1. Estimate the unrestricted model using OLS with R.Name this regression model olsu in R.Report your results using the package stargazer to create professional looking regression output tables.

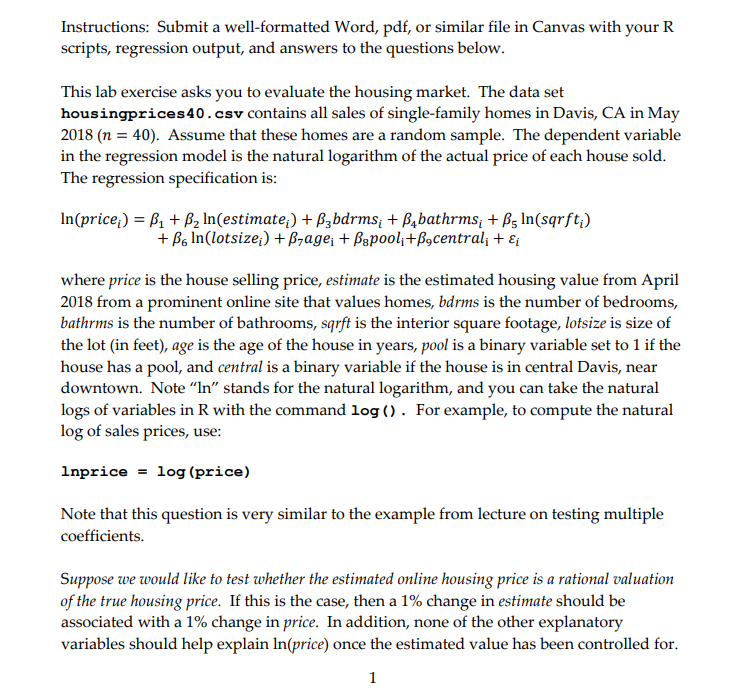

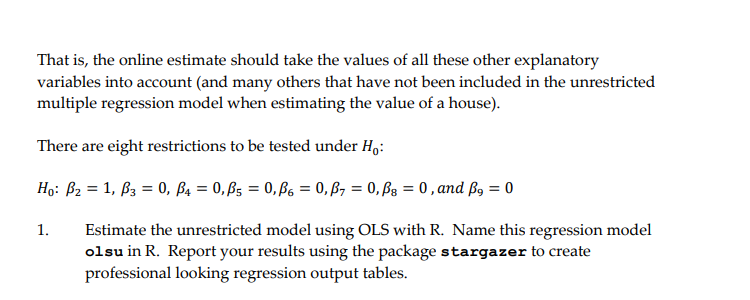

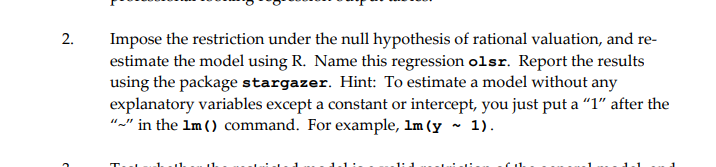

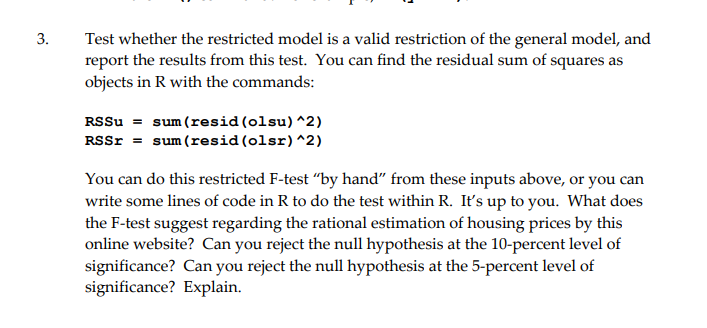

Instructions: Submit a well-formatted Word, pdf, or similar file in Canvas with your R scripts, regression output, and answers to the questions below. This lab exercise asks you to evaluate the housing market. The data set housingprices40 . cav contains all sales of single-family homes in Davis, CA in May 2018 (n = 40). Assume that these homes are a random sample. The dependent variable in the regression model is the natural logarithm of the actual price of each house sold. The regression specification is: In(price;) = 1 + $2 In(estimate; ) + Babarms; + BAbathrms; + Bs In(sqrft;) + Be In(lotsize;) + Byage; + Bapooli +Bgcentral; + &; where price is the house selling price, estimate is the estimated housing value from April 2018 from a prominent online site that values homes, bdrms is the number of bedrooms, bathrms is the number of bathrooms, sqrft is the interior square footage, lotsize is size of the lot (in feet), age is the age of the house in years, pool is a binary variable set to 1 if the house has a pool, and central is a binary variable if the house is in central Davis, near downtown. Note "In" stands for the natural logarithm, and you can take the natural logs of variables in R with the command log () . For example, to compute the natural log of sales prices, use: Inprice = log (price) Note that this question is very similar to the example from lecture on testing multiple coefficients. Suppose we would like to test whether the estimated online housing price is a rational valuation of the true housing price. If this is the case, then a 1% change in estimate should be associated with a 1% change in price. In addition, none of the other explanatory variables should help explain In(price) once the estimated value has been controlled for.That is, the online estimate should take the values of all these other explanatory variables into account (and many others that have not been included in the unrestricted multiple regression model when estimating the value of a house). There are eight restrictions to be tested under Ho: Ho: 2 = 1, B3 = 0, 84 = 0, 85 = 0, 86 = 0, B7 = 0, Bs = 0, and By = 0 Estimate the unrestricted model using OLS with R. Name this regression model olsu in R. Report your results using the package stargazer to create professional looking regression output tables.2. Impose the restriction under the null hypothesis of rational valuation, and re- estimate the model using R. Name this regression olsr. Report the results using the package stargazer. Hint: To estimate a model without any explanatory variables except a constant or intercept, you just put a "1" after the "~" in the 1m () command. For example, Im (y ~ 1).1. ... ._' Test whether the restricted model is a valid restriction of the general model, and report the results from this test. You can nd the residual sum of squares as objects in R with the commands: R551: R551: sminaidiolsu} *2} sumtrosidiolsrl*21 You can do this restricted F-test "by hand\" from these inputs above, or you can write some lines of code in R to do the test within R. It's up to you. Wt does the F-test suggest regarding the rational estimation of housing prices by this online website? Can you reject the null hypothesis at the Iii-percent level of signicance? Can you reject the null hypothesis at the 5-percent level of signicance? Explain