Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. During Year 10, P sold merchandise to ( S ) for ( $ 600,000 ). Seventy-five percent of this merchandise remains in S's inventory

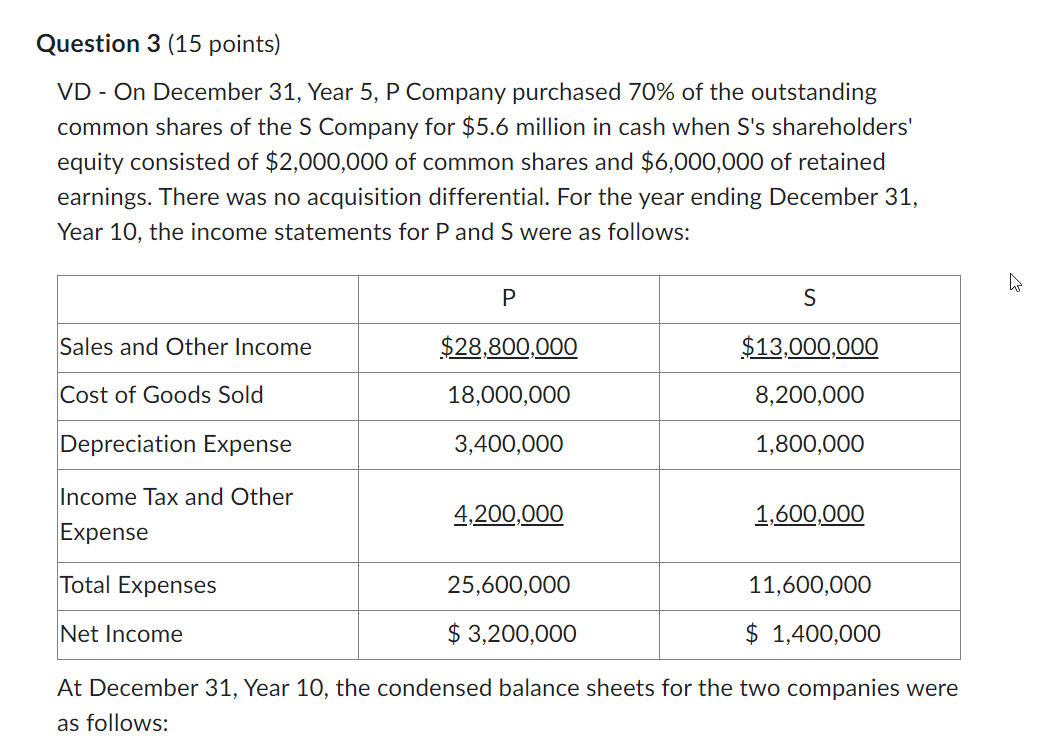

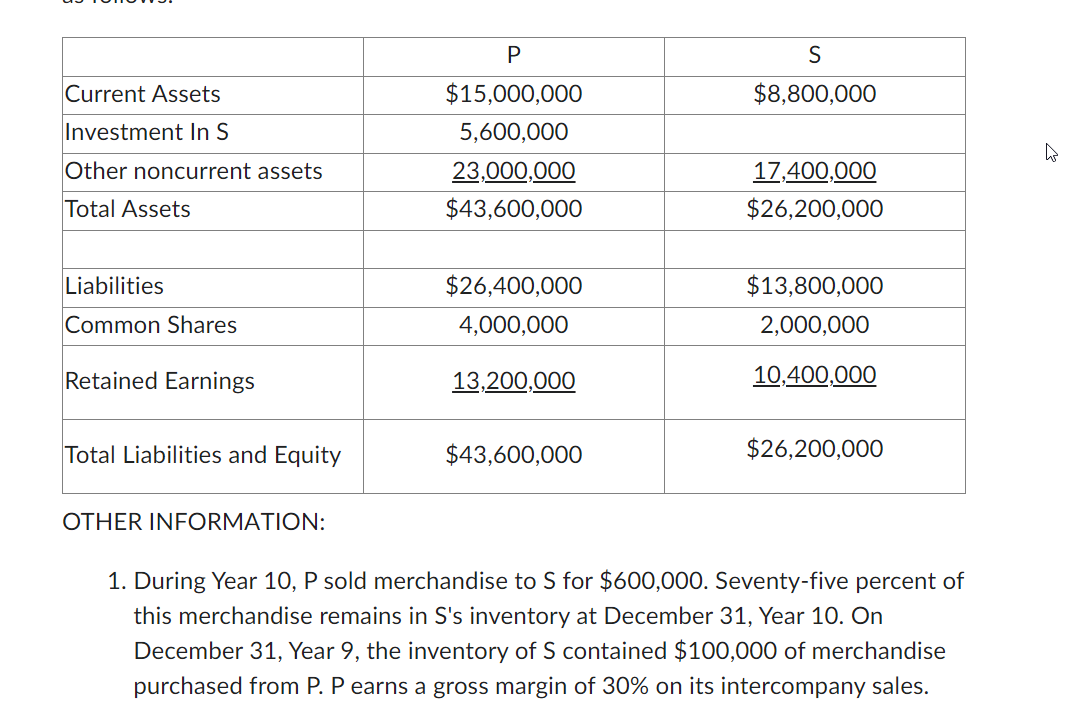

1. During Year 10, P sold merchandise to \\( S \\) for \\( \\$ 600,000 \\). Seventy-five percent of this merchandise remains in S's inventory at December 31, Year 10. On December 31, Year 9, the inventory of S contained \\( \\$ 100,000 \\) of merchandise purchased from P. P earns a gross margin of \30 on its intercompany sales. VD - On December 31, Year 5, P Company purchased \70 of the outstanding common shares of the \\( \\mathrm{S} \\) Company for \\( \\$ 5.6 \\) million in cash when S's shareholders' equity consisted of \\( \\$ 2,000,000 \\) of common shares and \\( \\$ 6,000,000 \\) of retained earnings. There was no acquisition differential. For the year ending December 31, Year 10, the income statements for \\( \\mathrm{P} \\) and \\( \\mathrm{S} \\) were as follows: At December 31, Year 10, the condensed balance sheets for the two companies were as follows: 2. On January 2, Year \\( 8, \\mathrm{~S} \\) sold land to \\( \\mathrm{P} \\) for \\( \\$ 1,200,000 \\). \\( \\mathrm{S} \\) purchased the land on January 1, Year 6, for \\( \\$ 1,100,000 \\). P still owns this land at December 31, Year 10. 3. During Year \\( 10, \\mathrm{P} \\) declared and paid dividends of \\( \\$ 2,600,000 \\), while \\( \\mathrm{S} \\) declared and paid dividends of \\( \\$ 800,000 \\). 4. P accounts for its investment in \\( \\mathrm{S} \\) using the cost method. 5. Both companies pay income tax at the rate of \35. Required: a) Prepare a schedule to show the calculation of consolidated net income. Include attribution to both shareholder groups. (5 marks) b) Prepare an intercompany profit analysis to show intercompany transaction schedule of profits before and after tax as well as the tax effects. (7 marks) c) Calculate consolidated retained earnings at December 31, Year 10. Show supporting calculations. (3 marks) 1. During Year 10, P sold merchandise to \\( S \\) for \\( \\$ 600,000 \\). Seventy-five percent of this merchandise remains in S's inventory at December 31, Year 10. On December 31, Year 9, the inventory of S contained \\( \\$ 100,000 \\) of merchandise purchased from P. P earns a gross margin of \30 on its intercompany sales. VD - On December 31, Year 5, P Company purchased \70 of the outstanding common shares of the \\( \\mathrm{S} \\) Company