Answered step by step

Verified Expert Solution

Question

1 Approved Answer

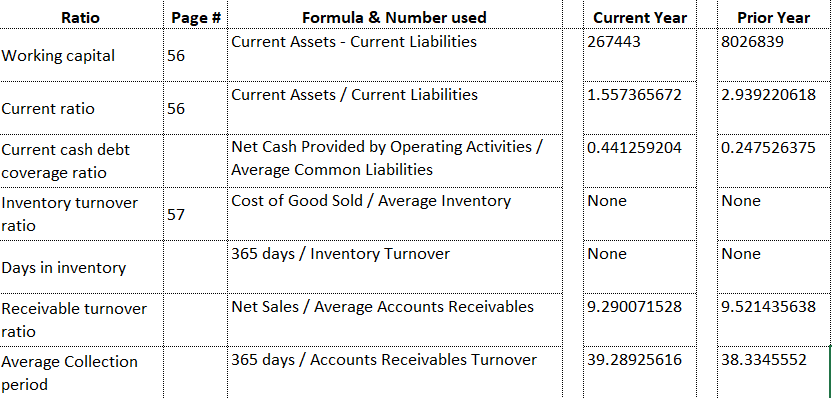

1) Evaluate liquidity: What do the above ratios suggest? 2) Did the company become more or less liquid when comparing this year to last year?

1) Evaluate liquidity: What do the above ratios suggest?

2) Did the company become more or less liquid when comparing this year to last year? Explain why?

Ratio Page # Formula & Number used Current Assets - Current Liabilities Current Year 267443 Prior Year 8026839 Working capital 56 Current Assets / Current Liabilities 1.557365672 2.939220618 Current ratio 56 0.441259204 0.247526375 Current cash debt coverage ratio Inventory turnover ratio Net Cash Provided by Operating Activities / Average Common Liabilities Cost of Good Sold / Average Inventory None None 365 days / Inventory Turnover None None Days in inventory Net Sales / Average Accounts Receivables 9.290071528 9.521435638 Receivable turnover ratio Average Collection period 365 days / Accounts Receivables Turnover 39.28925616 38.3345552Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started