1. Eagles Nest Clothiers issued bonds with a 8% annual stated interest rate and a $20,000 face value. The issue price was $19,780 and the market rate at the date of issue was 9% . Assume the company uses the effective interest rate method.

What is the amount of the first years interest payment to the bondholders?

a. $1,582

b. $1,800

c. $1,600

d. $1,780

2. Kelsey Corporation issued bonds on 1/1/year1. The bonds have a 10 year maturity, a face value of $200,000 and a stated interest rate of 3%. The market rate of interest on the date of issue was 4%. The bonds were issued for $183,777.

How much interest expense will Kelsey Corp. record related to this bond over the 10-year life. (You do not need to do an amortization schedule to answer this.)

a. $76,223

b. $96,223

c. $16,223

d. $43,777

e. $60,000

f. $63,777

g. $80,000

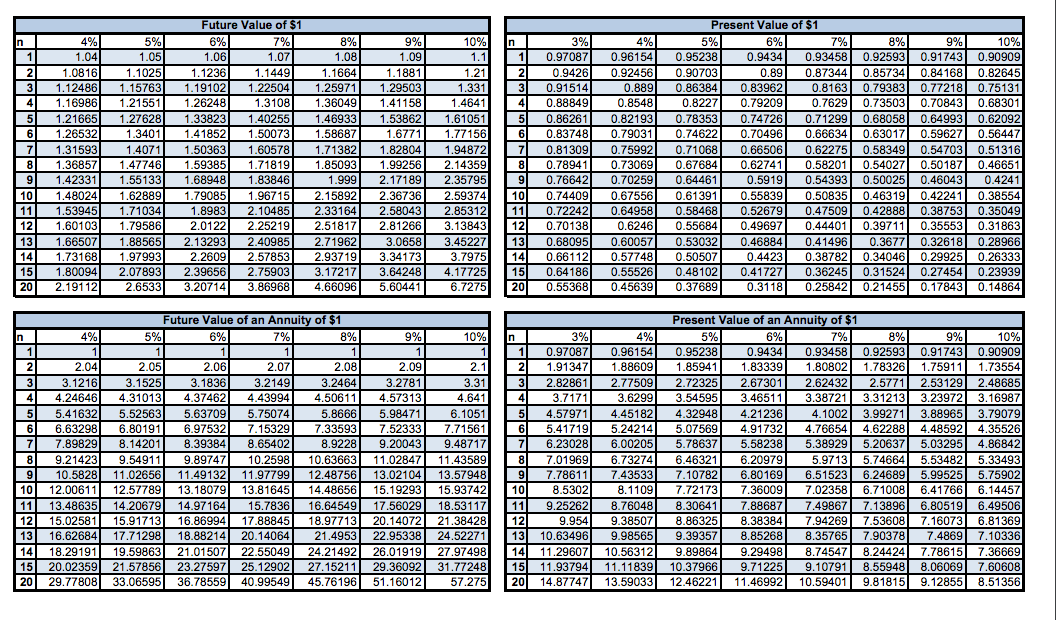

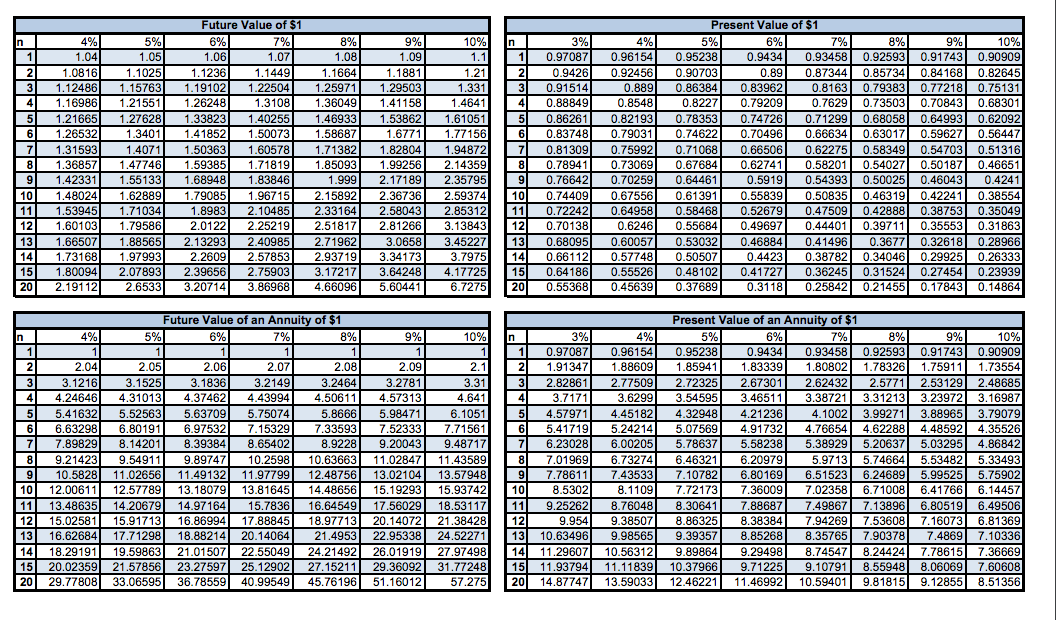

3. Jared Corp needs $900,000 for an expansion in 10 years. The company will make 10 equal annual deposits to fund this expansion. If the account earns 5% interest, how much does Jared need to deposit each year?

Choose the closest answer.

a. $71,554

b. $135,000

c. $45,000

d. $116,554

e. $90,000

4. If a bond is sold at a discount, the carrying value reported on the balance sheet in following years:

a. Stays the same each year

b. Increases each year

c. Decreases each year

5. Henrie purchased a stereo from his cousin. Henrie will pay $250 per year for 4 years.

If Henrie''s payments include interest at 9%, what was the purchase price of the stereo?

Choose the closest answer.

