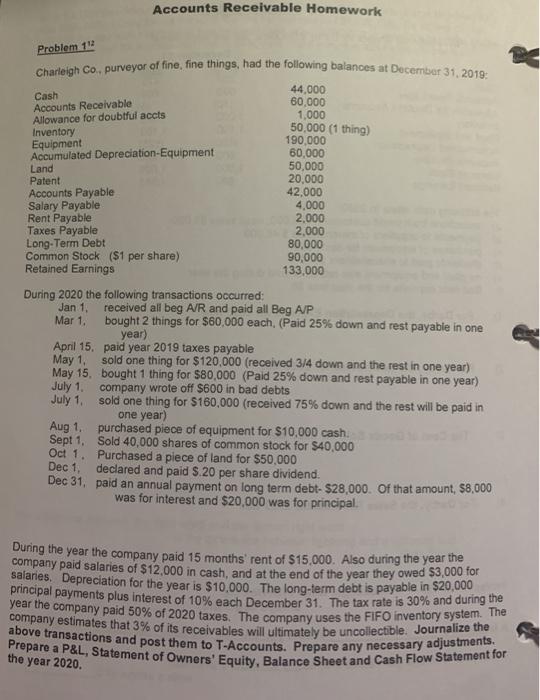

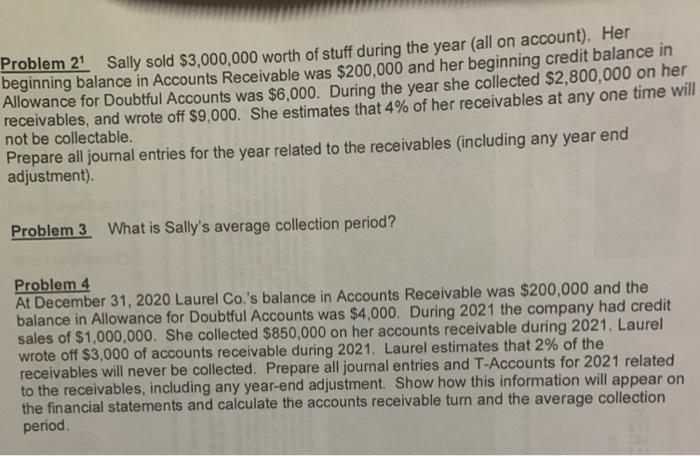

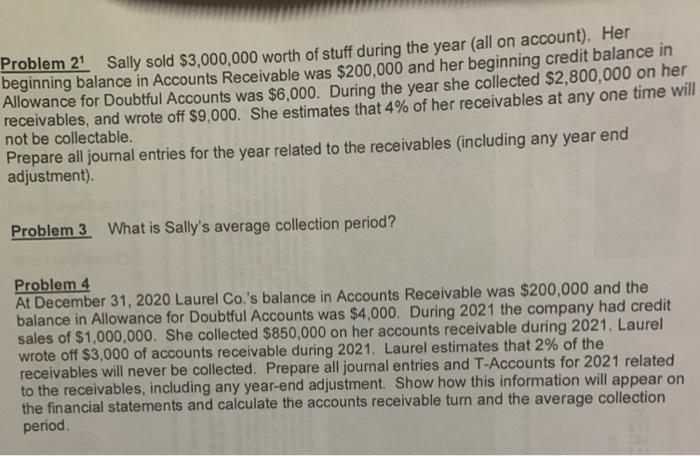

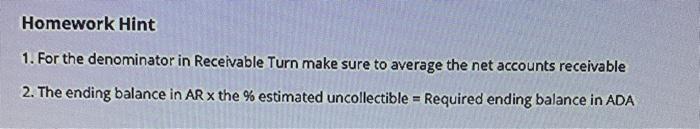

Accounts Receivable Homework Problem 11 Accounts Receivable Charleigh Co, purveyor of fine, fine things, had the following balances at December 31, 2019: 44.000 Cash 60,000 1,000 Allowance for doubtful accts 50,000 (1 thing) Inventory 190.000 Equipment Accumulated Depreciation Equipment 60,000 Land 50,000 Patent 20,000 Accounts Payable 42.000 Salary Payable 4.000 Rent Payable 2.000 Taxes Payable 2,000 Long-Term Debt 80,000 Common Stock ($1 per share) 90,000 Retained Earnings 133,000 During 2020 the following transactions occurred: Jan 1, received all beg A/R and paid all Beg AJP Mar 1. bought 2 things for $60,000 each. (Paid 25% down and rest payable in one year) April 15, paid year 2019 taxes payable May 1 sold one thing for $120,000 (received 3/4 down and the rest in one year) May 15, bought 1 thing for $80,000 (Paid 25% down and rest payable in one year) July 1 company wrote off $600 in bad debts July 1, sold one thing for $160,000 (received 75% down and the rest will be paid in one year) Aug 1, purchased piece of equipment for $10,000 cash Sept 1, Sold 40,000 shares of common stock for $40,000 Oct 1. Purchased a piece of land for $50,000 declared and paid $.20 per share dividend. Dec 31, paid an annual payment on long term debt-528,000. Of that amount, $8,000 was for interest and $20,000 was for principal Dec 1 During the year the company paid 15 months' rent of $15,000. Also during the year the company paid salaries of $12,000 in cash, and at the end of the year they owed $3,000 for salaries. Depreciation for the year is $10,000. The long-term debt is payable in $20,000 principal payments plus interest of 10% each December 31. The tax rate is 30% and during the company estimates that 3% of its receivables will ultimately be uncollectible. Journalize thes above transactions and post them to T-Accounts. Prepare any necessary adjustments. Prepare a P&L, Statement of Owners' Equity, Balance Sheet and Cash Flow Statement for the year 2020. Problem 2" Sally sold $3,000,000 worth of stuff during the year (all on account). Her beginning balance in Accounts Receivable was $200,000 and her beginning credit balance in Allowance for Doubtful Accounts was $6,000. During the year she collected $2,800,000 on her receivables, and wrote off $9,000. She estimates that 4% of her receivables at any one time will not be collectable. Prepare all journal entries for the year related to the receivables (including any year end adjustment). Problem 3 What is Sally's average collection period? Problem 4 At December 31, 2020 Laurel Co.'s balance in Accounts Receivable was $200,000 and the balance in Allowance for Doubtful Accounts was $4,000. During 2021 the company had credit sales of $1,000,000. She collected $850,000 on her accounts receivable during 2021. Laurel wrote off $3,000 of accounts receivable during 2021. Laurel estimates that 2% of the receivables will never be collected. Prepare all journal entries and T-Accounts for 2021 related to the receivables, including any year-end adjustment Show how this information will appear on the financial statements and calculate the accounts receivable turn and the average collection period Homework Hint 1. For the denominator in Receivable Turn make sure to average the net accounts receivable 2. The