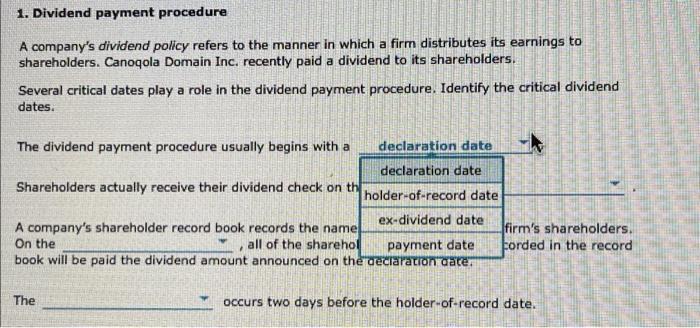

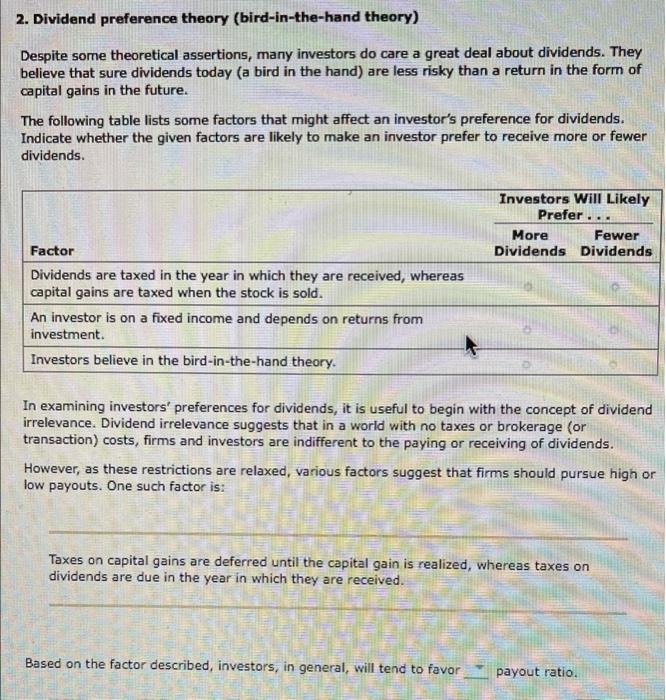

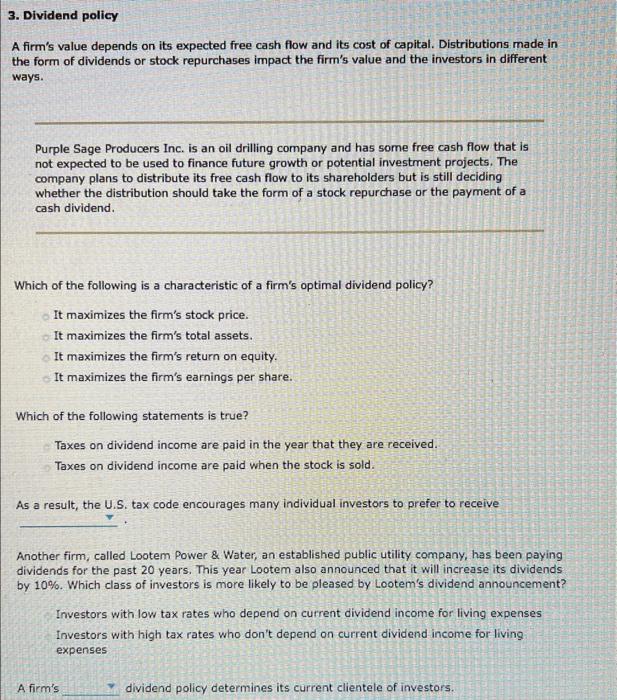

1. Dividend payment procedure A company's dividend policy refers to the manner in which a firm distributes its earnings to shareholders. Canoqola Domain Inc. recently paid a dividend to its shareholders. Several critical dates play a role in the dividend payment procedure. Identify the critical dividend dates. The dividend payment procedure usually begins with a declaration date declaration date Shareholders actually receive their dividend check on thi holder-of-record date A company's shareholder record book records the name ex-dividend date firm's shareholders. On the all of the sharehol payment date Forded in the record book will be paid the dividend amount announced on the declaration date, The occurs two days before the holder-of-record date. 2. Dividend preference theory (bird-in-the-hand theory) Despite some theoretical assertions, many investors do care a great deal about dividends. They believe that sure dividends today (a bird in the hand) are less risky than a return in the form of capital gains in the future. The following table lists some factors that might affect an investor's preference for dividends. Indicate whether the given factors are likely to make an investor prefer to receive more or fewer dividends. .. Investors Will Likely Prefer. More Fewer Dividends Dividends Factor Dividends are taxed in the year in which they are received, whereas capital gains are taxed when the stock is sold. An investor is on a fixed income and depends on returns from investment Investors believe in the bird-in-the-hand theory. In examining investors' preferences for dividends, it is useful to begin with the concept of dividend irrelevance. Dividend irrelevance suggests that in a world with no taxes or brokerage (or transaction) costs, firms and investors are indifferent to the paying or receiving of dividends. However, as these restrictions are relaxed, various factors suggest that firms should pursue high or low payouts. One such factor is: Taxes on capital gains are deferred until the capital gain is realized, whereas taxes on dividends are due in the year in which they are received. Based on the factor described, investors, in general, will tend to favor payout ratio. 3. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. Purple Sage Producers Inc. is an oil drilling company and has some free cash flow that is not expected to be used to finance future growth or potential investment projects. The company plans to distribute its free cash flow to its shareholders but is still deciding whether the distribution should take the form of a stock repurchase or the payment of a cash dividend. Which of the following is a characteristic of a firm's optimal dividend policy? It maximizes the firm's stock price. It maximizes the firm's total assets. It maximizes the firm's return on equity. It maximizes the firm's earnings per share. Which of the following statements is true? Taxes on dividend income are paid in the year that they are received. Taxes on dividend income are paid when the stock is sold. As a result, the U.S. tax code encourages many individual investors to prefer to receive Another firm, called Lootem Power & Water, an established public utility company, has been paying dividends for the past 20 years. This year Lootem also announced that it will increase its dividends by 10%. Which class of investors is more likely to be pleased by Lootem's dividend announcement? Investors with low tax rates who depend on current dividend income for living expenses Investors with high tax rates who don't depend on current dividend income for living expenses A firm's dividend policy determines its current clientele of investors