a. $870

b. $1,143

c. $810

d. $910

e. $1,000

8% 10% 21 " M 4% 1.04 1.0816 1.12486 1.16986 1.21665 1.26532 1.31593 1.36857 1.42331 1.48024) 1.53945] 1.60103 1.66507 1.73168 1.80094 2.19112 5% 1.05) 1.1025 1.15763 1.21551 1.27628| 1.3401 1.4071) 1.47746) 1.551331 1.62889) 1.71034) 1.79586) 1.88565 1.97993 2.078931 2.6533 Future Value of $1 6% 6% 7% 9% 1.06 1.07 1.08 1.09 1.1236 1.1449 1.1664 1.1881 1.19102 1.22504 1.25971 1.29503 1.26248 1.3108 1.36049 1.41158 1.33823|| 1.40255 1.46933 1.53862 1.41852) 1.50073 1.58687 1.6771 1.50363 1.60578 1.71382) 1.82804 1.59385) 1.71819 1.85093 1.99256 1.689481 1.83846 1.999) 2.17189 1.79085) 1.96715 2.15892 2.36736 1.8983) 2.10485 2.33164 2.58043 2.0122 2.25219 2.51817 2.81266 2.13293 2.40985 2.71962) 3.0658 2.2609) 2.57853 2.93719 3.34173 2.39656 2.75903 3.172171 3.64248 3.20714 3.86968 4.660965.60441 1.21 1.331 1.4641 1.61051 1.77156 1.94872 2.14359 2.35795 2.59374 2.85312 3.13843 3.45227 3.7975 4.17725 6.7275 3% 4% 1 0.97087 0.96154 0.9426) 0.92456| 31 0.91514 0.889| 41 0.88849 0.8548 5 0.86261 0.82193 6 0.837480.79031 71 0.81309) 0.75992 8 0.78941) 0.73069) 9 0.76642) 0.70259) | 10 0.74409) 0.67556 11) 0.72242 0.64958 12 0.70138) 0.6246 13 0.68095 0.60057 | 14 0.661120.57748 | 15 0.64186 0.55526 200.55368 0.45639 Present Value of $1 5% 6% 7% 8% 9% 10% 0.95238 0.94340.93458 0.92593 0.91743] 0.90909 0.90703 0.89 0.87344 0.85734 0.84168 0.82645 0.86384 0.83962 0.8163 0.79383 0.77218 0.75131 0.82271 0.79209 0.7629 0.73503 0.70843 0.68301 0.783531 0.74726 0.71299 0.68058 0.64993 0.62092 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.67684) 0.62741 0.58201 0.54027 0.50187 0.46651 0.64461 0 .5919 0.54393 0.50025 0.46043 0.4241 0.61391) 0.55839) 0.50835 0.46319] 0.42241 0.38554 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.55684 0.49697 0.44401 0.39711] 0.35553 0.31863 0.53032 0.46884 0.41496 0.3677 0.32618 0.28966 0.50507 0.4423 0.38782) 0.340461 0.29925 0.26333 0.481020.41727 0.36245 0.31524 0.27454 0.23939 0.37689 0.3118 0.25842 0.21455 0.17843 0.14864 10 111 12 13 14 15| 20 6% 6% 2 Future