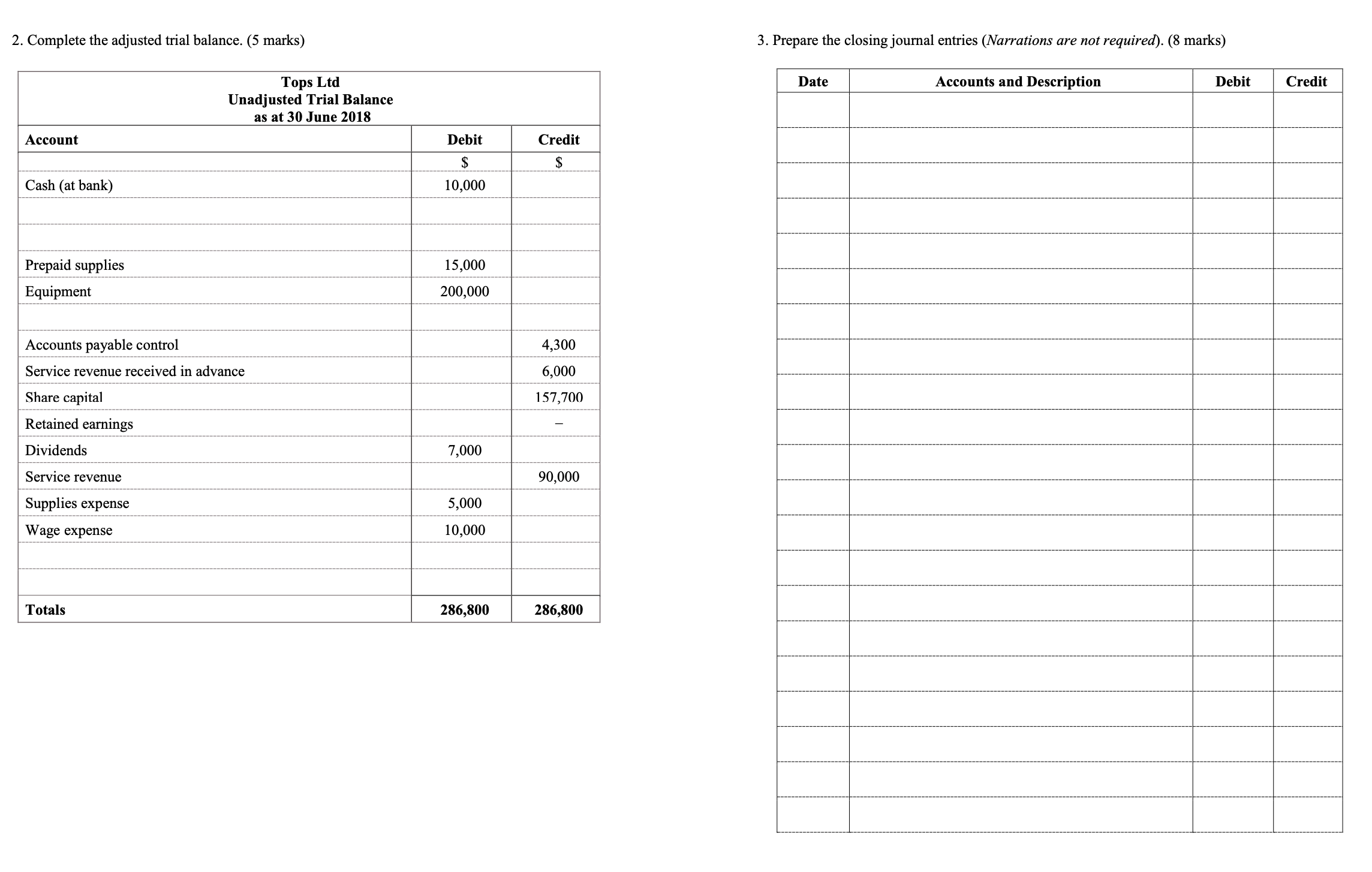

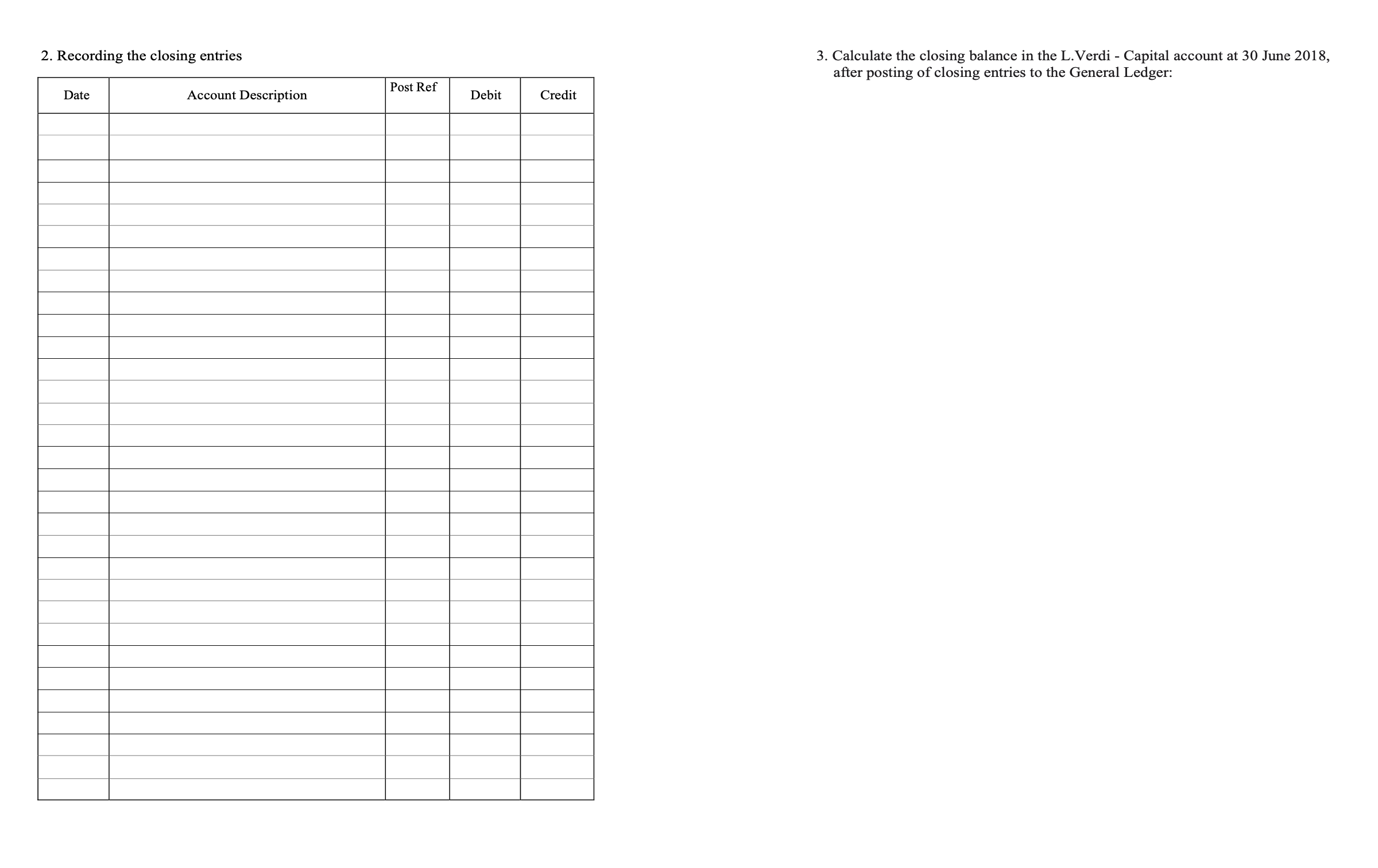

Question 1 (22 marks) Coastal Clothing Alterations is operated by Lorenzo Verdi. The business has prepared the following unadjusted and adjusted trial balances at 30 June 2018: Account Cash Accounts receivable Supplies Prepaid insurance Office furniture Accumulated depreciation Accounts payable Salaries payable Interest payable Loan payable Unearned alterations revenue Lorenzo Verdi, Capital Lorenzo Verdi, Drawings Alterations revenue Depreciation expense Supplies expense Electricity expense Salaries expense Rent expense Interest expense Insurance expense COASTAL CLOTHING ALTERATIONS Trial Balances as at 30 June 2018 $ Unadjusted Trial balance Debit 10 100 31 520 3 050 6 160 60 560 82 200 13 800 74 640 34 160 2 460 $ 318 650 $ Credit 23 020 17 680 33 600 4 030 36 230 204 090 $ 318 650 $ $ Adjusted trial balance Debit 10 100 33 850 2 180 3 720 60 560 82 200 6 380 870 13 800 77 330 34 160 3 440 2 440 331 030 $ Credit 29 400 17 680 2 690 980 33 600 2 690 36 230 207 760 $ 331 030 Required: 1. Prepare the adjusting journal entries that account for the differences between the two trial balances at 30 June 2018 (Narrations are not required). Note that Alternations Revenue may be affected by more than one adjusting entry (14 marks); 2. Prepare the closing journal entries (Narrations are not required) (6 marks); 3. Calculate the closing balance in the L Verdi - Capital account, after closing entries have been posted to the General Ledger (2 marks). 1. Recording the adjusting journal entries (AJES) AJE No. Date Account Description Debit Credit Question 5-20 marks (Accounting Cycle) PART A (14 marks) Each of these is an independent situation follow instructions of each section and answer question in space provided. (a) (b) A Limited uses the ageing method (indirect method) to calculate allowance for doubtful debts. This method requires an allowance for doubtful debts of $6,200 as at 30 June 2018. The balance of the allowance for doubtful debts prior to the adjusting journal entry is 700 DR. Prepare the adjusting journal entry as at 30 June 2018. Show all workings (2 marks) DATE DETAILS DR Explain the advantage of the ageing method (indirect method) in accounting for bad debts over the direct write-off method. (3 marks) CR Question 5-20 marks (Accounting Cycle) PART A (14 marks) continued (c) B Limited purchased a motor vehicle for $20,000 on 1 February 2018. The motor vehicle is estimated to have a residual value of $2,000 and a