for \\( \\$ 5.6 \\) million in cash when S's shareholders' equity consisted of \\( \\$ 2,000,000 \\) of common shares and \\( \\$ 6,000,000 \\) of retained earnings. There was no acquisition differential. For the year ending December 31, Year 10, the income statements for \\( \\mathrm{P} \\) and \\( \\mathrm{S} \\) were as follows: At December 31, Year 10, the condensed balance sheets for the two companies were as follows: 2. On January 2, Year \\( 8, \\mathrm{~S} \\) sold land to \\( \\mathrm{P} \\) for \\( \\$ 1,200,000 \\). \\( \\mathrm{S} \\) purchased the land on January 1, Year 6, for \\( \\$ 1,100,000 \\). P still owns this land at December 31, Year 10. 3. During Year \\( 10, \\mathrm{P} \\) declared and paid dividends of \\( \\$ 2,600,000 \\), while \\( \\mathrm{S} \\) declared and paid dividends of \\( \\$ 800,000 \\). 4. P accounts for its investment in \\( \\mathrm{S} \\) using the cost method. 5. Both companies pay income tax at the rate of \35. Required: a) Prepare a schedule to show the calculation of consolidated net income. Include attribution to both shareholder groups. (5 marks) b) Prepare an intercompany profit analysis to show intercompany transaction schedule of profits before and after tax as well as the tax effects. (7 marks) c) Calculate consolidated retained earnings at December 31, Year 10. Show supporting calculations

1. During Year 10, P sold merchandise to \\( S \\) for \\( \\$ 600,000 \\). Seventy-five percent of this merchandise remains in S's inventory at December 31, Year 10. On December 31, Year 9, the inventory of S contained \\( \\$ 100,000 \\) of merchandise purchased from P. P earns a gross margin of \30 on its intercompany sales. VD - On December 31, Year 5, P Company purchased \70 of the outstanding common shares of the \\( \\mathrm{S} \\) Company for \\( \\$ 5.6 \\) million in cash when S's shareholders' equity consisted of \\( \\$ 2,000,000 \\) of common shares and \\( \\$ 6,000,000 \\) of retained earnings. There was no acquisition differential. For the year ending December 31, Year 10, the income statements for \\( \\mathrm{P} \\) and \\( \\mathrm{S} \\) were as follows: At December 31, Year 10, the condensed balance sheets for the two companies were as follows: 2. On January 2, Year \\( 8, \\mathrm{~S} \\) sold land to \\( \\mathrm{P} \\) for \\( \\$ 1,200,000 \\). \\( \\mathrm{S} \\) purchased the land on January 1, Year 6, for \\( \\$ 1,100,000 \\). P still owns this land at December 31, Year 10. 