Question

1. Enter the debit amounts in the entry to record labor related amounts for the month for the following accounts: (Use commas, no $ signs,

1. Enter the debit amounts in the entry to record labor related amounts for the month for the following accounts: (Use commas, no $ signs, no decimals.)

WIP $

MOH $

Salaries expense $

Commission expense $

2. Enter the debit amounts in the entry to record labor related amounts for the month for the following accounts: (Use commas, no $ signs, no decimals.)

Employee benefits expense $

Employer payroll tax expense $

3. In the entry to record the September salaries, Payroll taxes payable should be credited for $_____________. (Use commas, no $ signs, no decimals)

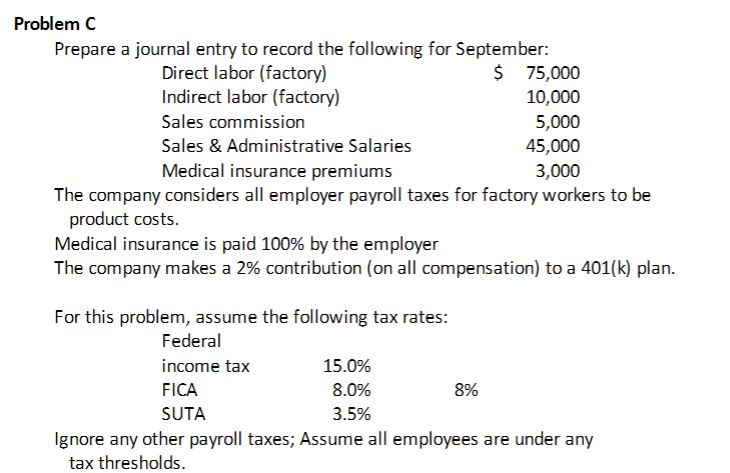

Problem C Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales commission Sales & Administrative Salaries Medical insurance premiums 75,000 10,000 5,000 45,000 The company considers all employer payroll taxes for factory workers to be product costs Medical insurance is paid 100% by the employer The company makes a 2% contribution (on all compensation) to a 401(k) plan. For this problem, assume the following tax rates Federal income tax FICA SUTA 15.0% 8.0% 3.5% 8% Ignore any other payroll taxes; Assume all employees are under any tax thresholds Problem C Prepare a journal entry to record the following for September: Direct labor (factory) Indirect labor (factory) Sales commission Sales & Administrative Salaries Medical insurance premiums 75,000 10,000 5,000 45,000 The company considers all employer payroll taxes for factory workers to be product costs Medical insurance is paid 100% by the employer The company makes a 2% contribution (on all compensation) to a 401(k) plan. For this problem, assume the following tax rates Federal income tax FICA SUTA 15.0% 8.0% 3.5% 8% Ignore any other payroll taxes; Assume all employees are under any tax thresholdsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started