1) ESTIMATION OF SUSTAINABLE SALES GROWTH RATES

2) ESTIMATION OF ADDITIONAL FINANCING NECESSARY TO SUPPORT GROWTH

3) PERCENTAGE OF SALES PROJECTED FINANCIAL STATEMENTS

A. Sales forecast

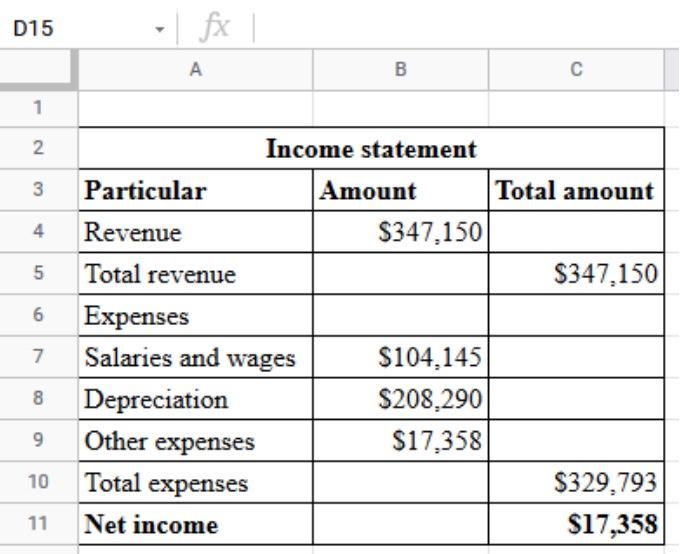

B. Projection of the income statement

C. Balance sheet projection

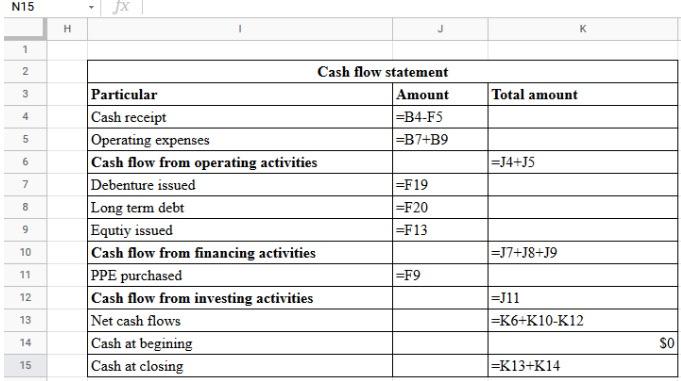

D. Forecast cash flow statement