Value of an Annuity of $1 4% 5% 8% 9% 11 2.04 2.05 2.06 2.07 2.08 2.09 3.1216 3.1525 3.1836|| 3.2149| 3.2464 3.2781 3.31 4.24646 4.31013 4.37462 4.43994 4.50611 4.57313 4.641 5.41632 5.52563 5.63709 5.75074 5.8666 5.98471 6.1051 6.63298 6.80191 6.97532 7.15329 7.33593 7.52333 7.71561 7.89829) 8.14201 8.39384 8.65402 8.92289.20043 9.48717 9.21423 9.54911 9.89747 10.2598 10.63663 11.02847| 11.43589 10.5828 11.02656 11.49132 11.97799 12.48756 13.02104 13.57948 12.00611] 12.57789 13.18079 13.81645 14.48656 15.19293 15.93742 11 13.48635 14.20679 14.97164 15.7836) 16.64549] 17.56029 18.53117 12] 15.02581/ 15.917131 16.86994 17.88845 18.97713] 20.14072 21.38428 13] 16.62684 17.71298] 18.88214] 20.14064 21.4953 22.95338) 24.52271 14 18.29191 19.59863 21.01507 22.55049 24.21492 26.01919 27.97498 15| 20.02359 21.57856| 23.27597 25.12902) 27.15211 29.36092 31.77248 20 29.77808 33.06595 36.78559 40.99549 45.76196 51.16012 57.275 3% 4% 1 0.97087 0.96154 2 1.91347) 1.88609 3 2.82861 2.77509 4 3.7171 3.6299 51 4.57971 4.45182 6 5.41719 5.24214 7 6.23028 6.00205|| 8 7.01969) 6.73274 9 7.78611 7.43533 108.53028.11091 11 9.25262 8.76048 12 9 .954) 9.38507 13 10.63496 9.98565 14 11.29607) 10.56312 15 11.93794 11.11839 20 14.87747 13.59033 Present Value of an Annuity of $1 5% 7% 1 8% 9% 10% 0.95238 0.9434 0.93458 0.92593 0.91743 0.90909 1.85941 1.83339 1.80802 1.78326 1.75911) 1.73554 2.72325 2.67301 2.62432 2.5771 2.53129 2.48685 3.54595 3.46511 3.38721 3.312131 3.23972 3.16987 4.32948 4.21236 4.1002) 3.99271) 3.88965 3.79079 5.07569 4.91732 4.76654 4.62288 4.485921 4.35526 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 6.46321 6.20979 5.9713 5.74664 5.53482 5.33493 7.10782 6.80169) 6.51523 6.24689) 5.99525 5.75902 7.72173 7.36009 7.02358 6.71008 6.417666.14457 8.30641 7.88687) 7.49867 7.13896 6.80519 6.49506 8.863258.38384 7.94269 7.53608 7.16073 6.81369 9.39357 8.85268 8.35765 7.90378 7.4869| 7.10336 9.89864 9.29498 8.745471 8.24424 7.78615 7.36669 10.37966 9.71225 9.10791 8.559488.06069| 7.60608 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 10