Question

1. Explain what shared services are and why organisations establish them. In your response, identify the shared services that exist within the Foleo Group of

1. Explain what shared services are and why organisations establish them. In your response, identify the shared services that exist within the Foleo Group of businesses.

2. Assume that Foleo Skills can outsource their promotion campaign to an external provider for $4,500.

(a) Is it likely that the internal trade will take place? Why? (Hint: calculate the internal transfer price) (1.5 marks)

(b) Would Marketing Department prefer to sell internally or externally? Support your answer by comparing the contribution margin earned by Marketing Department from each option. (Hint: the external selling price would be the same as the internal transfer price) (1.5 marks)

(c) Is the situation in part (a) in the best interests of the organisation as a whole? Explain. (1 mark)

3. Disregard the current method of calculating the transfer price and instead assume that the transfer price will be determined by negotiation between the Marketing Department Manager and Elise Burton (the Foleo Skills Business Unit Manager). Also assume that Elise Burton can still outsource the campaign for the price of $4,500.

(a) Calculate the range of transfer prices (i.e. the minimum and maximum) that would be acceptable to both the Marketing Department and Foleo Skills. (Hint: Use the General Transfer Pricing Rule for minimum price in your calculations and show all workings.) (1.5 marks)

(b) Will the internal trade take place based on the new transfer price calculated in part (a)? Explain. (Hint: Consider both Marketing and Foleo Skills in your response.) (2.5 marks)

(c) Is the situation resulting from part (b) in the best interests of the organisation as a whole? Explain. (Hint: Identify any costs or savings that will support your answer.) (1 mark)

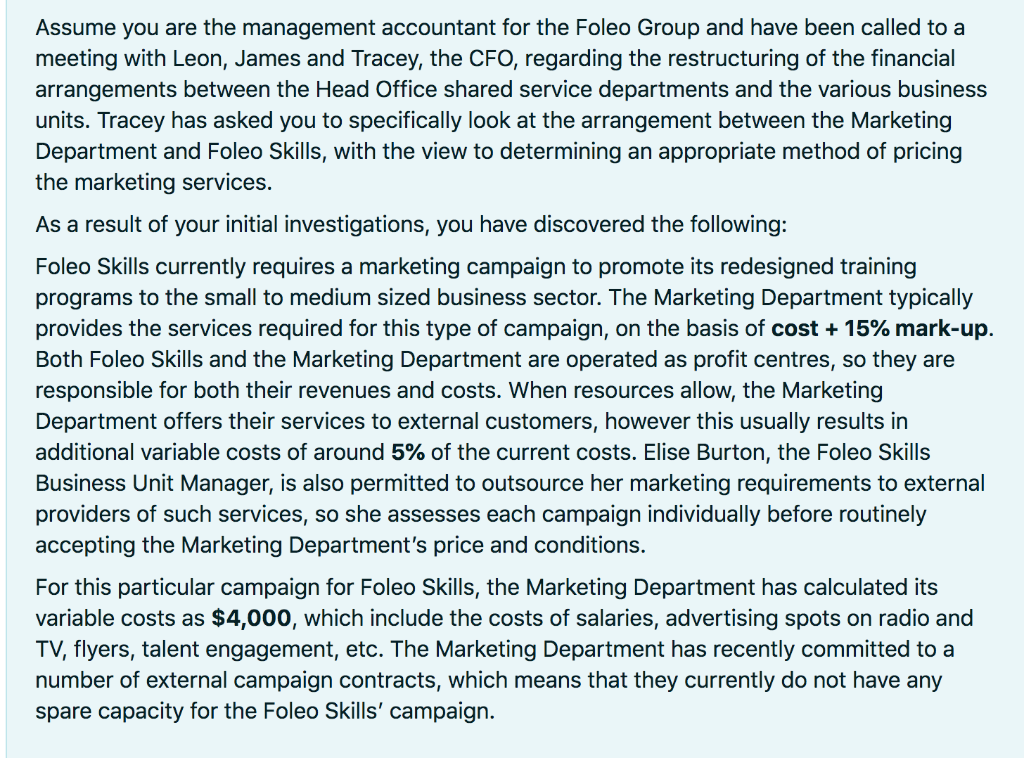

Assume you are the management accountant for the Foleo Group and have been called to a meeting with Leon, James and Tracey, the CFO, regarding the restructuring of the financial arrangements between the Head Office shared service departments and the various business units. Tracey has asked you to specifically look at the arrangement between the Marketing Department and Foleo Skills, with the view to determining an appropriate method of pricing the marketing services. As a result of your initial investigations, you have discovered the following: Foleo Skills currently requires a marketing campaign to promote its redesigned training programs to the small to medium sized business sector. The Marketing Department typically provides the services required for this type of campaign, on the basis of cost + 15% mark-up. Both Foleo Skills and the Marketing Department are operated as profit centres, so they are responsible for both their revenues and costs. When resources allow, the Marketing Department offers their services to external customers, however this usually results in additional variable costs of around 5% of the current costs. Elise Burton, the Foleo Skills Business Unit Manager, is also permitted to outsource her marketing requirements to external providers of such services, so she assesses each campaign individually before routinely accepting the Marketing Department's price and conditions. For this particular campaign for Foleo Skills, the Marketing Department has calculated its variable costs as $4,000, which include the costs of salaries, advertising spots on radio and TV, flyers, talent engagement, etc. The Marketing Department has recently committed to a number of external campaign contracts, which means that they currently do not have any spare capacity for the Foleo Skills' campaignStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started