3. During Year \\( 10, \\mathrm{P} \\) declared and paid dividends of \\( \\$ 2,600,000 \\), while \\( \\mathrm{S} \\) declared and paid dividends of \\( \\$ 800,000 \\). 4. P accounts for its investment in \\( \\mathrm{S} \\) using the cost method. 5. Both companies pay income tax at the rate of \35. Required: a) Prepare a schedule to show the calculation of consolidated net income. Include attribution to both shareholder groups. (5 marks) b) Prepare an intercompany profit analysis to show intercompany transaction schedule of profits before and after tax as well as the tax effects. (7 marks) c) Calculate consolidated retained earnings at December 31, Year 10. Show supporting calculations. (3 marks) 1. During Year 10, P sold merchandise to \\( S \\) for \\( \\$ 600,000 \\). Seventy-five percent of this merchandise remains in S's inventory at December 31, Year 10. On December 31, Year 9, the inventory of S contained \\( \\$ 100,000 \\) of merchandise purchased from P. P earns a gross margin of \30 on its intercompany sales. VD - On December 31, Year 5, P Company purchased \70 of the outstanding common shares of the \\( \\mathrm{S} \\) Company for \\( \\$ 5.6 \\) million in cash when S's shareholders' equity consisted of \\( \\$ 2,000,000 \\) of common shares and \\( \\$ 6,000,000 \\) of retained earnings. There was no acquisition differential. For the year ending December 31, Year 10, the income statements for \\( \\mathrm{P} \\) and \\( \\mathrm{S} \\) were as follows: At December 31, Year 10, the condensed balance sheets for the two companies were as follows: 2. On January 2, Year \\( 8, \\mathrm{~S} \\) sold land to \\( \\mathrm{P} \\) for \\( \\$ 1,200,000 \\). \\( \\mathrm{S} \\) purchased the land on January 1, Year 6, for \\( \\$ 1,100,000 \\). P still owns this land at December 31, Year 10. 3. During Year \\( 10, \\mathrm{P} \\) declared and paid dividends of \\( \\$ 2,600,000 \\), while \\( \\mathrm{S} \\) declared and paid dividends of \\( \\$ 800,000 \\). 4. P accounts for its investment in \\( \\mathrm{S} \\) using the cost method. 5. Both companies pay income tax at the rate of \35. Required: a) Prepare a schedule to show the calculation of consolidated net income. Include attribution to both shareholder groups. (5 marks) b) Prepare an intercompany profit analysis to show intercompany transaction schedule of profits before and after tax as well as the tax effects. (7 marks) c) Calculate consolidated retained earnings at December 31, Year 10. Show supporting calculations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started