Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Discuss in detail, each item in the stockholders' equity section of Mountain Sport Inc, 2. Discuss in detail the following items included in the

1. Discuss in detail, each item in the stockholders' equity section of Mountain Sport Inc,

2. Discuss in detail the following items included in the financial statement:

A. Gross profit

B. Accumulated depreciation

C. Depreciation Expense-office equipment

D.Prepaid Rent

E. Premium on bonds payable

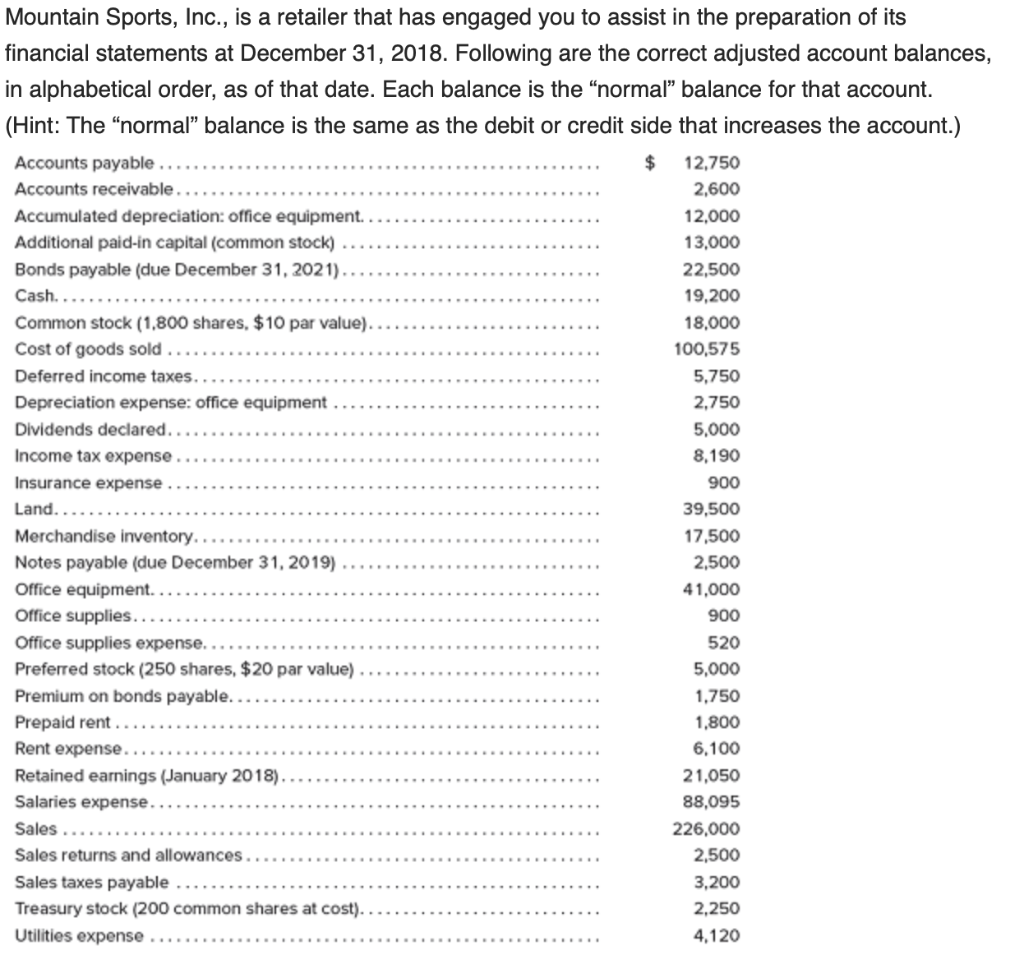

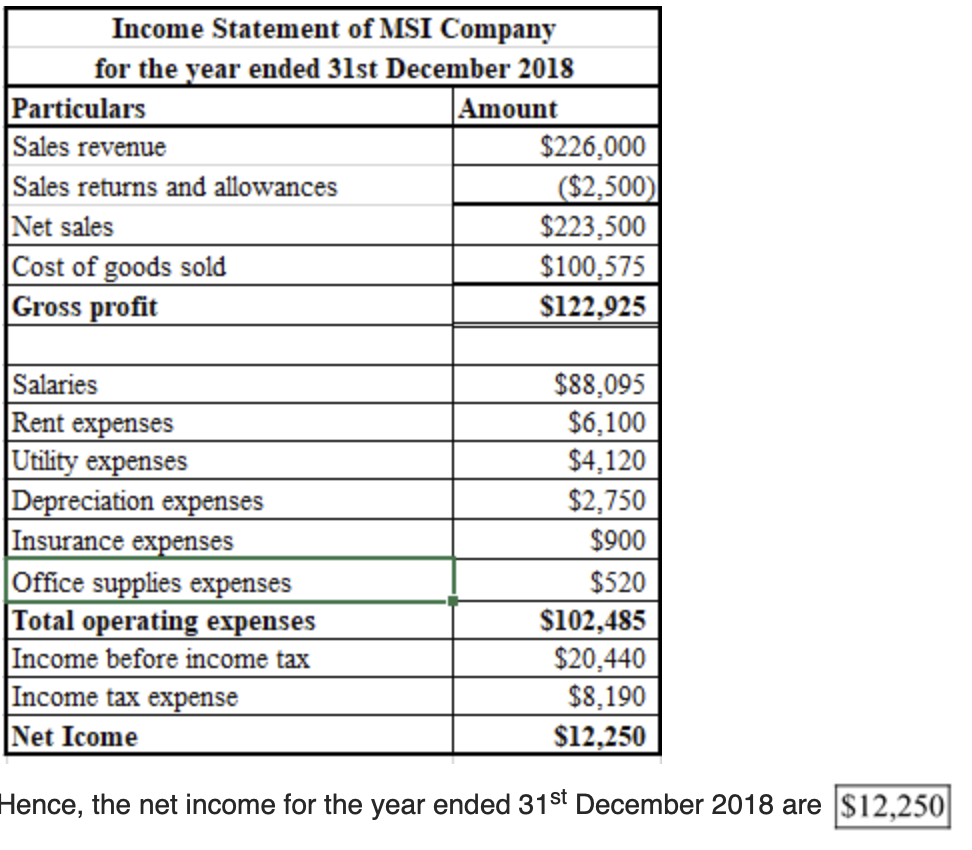

Cash.............................. . . . Mountain Sports, Inc., is a retailer that has engaged you to assist in the preparation of its financial statements at December 31, 2018. Following are the correct adjusted account balances, in alphabetical order, as of that date. Each balance is the normal balance for that account. (Hint: The "normal" balance is the same as the debit or credit side that increases the account.) Accounts payable ....... $ 12,750 Accounts receivable 2,600 Accumulated depreciation: office equipment.. 12,000 Additional paid-in capital (common stock) ....... 13,000 Bonds payable (due December 31, 2021)...... 22,500 Cash... 19,200 Common stock (1,800 shares. $10 par value).... 18,000 Cost of goods sold 100,575 Deferred income taxes...... 