Question

1) Discuss each step you have taken to prepare the acquisition analysis. Include all relevant account names, amounts and explanations of calculations. 2) Discuss the

1) Discuss each step you have taken to prepare the acquisition analysis. Include all relevant account names, amounts and explanations of calculations.

2) Discuss the accounting adjustments required to account for the fair value adjustment of inventories at the acquisition date.

3) At the acquisition date, Billy Ltd recorded a Dividend payable for $8,000. Discuss how you have treated this item in the acquisition analysis and the worksheet. Provide an explanation as to your actions.

4) Discuss the accounting processes, calculations and consolidation entries you have made for the Machine and all the related accounts.

5) explain the purpose of the 'Transfer from BCVR' account and all consolidation entries which you have posted to this account.

6) Joel Ltd provided Billy Ltd with a loan for $326,000 on 31 December 2019. Explain the accounting processes, calculations and consolidation entries you have provided to account for the loan and interest.

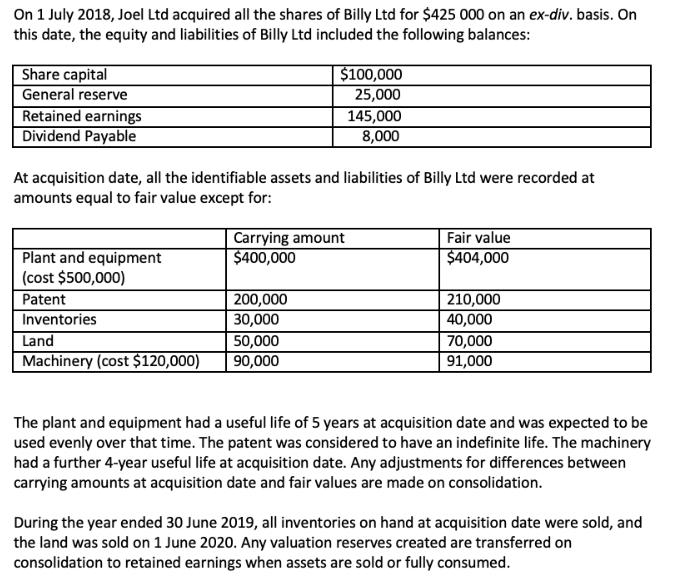

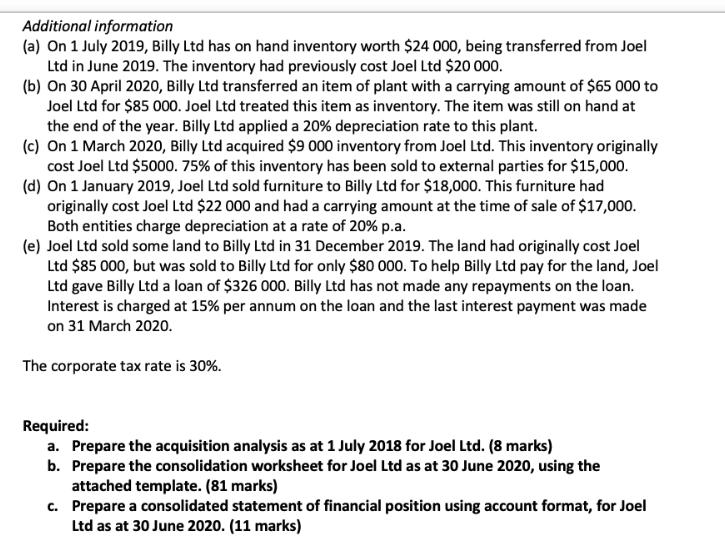

On 1 July 2018, Joel Ltd acquired all the shares of Billy Ltd for $425 000 on an ex-div. basis. On this date, the equity and liabilities of Billy Ltd included the following balances: Share capital General reserve Retained earnings $100,000 25,000 145,000 8,000 Dividend Payable At acquisition date, all the identifiable assets and liabilities of Billy Ltd were recorded at amounts equal to fair value except for: Carrying amount Plant and equipment $400,000 (cost $500,000) Patent 200,000 Inventories 30,000 Land 50,000 Machinery (cost $120,000) 90,000 Fair value $404,000 210,000 40,000 70,000 91,000 The plant and equipment had a useful life of 5 years at acquisition date and was expected to be used evenly over that time. The patent was considered to have an indefinite life. The machinery had a further 4-year useful life at acquisition date. Any adjustments for differences between carrying amounts at acquisition date and fair values are made on consolidation. During the year ended 30 June 2019, all inventories on hand at acquisition date were sold, and the land was sold on 1 June 2020. Any valuation reserves created are transferred on consolidation to retained earnings when assets are sold or fully consumed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps I have taken to prepare the acquisition analysis for Joel Ltds acquisition of Bil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started