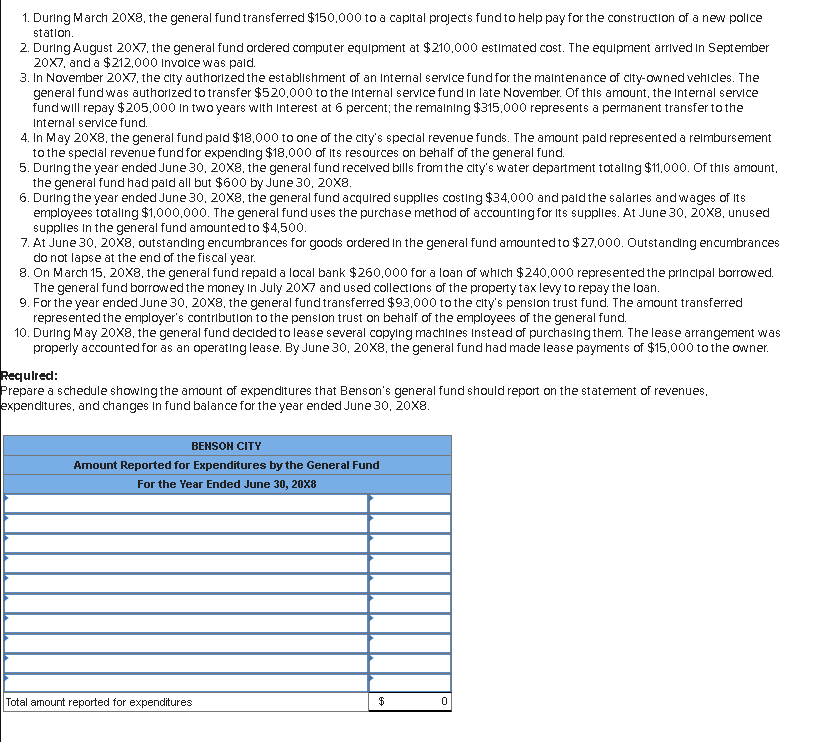

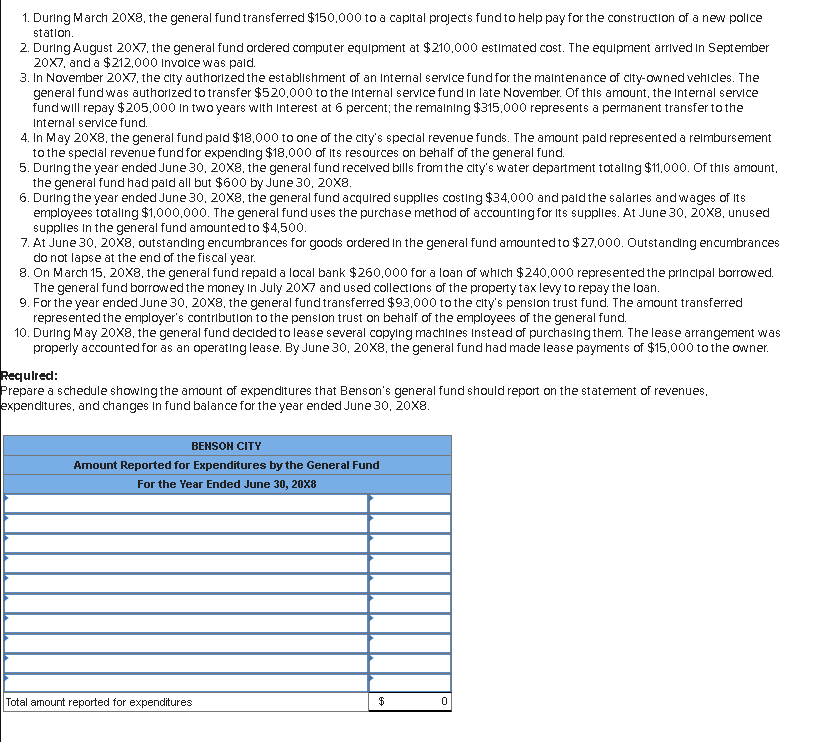

1. During March 208, the general fund transferred $150.000 to a capltal projects fund to help pay for the construction of a new police station. 2. Durng August 207, the general fund ordered computer equipment at $210.000 estlmated cost. The equipment arrlved In September 207, and a $212,000 Involce was pald. 3. In November 207, the clty authorized the establishment of an Internal service fund for the maintenance of clty-owned vehicles. The general fund was authorized to transfer $520.000 to the internal service fund in late November. Of this amount, the Internal service fund will repay $205.000 in two years with Interest at 6 percent; the remaining $315,000 represents a permanent transfer to the Internal service fund. 4. In May 208, the general fund pald $18,000 to one of the clty's speclal revenue funds. The amount pald represented a reimbursement to the speclal revenue fund for expending $18.000 of Its resources on behalf of the general fund. 5. During the year ended June 30,208, the general fund recelved bills from the city's water department totalling $11,000. Of this amount. the general fund had pald all but $600 by June 30 , 208. 6. During the year ended June 30.208, the general fund acquired supplles costing $34,000 and pald the salarles and wages of Its supplles in the general fund amounted to $4,500. do not lapse at the end of the fiscal year. 8. On March 15, 20X8, the general fund repald a local bank $260,000 for a loan of which $240.000 represented the princlpal borrowed. The general fund borrowed the money In July 20x7 and used collections of the property tax lewy to repay the loan. 9. For the year ended June 30,208, the general fund transferred $93,000 to the city's pension trust fund. The amount transferred represented the employer's contribution to the pension trust on behalf of the employees of the general fund. 10. During May 208, the general fund decided to lease several copying machines Instead of purchasing them. The lease arrangement was properly accounted for as an operating lease. By June 30. 20x8, the general fund had made lease payments of $15,000 to the owner. ancculred: repare a schedule showing the amount of expendlures that Benson's general fund should report on the statement of revenues. xpendltures, and changes In fund balance for the year ended June 30,208