useful life of six (6) years. Prepare the depreciation journal for the year ending 30 June 2018 and show how this item would be presented in the financial statements. Show all workings. (4 marks) DATE DETAILS Extract from financial statements DR CR Question 5-20 marks (Accounting Cycle) PART A (14 marks) continued (d) Salaries are paid every Friday for the week (Monday to Friday). The weekly amount paid is $12,000. The balance date is Wednesday 30th June 2018. Prepare the adjusting journal entry to accrue the salaries expense to 30 June 2018. Also prepare the journal entry to record the cash payment on Friday 2nd July 2018. (5 marks) DATE DETAILS DR CR Question 5-20 marks (Accounting Cycle) PART B (6 marks) Name two (2) key reports included in general purpose financial reports. Explain the key components of the report and briefly explain how each report provides useful information. (6 marks) Question 1: Accounting Cycle (a) Explain the role of the general ledger in the accounting process? [16 marks] (2 marks) (b) Background information: Alan Williams is an electrician and owns and runs his own (sole trader) business named 'Alan's Building Services'. He has prepared an adjusted trial balance for the month of September 2017 presented below: Required: (1) (2) (3) Account 'Alan William's Building Services' Adjusted Trial Balance as at 30 September 2017 Cash (at bank) Accounts receivable (control) Prepaid rent Trucks Accumulated depreciation_trucks Accounts payable (control) Wages payable Unearned revenue Owner's Capital_A. Williams_01/9/17 Drawings Service revenue Petrol expense Electricity expense Depreciation expense_truck Wages expense Rent expense Totals Debit $ 456 4,891 16,642 130,210 5,400 643 342 1,670 2,360 2,100 164,714 Credit $ 6,640 1,698 2,360 4,706 140,000 9,310 164,714 Prepare closing entries for the month of September 2017. Narrations are required. (6 marks) Post the closing entries in Part (1) to the Owner's Capital account.' (4 marks) Prepare the Post-closing trial balance (4 marks) Part (1) Date Accounts and Description Post Ref Debit Credit Part (2) Part (3) Account Debit Owner's Capital, A. Williams Debit $ Credit Credit $ Question 1. Accounting Cycle (25 marks) 'Tops Ltd' has prepared an Unadjusted Trial Balance (UTB) for the year ended 30 June 2018. The UTB is presented below Account Tops Ltd Unadjusted Trial Balance as at 30 June 2018 Cash (at bank) Accounts receivable control Prepaid supplies Equipment Accounts payable control Service revenue received in advance Share capital Retained