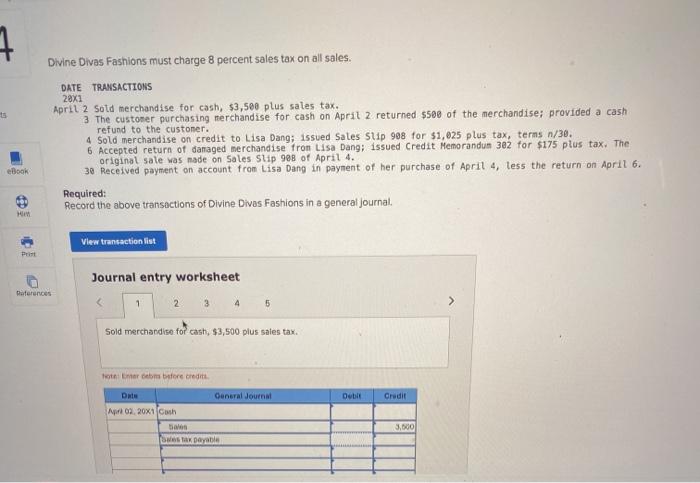

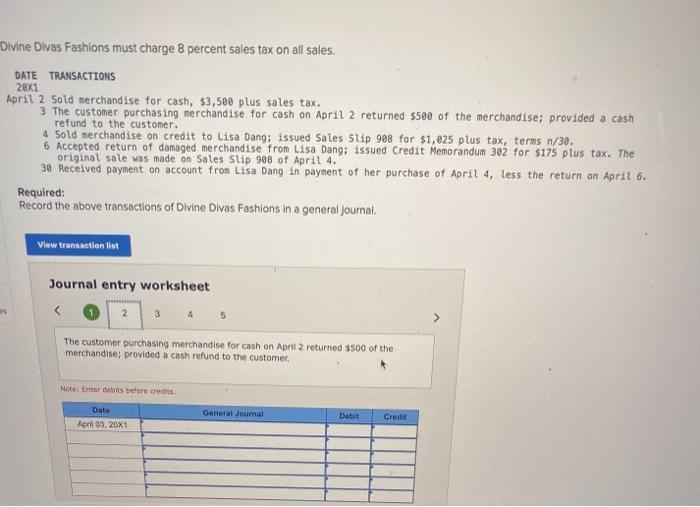

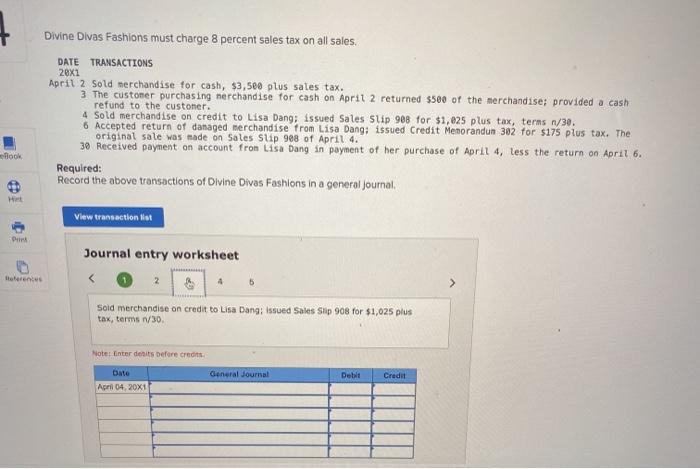

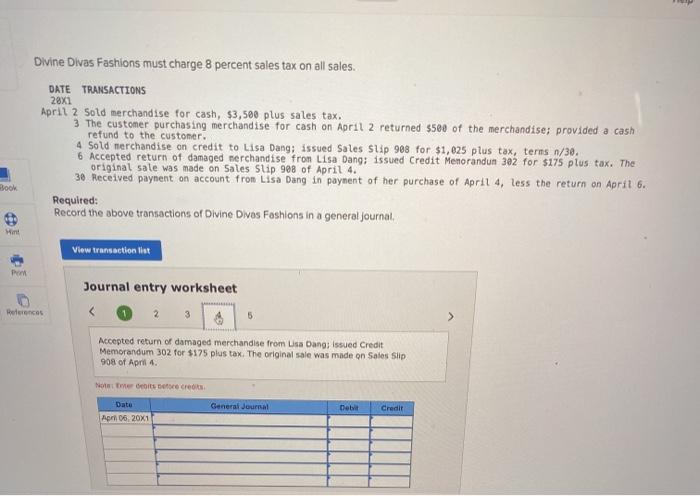

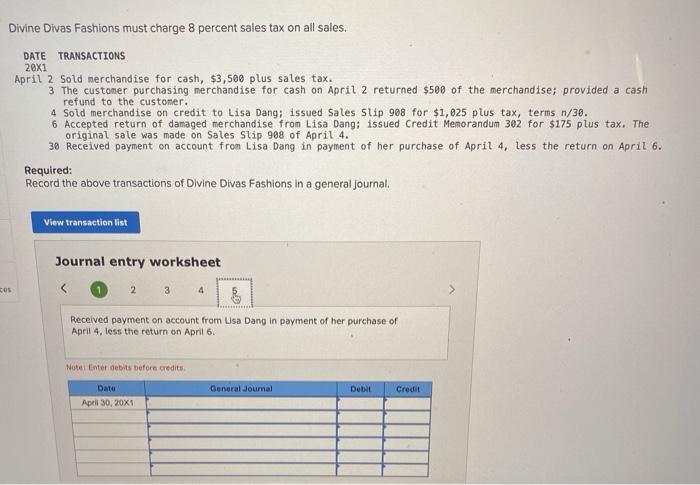

1 Divine Divas Fashions must charge 8 percent sales tax on all sales. DATE TRANSACTIONS 28x1 April 2 Sold merchandise for cash, $3,500 plus sales tax. 3 The customer purchasing merchandise for cash on April 2 returned $508 of the merchandise; provided a cash refund to the customer. 4 Sold merchandise on credit to Lisa Dang; issued Sales Suip 908 for $1,025 plus tax, terms n/30. 6 Accepted return of damaged merchandise fron Lisa Dang; issued Credit Memorandum 302 for $175 plus tax. The original sale was made on Sales Suip 908 of April 4. 30 Received payment on account from Lisa Dang in payment of her purchase of April 4, less the return on April 6. Required: Record the above transactions of Divine Divas Fashions in a general Journal. eBook H View transaction lit Motorences Journal entry worksheet 3 1 2 4 5 > Sold merchandise for cash, $3,500 plus sales tax Tot Enter om before credit General Journal Dubit Credit Date 0,20x1 Cash 3,600 wak payable Divine Divas Fashions must charge 8 percent sales tax on all sales. DATE TRANSACTIONS 28x1 April 2 Sold merchandise for cash, $3,500 plus sales tax. 3 The customer purchasing merchandise for cash on April 2 returned $500 of the merchandise; provided a cash refund to the customer. 4 Sold merchandise on credit to Lisa Dang; issued Sales Slip 908 for $1,025 plus tax, terms n/30. 6 Accepted return of damaged merchandise from Lisa Dang; issued Credit Memorandum 302 for $175 plus tax. The original sale was made on Sales Slip 998 of April 4. 38 Received payment on account fron Lisa Dang in payment of her purchase of April 4, less the return on April 6. Required: Record the above transactions of Divine Divas Fashions in a general Journal View transaction lit Journal entry worksheet 26 2 3 4 5 The customer purchasing merchandise for cash on April 2 returned $500 of the merchandise; provided a cash refund to the customer Note Enter der before credits General Joumal Date Apr 03, 20X1 Debit Credit 7 Divine Divas Fashions must charge 8 percent sales tax on all sales. DATE TRANSACTIONS 20x1 April 2 Sold merchandise for cash, $3,500 plus sales tax. 3 The customer purchasing merchandise for cash on April 2 returned $500 of the merchandise; provided a cash refund to the custoner. 4 Sold merchandise on credit to Lisa Dang: issued Sales Slip 908 for $1,025 plus tax, terms n/30. 