Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Explain the following a. Sunk Cost b. Opportunity Cost c. Salvage Value d. Capitalised Cost (4 Marks) 2. As a; student of the University

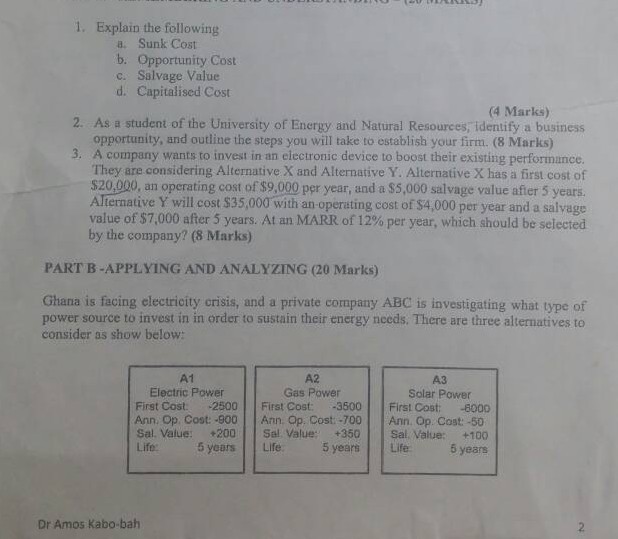

1. Explain the following a. Sunk Cost b. Opportunity Cost c. Salvage Value d. Capitalised Cost (4 Marks) 2. As a; student of the University of Energy and Natural Resources, identify a business opportunity, and outline the steps you will take to establish your firm. (8 Marks) A company wants to invest in an electronic device to boost their existing performance. They are considering Alternative X and Alternative Y. Alternative X has a first cost of $20,000, an operating cost of $9,000 per year, and a $5,000 salvage value after 5 years Alternative Y will cost S35,00?with an operating cost of$4,000 per year and a salvage value of $7,000 after 5 years. At an MARR of 12% per year, which should be selected by the company? (8 Marks) 3. PART B-APPLYING AND ANALYZING (20 Marks) Ghana is facing electricity crisis, and a private company ABC is investigating what type of power source to invest in in order to sustain their energy needs. There are three alternatives to consider as show below: A1 Electric Power A2 Gas Power First Cost. 2500 First Cost: -3500 First Cost: -8000 Ann. Op. Cost:-900 Ann. Op, Cost-700Ann. Op Cost: -50 Sal. Value: 200 Sal Value: +350 Sal. Value: +100 ?? Solar Power Life 5 yearsLife 5 years Life 5 years Dr Amos Kabo-bah

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started