Answered step by step

Verified Expert Solution

Question

1 Approved Answer

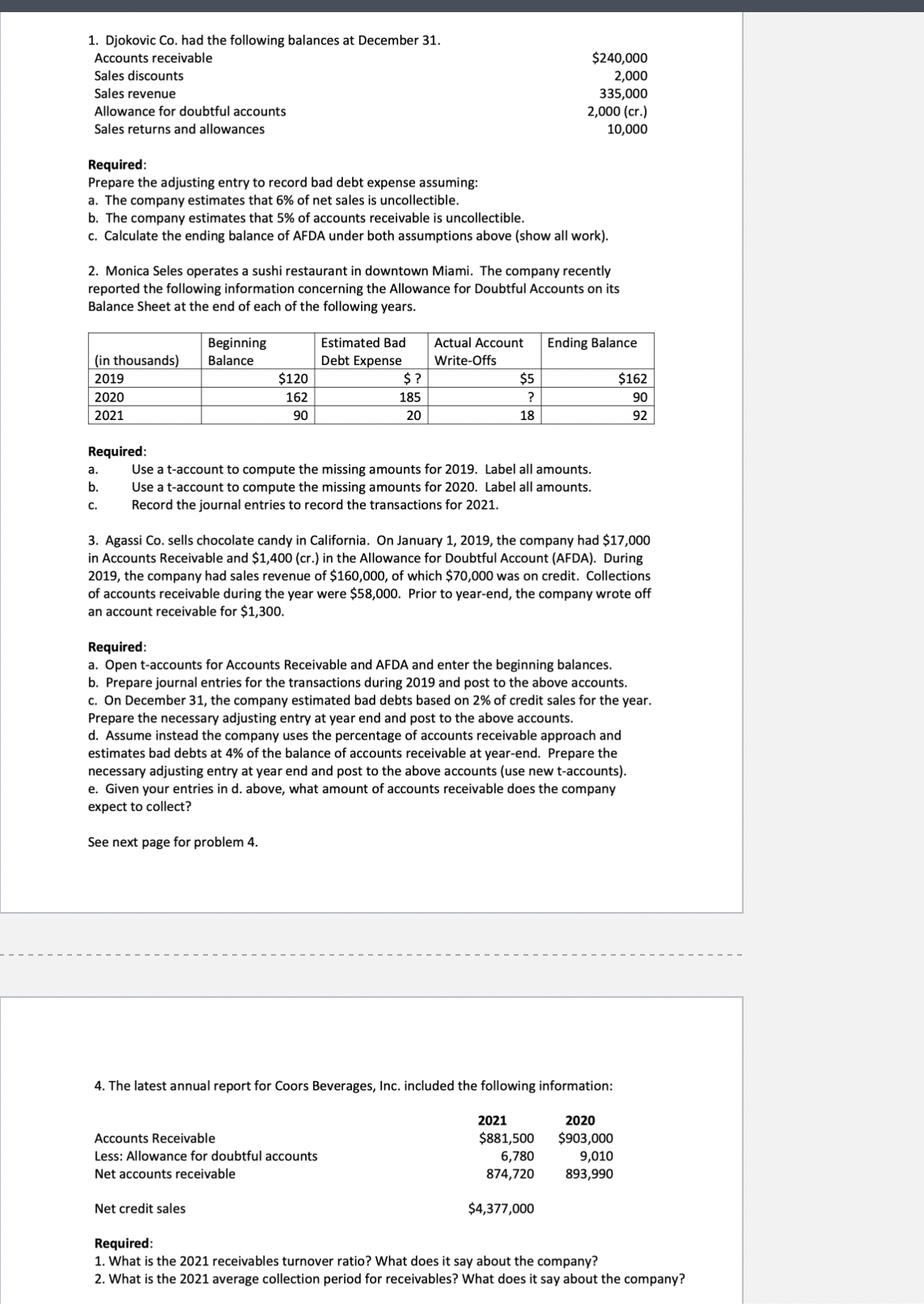

1. Djokovic Co. had the following balances at December 31. Accounts receivable Sales discounts Sales revenue Allowance for doubtful accounts Sales returns and allowances

1. Djokovic Co. had the following balances at December 31. Accounts receivable Sales discounts Sales revenue Allowance for doubtful accounts Sales returns and allowances Required: Prepare the adjusting entry to record bad debt expense assuming: a. The company estimates that 6% of net sales is uncollectible. b. The company estimates that 5% of accounts receivable is uncollectible. $240,000 2,000 335,000 2,000 (cr.) 10,000 c. Calculate the ending balance of AFDA under both assumptions above (show all work). 2. Monica Seles operates a sushi restaurant in downtown Miami. The company recently reported the following information concerning the Allowance for Doubtful Accounts on its Balance Sheet at the end of each of the following years. Beginning (in thousands) Balance Estimated Bad Debt Expense Actual Account Write-Offs Ending Balance 2019 $120 $? $5 $162 2020 162 185 ? 90 2021 90 20 18 92 Required: a. b. C. Use a t-account to compute the missing amounts for 2019. Label all amounts. Use a t-account to compute the missing amounts for 2020. Label all amounts. Record the journal entries to record the transactions for 2021. 3. Agassi Co. sells chocolate candy in California. On January 1, 2019, the company had $17,000 in Accounts Receivable and $1,400 (cr.) in the Allowance for Doubtful Account (AFDA). During 2019, the company had sales revenue of $160,000, of which $70,000 was on credit. Collections of accounts receivable during the year were $58,000. Prior to year-end, the company wrote off an account receivable for $1,300. Required: a. Open t-accounts for Accounts Receivable and AFDA and enter the beginning balances. b. Prepare journal entries for the transactions during 2019 and post to the above accounts. c. On December 31, the company estimated bad debts based on 2% of credit sales for the year. Prepare the necessary adjusting entry at year end and post to the above accounts. d. Assume instead the company uses the percentage of accounts receivable approach and estimates bad debts at 4% of the balance of accounts receivable at year-end. Prepare the necessary adjusting entry at year end and post to the above accounts (use new t-accounts). e. Given your entries in d. above, what amount of accounts receivable does the company expect to collect? See next page for problem 4. 4. The latest annual report for Coors Beverages, Inc. included the following information: Accounts Receivable Less: Allowance for doubtful accounts Net accounts receivable Net credit sales Required: 2021 $881,500 6,780 874,720 2020 $903,000 9,010 893,990 $4,377,000 1. What is the 2021 receivables turnover ratio? What does it say about the company? 2. What is the 2021 average collection period for receivables? What does it say about the company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started