Answered step by step

Verified Expert Solution

Question

1 Approved Answer

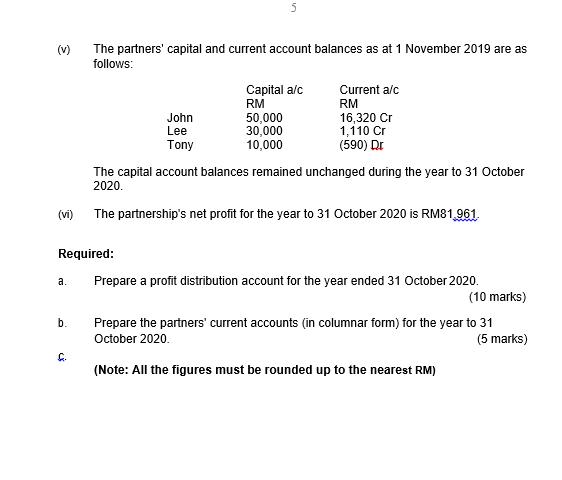

(V) 5 The partners' capital and current account balances as at 1 November 2019 are as follows: Capital a/c Current a/c RM RM John

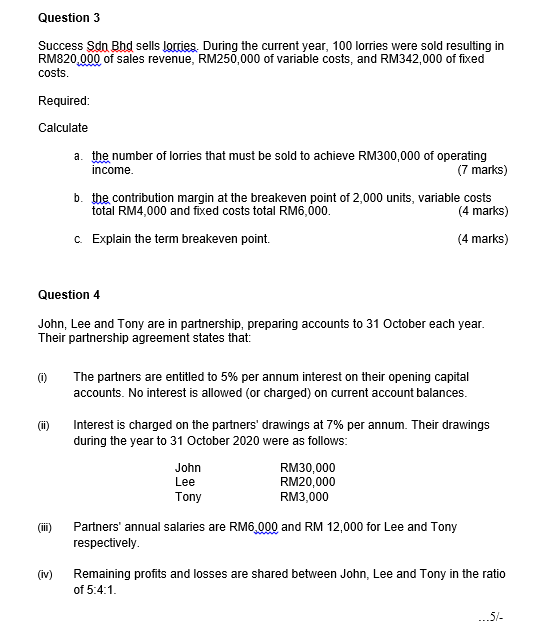

(V) 5 The partners' capital and current account balances as at 1 November 2019 are as follows: Capital a/c Current a/c RM RM John Lee Tony 50,000 16,320 Cr 30,000 1,110 Cr 10,000 (590) Dr (vi) The capital account balances remained unchanged during the year to 31 October 2020. The partnership's net profit for the year to 31 October 2020 is RM81.961. Required: a. Prepare a profit distribution account for the year ended 31 October 2020. (10 marks) b. Prepare the partners' current accounts (in columnar form) for the year to 31 October 2020. (5 marks) F. (Note: All the figures must be rounded up to the nearest RM) Question 3 Success Sdn Bhd sells Jorries. During the current year, 100 lorries were sold resulting in RM820,000 of sales revenue, RM250,000 of variable costs, and RM342,000 of fixed costs. Required: Calculate a. the number of lorries that must be sold to achieve RM300,000 of operating income. (7 marks) b. the contribution margin at the breakeven point of 2,000 units, variable costs total RM4,000 and fixed costs total RM6,000. c. Explain the term breakeven point. (4 marks) (4 marks) Question 4 John, Lee and Tony are in partnership, preparing accounts to 31 October each year. Their partnership agreement states that: (i) The partners are entitled to 5% per annum interest on their opening capital accounts. No interest is allowed (or charged) on current account balances. (ii) (iii) (iv) Interest is charged on the partners' drawings at 7% per annum. Their drawings during the year to 31 October 2020 were as follows: John Lee Tony RM30,000 RM20,000 RM3,000 Partners' annual salaries are RM6,000 and RM 12,000 for Lee and Tony respectively. Remaining profits and losses are shared between John, Lee and Tony in the ratio of 5:4:1. ...5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Profit Distribution Account for the year ended 31 O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started