6 Accepted return of damaged merchandise from Lisa Dang; issued Credit Menorandum 302 for $175 plus tax. The original sale was made on Sales Suip 908 of April 4. 30 Received payment on account fron Lasa Dang in payment of her purchase of April 4, less the return on April 6. Required: Record the above transactions of Divine Divas Fashions in a general Journal Book HE View transaction to Drink Journal entry worksheet torent 2 4 Sold merchandise on credit to Lisa Dang: Issued Sales Slip 908 for $1,025 plus tax, terms 1/30 Note Enter dents before credits General Journal Debit Credit Date April 04, 20X1 Divine Divas Fashions must charge 8 percent sales tax on all sales. DATE TRANSACTIONS 28x1 April 2 Sold merchandise for cash, $3,500 plus sales tax. 3 The customer purchasing merchandise for cash on April 2 returned $500 of the merchandise: provided a cash refund to the customer. 4 Sold merchandise on credit to Lisa Dang; issued Sales Slip 988 for $1,025 plus tax, terms n/30. 6 Accepted return of damaged merchandise from Lisa Dang; issued Credit Memorandun 302 for $175 plus tax. The 30 Received paynent on account from Lisa Dang in paynent of her purchase of April 4, less the return on April 6. Required: Record the above transactions of Divine Dives Foshions in a general Journal Book Wint View transaction line Pom Journal entry worksheet Rencos 3 5 > Accepted return of damaged merchandise from Lisa Dano: Issued Credit Memorandum 302 for $175 plus tax. The original sole was made on Sales Slip 908 of April Not meitene credits General Journal Date Apr 06, 20X1 Debit Credit Divine Divas Fashions must charge 8 percent sales tax on all sales. DATE TRANSACTIONS 28x1 April 2 Sold merchandise for cash, $3,500 plus sales tax. 3 The customer purchasing merchandise for cash on April 2 returned $500 of the merchandise; provided a cash refund to the customer. 4 Sold merchandise on credit to Lisa Dang; issued Sales Slip 908 for $1,025 plus tax, terms n/30. 6 Accepted return of damaged merchandise from Lisa Dang; issued Credit Memorandum 302 for $175 plus tax. The original sale was made on Sales Slip 908 of April 4. 30 Received payment on account from Lisa Dang in payment of her purchase of April 4, less the return on April 6. Required: Record the above transactions of Divine Divas Fashions in a general Journal View transaction list Journal entry worksheet 2 3 ces > 0 Received payment on account from Lisa Dang in payment of her purchase of April 4, less the return on April 6. Note Enter debts before credits General Journal Det Credit Dato April 30, 20X1