Answered step by step

Verified Expert Solution

Question

1 Approved Answer

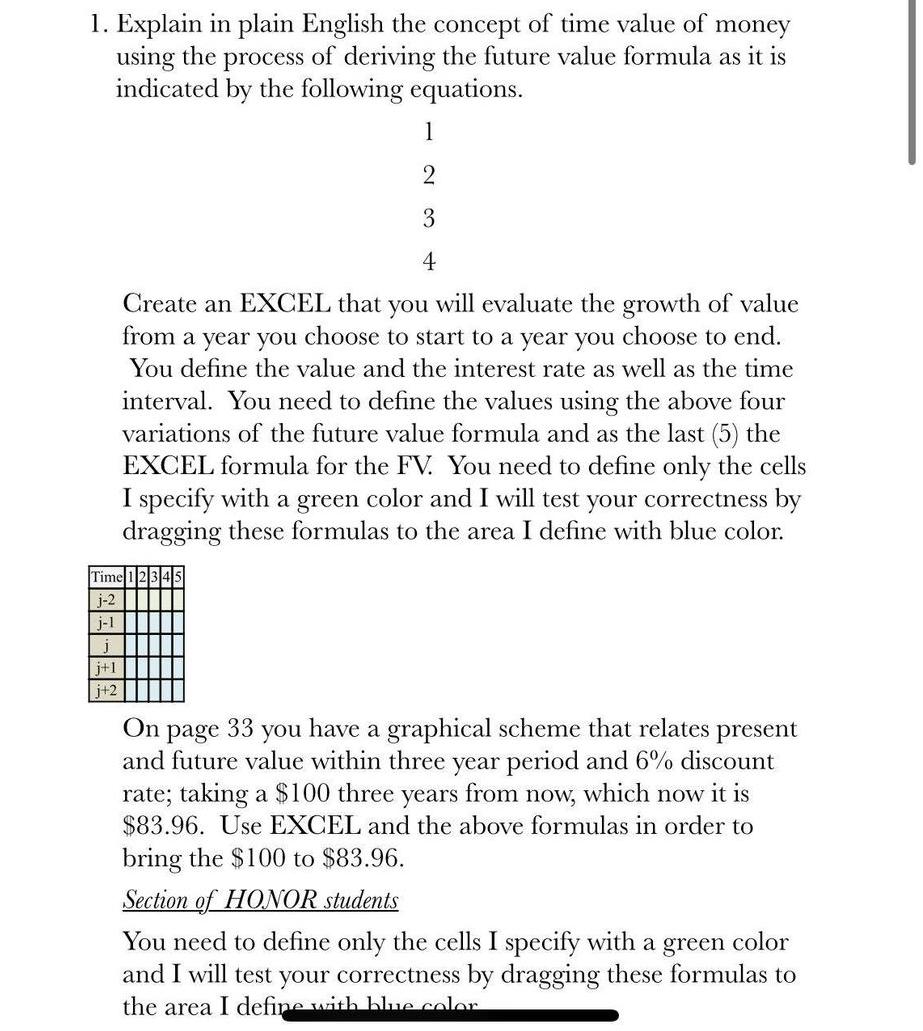

1. Explain in plain English the concept of time value of money using the process of deriving the future value formula as it is