ending balance in ARx the % estimated uncollectible = Required ending balance in ADA Accounts Receivable Homework Problem 11 Accounts Receivable Charleigh Co, purveyor of fine, fine things, had the following balances at December 31, 2019: 44.000 Cash 60,000 1,000 Allowance for doubtful accts 50,000 (1 thing) Inventory 190.000 Equipment Accumulated Depreciation Equipment 60,000 Land 50,000 Patent 20,000 Accounts Payable 42.000 Salary Payable 4.000 Rent Payable 2.000 Taxes Payable 2,000 Long-Term Debt 80,000 Common Stock ($1 per share) 90,000 Retained Earnings 133,000 During 2020 the following transactions occurred: Jan 1, received all beg A/R and paid all Beg AJP Mar 1. bought 2 things for $60,000 each. (Paid 25% down and rest payable in one year) April 15, paid year 2019 taxes payable May 1 sold one thing for $120,000 (received 3/4 down and the rest in one year) May 15, bought 1 thing for $80,000 (Paid 25% down and rest payable in one year) July 1 company wrote off $600 in bad debts July 1, sold one thing for $160,000 (received 75% down and the rest will be paid in one year) Aug 1, purchased piece of equipment for $10,000 cash Sept 1, Sold 40,000 shares of common stock for $40,000 Oct 1. Purchased a piece of land for $50,000 declared and paid $.20 per share dividend. Dec 31, paid an annual payment on long term debt-528,000. Of that amount, $8,000 was for interest and $20,000 was for principal Dec 1 During the year the company paid 15 months' rent of $15,000. Also during the year the company paid salaries of $12,000 in cash, and at the end of the year they owed $3,000 for salaries. Depreciation for the year is $10,000. The long-term debt is payable in $20,000 principal payments plus interest of 10% each December 31. The tax rate is 30% and during the company estimates that 3% of its receivables will ultimately be uncollectible. Journalize thes above transactions and post them to T-Accounts. Prepare any necessary adjustments. Prepare a P&L, Statement of Owners' Equity, Balance Sheet and Cash Flow Statement for the year 2020. Problem 2" Sally sold $3,000,000 worth of stuff during the year (all on account). Her beginning balance in Accounts Receivable was $200,000 and her beginning credit balance in Allowance for Doubtful Accounts was $6,000. During the year she collected $2,800,000 on her receivables, and wrote off $9,000. She estimates that 4% of her receivables at any one time will not be collectable. Prepare all journal entries for the year related to the receivables (including any year end adjustment). Problem 3 What is Sally's average collection period? Problem 4 At December 31, 2020 Laurel Co.'s balance in Accounts Receivable was $200,000 and the balance in Allowance for Doubtful Accounts was $4,000. During 2021 the company had credit sales of $1,000,000. She collected $850,000 on her accounts receivable during 2021. Laurel wrote off $3,000 of accounts receivable during 2021. Laurel estimates that 2% of the receivables will never be collected. Prepare all journal entries and T-Accounts for 2021 related to the receivables, including any year-end adjustment Show how this information will appear on the financial statements and calculate the accounts receivable turn and the average collection period Homework Hint 1. For the denominator in Receivable Turn make sure to average the net accounts receivable 2. The ending balance in ARx the % estimated uncollectible = Required ending balance in ADA