Answered step by step

Verified Expert Solution

Question

1 Approved Answer

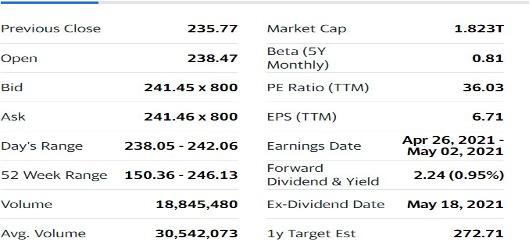

1. estimate the sustainable growth rate. 2. Calculate the expected stock price using the constant dividend growth rate model if the discount rate is 10.1%

1. estimate the sustainable growth rate.

2. Calculate the expected stock price using the constant dividend growth rate model if the discount rate is 10.1%

3. Calculate the expected stock price using the two-stage dividend growth model assuming the firm will initially grow at a rate g1 (sustainable growth rate calculated in section 1) for 4 years, and thereafter, it will grow at a rate (g2 =4%)forever. The discount rate is 10.1%

Previous Close 235.77 1.823T Open 238.47 0.81 Market Cap Beta (5Y Monthly) PE Ratio (TTM) EPS (TTM) 241.45 x 800 36.03 Bid Ask 241.46 x 800 6.71 238.05 - 242.06 Day's Range 52 Week Range Earnings Date Forward Dividend & Yield Ex-Dividend Date Apr 26, 2021- May 02, 2021 2.24 (0.95%) 150.36 - 246.13 Volume 18,845,480 May 18, 2021 Avg. Volume 30,542,073 1 y Target Est 272.71 Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter (mra) Jun 29, 2020 Dec 30, 2020 33.47% 39.24% Profitability Profit Margin Operating Margin (ttm) Management Effectiveness Return on Assets (ttm) Return on Equity (ttm) 12.81% 42.7096 Previous Close 235.77 1.823T Open 238.47 0.81 Market Cap Beta (5Y Monthly) PE Ratio (TTM) EPS (TTM) 241.45 x 800 36.03 Bid Ask 241.46 x 800 6.71 238.05 - 242.06 Day's Range 52 Week Range Earnings Date Forward Dividend & Yield Ex-Dividend Date Apr 26, 2021- May 02, 2021 2.24 (0.95%) 150.36 - 246.13 Volume 18,845,480 May 18, 2021 Avg. Volume 30,542,073 1 y Target Est 272.71 Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter (mra) Jun 29, 2020 Dec 30, 2020 33.47% 39.24% Profitability Profit Margin Operating Margin (ttm) Management Effectiveness Return on Assets (ttm) Return on Equity (ttm) 12.81% 42.7096Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started