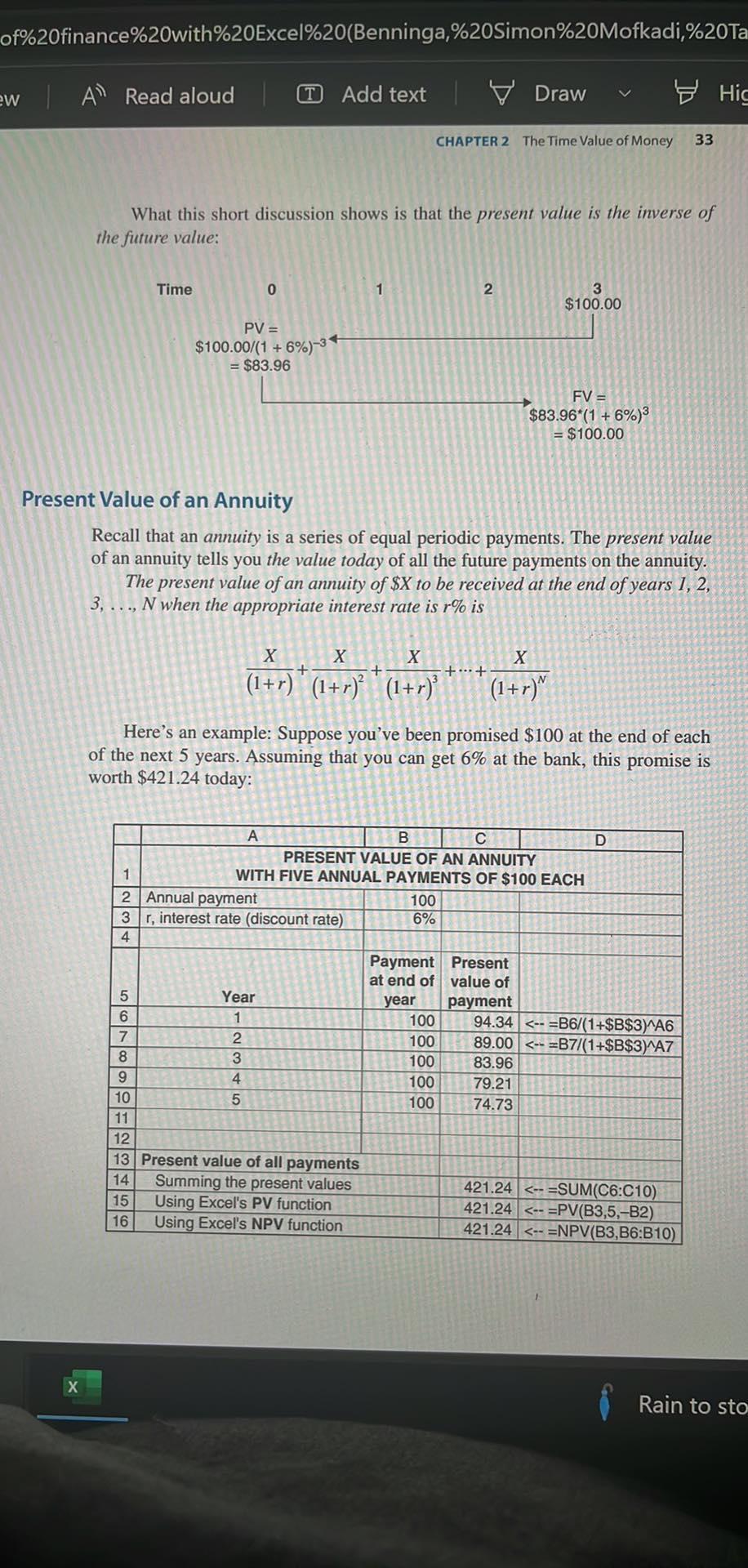

1. Explain in plain English the concept of time value of money using the process of deriving the future value formula as it is indicated by the following equations. 1 2 Time j-2 j-1 3 4 Create an EXCEL that you will evaluate the growth of value from a year you choose to start to a year you choose to end. You define the value and the interest rate as well as the time interval. You need to define the values using the above four variations of the future value formula and as the last (5) the EXCEL formula for the FV. You need to define only the cells I specify with a green color and I will test your correctness by dragging these formulas to the area I define with blue color. j j+1 j+2 On page 33 you have a graphical scheme that relates present and future value within three year period and 6% discount rate; taking a $100 three years from now, which now it is $83.96. Use EXCEL and the above formulas in order to bring the $100 to $83.96. Section of HONOR students You need to define only the cells I specify with a green color and I will test your correctness by dragging these formulas to the area I define with blue color of%20finance%20with%20Excel%20(Benninga,%20Simon%20Mofkadi,%20Ta ew A Read aloud Add text Draw CHAPTER 2 The Time Value of Money 33 What this short discussion shows is that the present value is the inverse of the future value: Time 0 1 2 3 $100.00 PV= $100.00/(1+ = $83.96 6%)-3 FV = $83.96*(1+6%)3 = $100.00 Present Value of an Annuity Recall that an annuity is a series of equal periodic payments. The present value of an annuity tells you the value today of all the future payments on the annuity. The present value of an annuity of $X to be received at the end of years 1, 2, 3,..., N when the appropriate interest rate is r% is X X X X X + + ++ (1+r) (1+r) (1+r) (1+r) Here's an example: Suppose you've been promised $100 at the end of each of the next 5 years. Assuming that you can get 6% at the bank, this promise is worth $421.24 today: 1 A B C PRESENT VALUE OF AN ANNUITY WITH FIVE ANNUAL PAYMENTS OF $100 EACH 2 Annual payment D 3 r, interest rate (discount rate) 100 6% 4 Payment at end of Present value of 5 Year year 6 1 100 7 2 100 payment 94.34

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER What Is the Time Value of Money TVM The time value of money TVM is the concept that a sum of money is worth more now than the same sum will be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started