E. Financing cost implications associated with the need for additional funds

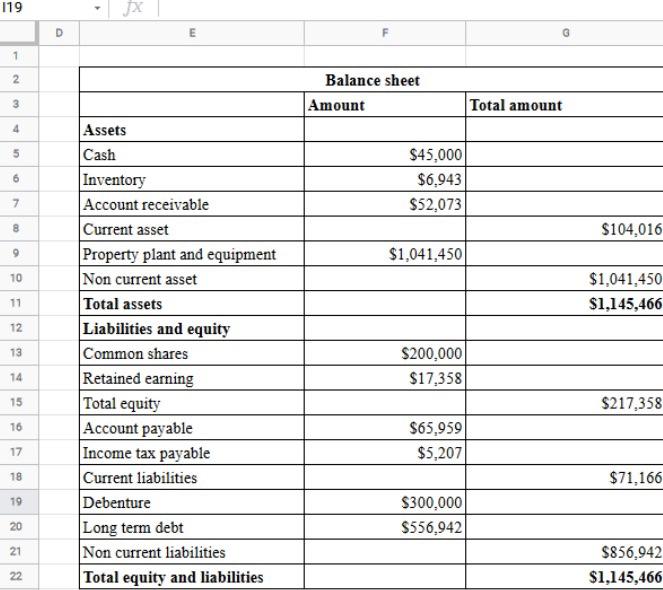

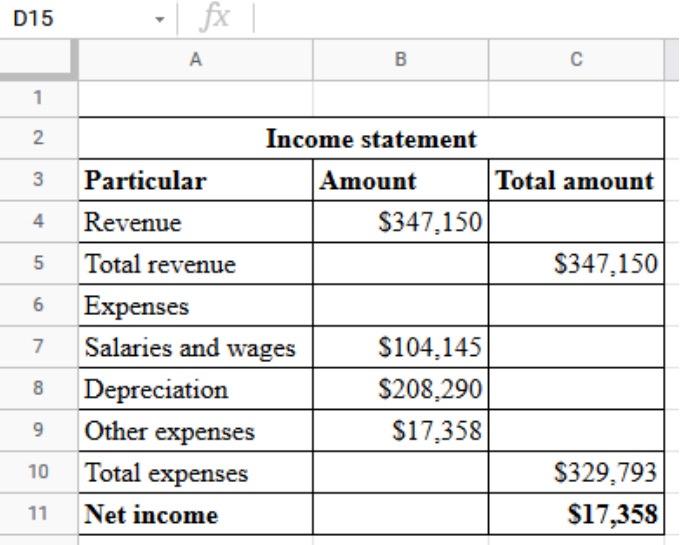

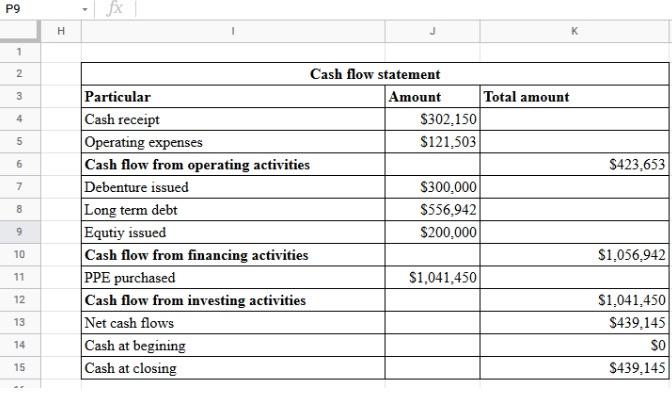

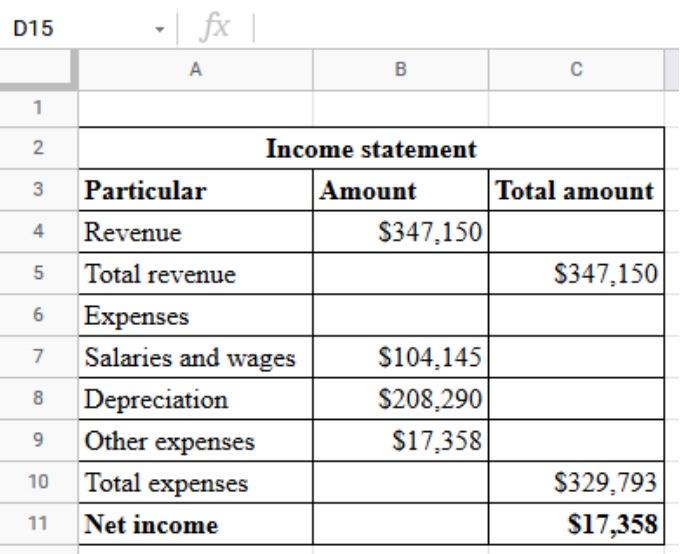

Look up the financial statements that you created in the second week to complete the following parts:

119 D E G 1 2. N Balance sheet Amount 3 Total amount 4 5 6 $45,000 $6,943 $52,073 7 8 $104,016 9 $1,041,450 10 $1,041,450 $1,145,466 11 12 13 Assets Cash Inventory Account receivable Current asset Property plant and equipment Non current asset Total assets Liabilities and equity Common shares Retained earning Total equity Account payable Income tax payable Current liabilities Debenture Long term debt Non current liabilities Total equity and liabilities $200,000 $17,358 14 $217,358 15 16 $65,959 $5,207 17 18 $71,166 19 $300,000 $556,942 20 21 $856,942 $1,145,466 22 D15 fx B 1 2 Income statement 3 Particular Amount Total amount 4 $347,150 Revenue Total revenue on 5 $347,150 6 7 8 Expenses Salaries and wages Depreciation Other expenses Total expenses Net income $104,145 $208,290 $17,358 9 10 $329,793 $17,358 11 P9 H K 1 2 3 4 5 ON $423,653 7 8 8 9 Cash flow statement Particular Amount Total amount Cash receipt $302,150 Operating expenses $121,503 Cash flow from operating activities Debenture issued $300,000 Long term debt $556,942 Equtiy issued $200,000 Cash flow from financing activities PPE purchased $1,041,450 Cash flow from investing activities Net cash flows Cash at begining Cash at closing 9 ON 10 $1,056,942 11 12 13 $1,041.450 $439,145 SO $439.145 14 15 D15 fx A B 1 2 Income statement N 3 Particular 4 Revenue Amount Total amount $347,150 $347,150 5 Total revenue 6 7 8 Expenses Salaries and wages Depreciation Other expenses Total expenses Net income $104,145 $208,290 $17,358 9 10 $329,793 $17,358 11 N15 + X H J K 1 2 3 Total amount 4 4 5 5 6 =J4+J5 7 8 Cash flow statement Particular Amount Cash receipt =B4-F5 Operating expenses =B7+B9 Cash flow from operating activities Debenture issued =F19 Long term debt =F20 Equtiy issued =F13 Cash flow from financing activities PPE purchased =F9 Cash flow from investing activities Net cash flows Cash at begining Cash at closing 9 10 =J7+J8-19 11 12 =J11 =K6+K10-K12 13 14 SO 15 I=K13+K14 D15 fx A B 1 2 Income statement N 3 Particular 4 Revenue Amount Total amount $347,150 $347,150 5 Total revenue 6 7 8 Expenses Salaries and wages Depreciation Other expenses Total expenses Net income $104,145 $208,290 $17,358 9 10 $329,793 $17,358 11 119 D E G 1 2. N Balance sheet Amount 3 Total amount 4 5 6 $45,000 $6,943 $52,073 7 8 $104,016 9 $1,041,450 10 $1,041,450 $1,145,466 11 12 13 Assets Cash Inventory Account receivable Current asset Property plant and equipment Non current asset Total assets Liabilities and equity Common shares Retained earning Total equity Account payable Income tax payable Current liabilities Debenture Long term debt Non current liabilities Total equity and liabilities $200,000 $17,358 14 $217,358 15 16 $65,959 $5,207 17 18 $71,166 19 $300,000 $556,942 20 21 $856,942 $1,145,466 22 D15 fx B 1 2 Income statement 3 Particular Amount Total amount 4 $347,150 Revenue Total revenue on 5 $347,150 6 7 8 Expenses Salaries and wages Depreciation Other expenses Total expenses Net income $104,145 $208,290 $17,358 9 10 $329,793 $17,358 11 P9 H K 1 2 3 4 5 ON $423,653 7 8 8 9 Cash flow statement Particular Amount Total amount Cash receipt $302,150 Operating expenses $121,503 Cash flow from operating activities Debenture issued $300,000 Long term debt $556,942 Equtiy issued $200,000 Cash flow from financing activities PPE purchased $1,041,450 Cash flow from investing activities Net cash flows Cash at begining Cash at closing 9 ON 10 $1,056,942 11 12 13 $1,041.450 $439,145 SO $439.145 14 15 D15 fx A B 1 2 Income statement N 3 Particular 4 Revenue Amount Total amount $347,150 $347,150 5 Total revenue 6 7 8 Expenses Salaries and wages Depreciation Other expenses Total expenses Net income $104,145 $208,290 $17,358 9 10 $329,793 $17,358 11 N15 + X H J K 1 2 3 Total amount 4 4 5 5 6 =J4+J5 7 8 Cash flow statement Particular Amount Cash receipt =B4-F5 Operating expenses =B7+B9 Cash flow from operating activities Debenture issued =F19 Long term debt =F20 Equtiy issued =F13 Cash flow from financing activities PPE purchased =F9 Cash flow from investing activities Net cash flows Cash at begining Cash at closing 9 10 =J7+J8-19 11 12 =J11 =K6+K10-K12 13 14 SO 15 I=K13+K14 D15 fx A B 1 2 Income statement N 3 Particular 4 Revenue Amount Total amount $347,150 $347,150 5 Total revenue 6 7 8 Expenses Salaries and wages Depreciation Other expenses Total expenses Net income $104,145 $208,290 $17,358 9 10 $329,793 $17,358 11