Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Entry A1 without Goodwill: 2) Entry A2 for goodwill 3) Entry 1 4)Entry D 5) Entry E 6) Entry P On January 1,2014 ,

1) Entry A1 without Goodwill:

2) Entry A2 for goodwill

3) Entry 1

4)Entry D

5) Entry E

6) Entry P

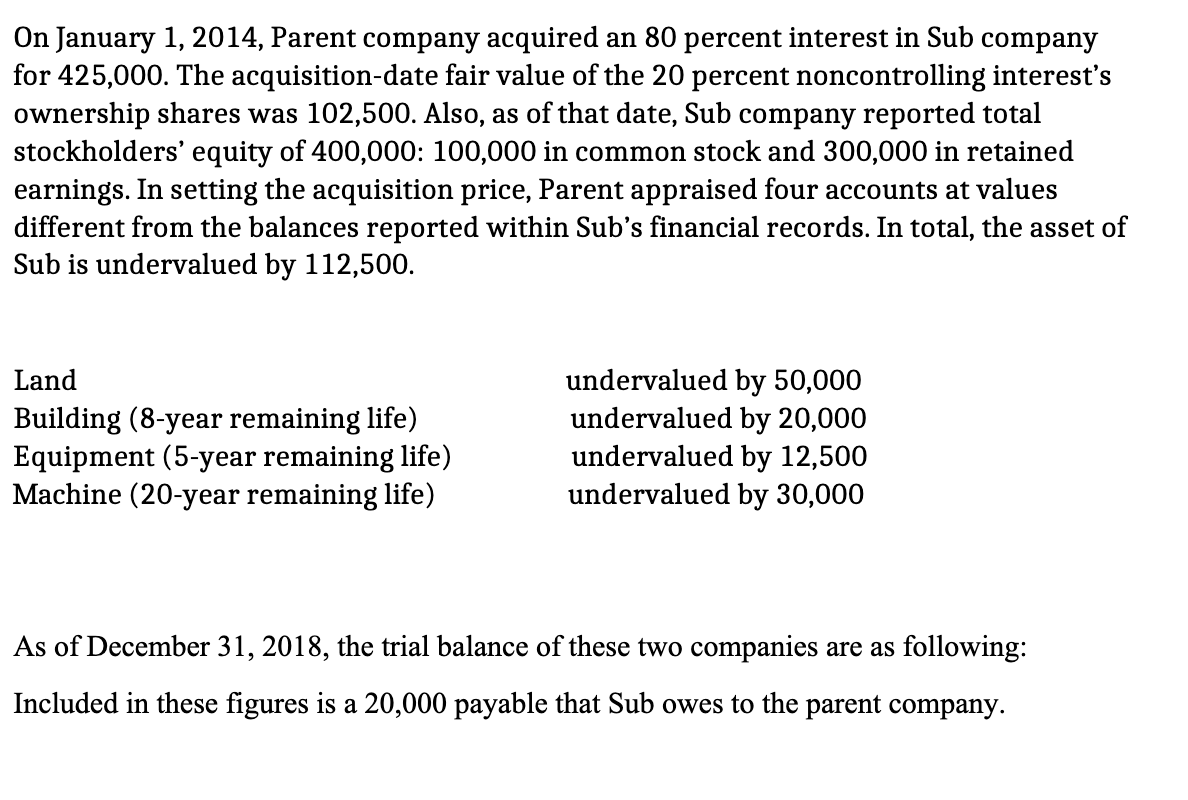

On January 1,2014 , Parent company acquired an 80 percent interest in Sub company for 425,000 . The acquisition-date fair value of the 20 percent noncontrolling interest's ownership shares was 102,500 . Also, as of that date, Sub company reported total stockholders' equity of 400,000: 100,000 in common stock and 300,000 in retained earnings. In setting the acquisition price, Parent appraised four accounts at values different from the balances reported within Sub's financial records. In total, the asset of Sub is undervalued by 112,500. As of December 31, 2018, the trial balance of these two companies are as following: Included in these figures is a 20,000 payable that Sub owes to the parent companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started