5,750 Depreciation expense: office equipment 2,750 Dividends declared. 5,000 Income tax expense.. 8,190 Insurance expense...... 900 Land..................... 39,500 Merchandise inventory.... 17,500 Notes payable (due December 31, 2019) 2,500 Office equipment. 41,000 Office supplies...... 900 Office supplies expense........ 520 Preferred stock (250 shares, $20 par value) 5,000 Premium on bonds payable..... 1,750 Prepaid rent........ 1,800 Rent expense 6.100 Retained earnings (January 2018)..... 21,050 Salaries expense........ 88,095 Sales .................. 226,000 Sales returns and allowances........ 2,500 Sales taxes payable ....... 3,200 Treasury stock (200 common shares at cost). 2,250 Utilities expense ...... 4,120 Income Statement of MSI Company for the year ended 31st December 2018 Particulars Amount Sales revenue $226,000 Sales returns and allowances ($2,500) Net sales $223,500 Cost of goods sold $100,575 Gross profit $122,925 Salaries Rent expenses Utility expenses Depreciation expenses Insurance expenses Office supplies expenses Total operating expenses Income before income tax Income tax expense Net Icome $88,095 $6.100 $4.120 $2,750 $900 $520 $102,485 $20,440 $8,190 $12.250 Hence, the net income for the year ended 31st December 2018 are $12,250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started