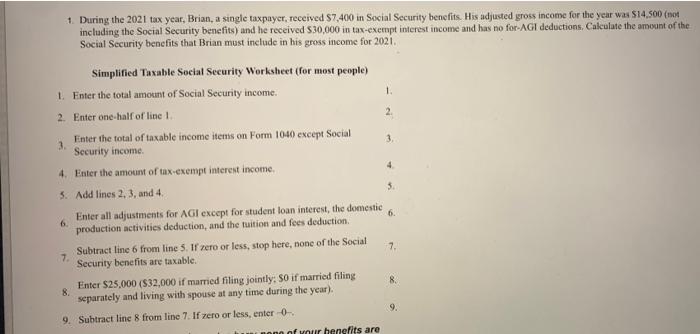

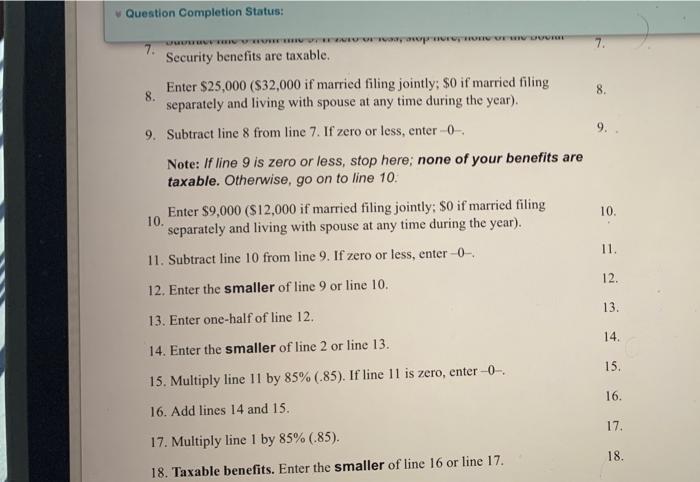

1. During the 2021 tax year, Brian, a single taxpayer, received 87,400 in Social Security benefits. His adjusted gross income for the year was $14.500 (not including the Social Security benefits) and he received 30,000 in tax-exempt interest income and has no for-AGI deductions Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2021 1 2 Simplified Taxable Social Security Worksheet (for most people) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 Enter the total of taxable income items on Form 1040 except Social 3 Security income 4. Enter the amount of tax exempt interest income 3. 4 3. 5. Add lines 2.3, and 4 6. 7. Enter all adjustments for AGI except for student loan interest, the domestic 6. production activities deduction, and the tuition and fees deduction Subtract line 6 from line 5. If zero or less, stop here, none of the Social 7 Security benefits are taxable. Enter $25,000 (532,000 if married filing jointly: So if married filing 8 separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter 0 on of your benefits are 8 9. Question Completion Status: pm Wor 8. 9. 7. Security benefits are taxable. Enter $25,000 ($32,000 if married filing jointly: $0 if married filing separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter 0 Note: If line 9 is zero or less, stop here: none of your benefits are taxable. Otherwise, go on to line 10. Enter $9,000 ($12,000 if married filing jointly: So if married filing 10. separately and living with spouse at any time during the year). 11. Subtract line 10 from line 9. If zero or less, enter-0- 10. 11. 12. 12. Enter the smaller of line 9 or line 10. 13. Enter one-half of line 12. 13. 14. 14. Enter the smaller of line 2 or line 13. 15. 15. Multiply line 11 by 85% (.85). If line 11 is zero, enter-O-. 16. 16. Add lines 14 and 15. 17. 17. Multiply line 1 by 85% (.85). 18. 18. Taxable benefits. Enter the smaller of line 16 or line 17. 1. During the 2021 tax year, Brian, a single taxpayer, received 87,400 in Social Security benefits. His adjusted gross income for the year was $14.500 (not including the Social Security benefits) and he received 30,000 in tax-exempt interest income and has no for-AGI deductions Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2021 1 2 Simplified Taxable Social Security Worksheet (for most people) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 Enter the total of taxable income items on Form 1040 except Social 3 Security income 4. Enter the amount of tax exempt interest income 3. 4 3. 5. Add lines 2.3, and 4 6. 7. Enter all adjustments for AGI except for student loan interest, the domestic 6. production activities deduction, and the tuition and fees deduction Subtract line 6 from line 5. If zero or less, stop here, none of the Social 7 Security benefits are taxable. Enter $25,000 (532,000 if married filing jointly: So if married filing 8 separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter 0 on of your benefits are 8 9. Question Completion Status: pm Wor 8. 9. 7. Security benefits are taxable. Enter $25,000 ($32,000 if married filing jointly: $0 if married filing separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter 0 Note: If line 9 is zero or less, stop here: none of your benefits are taxable. Otherwise, go on to line 10. Enter $9,000 ($12,000 if married filing jointly: So if married filing 10. separately and living with spouse at any time during the year). 11. Subtract line 10 from line 9. If zero or less, enter-0- 10. 11. 12. 12. Enter the smaller of line 9 or line 10. 13. Enter one-half of line 12. 13. 14. 14. Enter the smaller of line 2 or line 13. 15. 15. Multiply line 11 by 85% (.85). If line 11 is zero, enter-O-. 16. 16. Add lines 14 and 15. 17. 17. Multiply line 1 by 85% (.85). 18. 18. Taxable benefits. Enter the smaller of line 16 or line 17