earnings Dividends Service revenue Supplies expense Wage expense Totals Debit $ 10,000 11,000 15,000 200,000 7,000 5,000 10,000 $258,000 Credit $ 4,300 6,000 157,700 90,000 $258,000 Additional information: the accountant reviewed the account balances and found the following issues which required consideration: (a) Tops Ltd purchased a new equipment on 1 January 2018 at a cost of $204,000. The entity expected that the equipment to be used for 4 years and has residual value 4,000 at the end of its life. The company decides to use straight-line method to estimate the depreciation expense for the equipment. The depreciation expense however has not been recorded. (b) The accounts receivable ageing schedule showed that at year-end, $5,000 of account receivable is estimated to be uncollectable. The organisation uses the Allowance Method to account for bad and doubtful debts. (c) A specific customer's accounts receivable representing $1,200 is identified as uncollectible with certainty. Required: 1. Post the adjusting journal entries to the appropriate columns. Narrations are required. (Post reference is not required for this question.) (12 marks) 2. Complete the adjusted trial balance. (5 marks) 3. Prepare the closing journal entries (Narrations are not required). (8 marks) 1. Post the adjusting journal entries to the appropriate columns. Narrations are required. (Post reference is not required for this question.) (12 marks) Accounts and Description Date Debit Credit 2. Complete the adjusted trial balance. (5 marks) Account Cash (at bank) Prepaid supplies Equipment Accounts payable control Service revenue received in advance Share capital Retained earnings Dividends Service revenue Supplies expense Wage expense Tops Ltd Unadjusted Trial Balance as 30 June 2018 Totals Debit $ 10,000 15,000 200,000 7,000 5,000 10,000 286,800 Credit $ 4,300 6,000 157,700 90,000 286,800 3. Prepare the closing journal entries (Narrations are not required). (8 marks) Accounts and Description Date Debit Credit 2. Recording the closing entries Date Account Description Post Ref Debit Credit 3. Calculate the closing balance in the L.Verdi - Capital account at 30 June 2018, after posting of closing entries to the General Ledger:

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Adjusting Journal Entries AJEs a To record depreciation expense Debit Depreciation Expense 6380 Credit Accumulated Depreciation 6380 b To adjust supplies expense Debit Supplies Expense 1870 Credit S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started